Share This Page

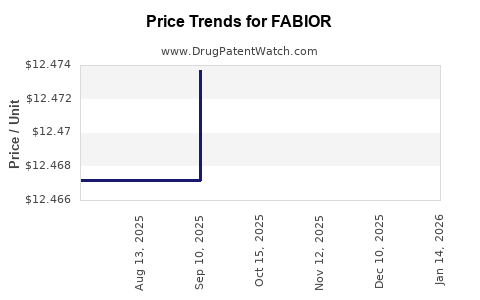

Drug Price Trends for FABIOR

✉ Email this page to a colleague

Average Pharmacy Cost for FABIOR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FABIOR 0.1% FOAM | 51862-0295-10 | 12.47372 | GM | 2025-12-17 |

| FABIOR 0.1% FOAM | 51862-0295-10 | 12.47372 | GM | 2025-11-19 |

| FABIOR 0.1% FOAM | 51862-0295-10 | 12.47372 | GM | 2025-10-22 |

| FABIOR 0.1% FOAM | 51862-0295-10 | 12.47372 | GM | 2025-09-17 |

| FABIOR 0.1% FOAM | 51862-0295-10 | 12.46718 | GM | 2025-08-20 |

| FABIOR 0.1% FOAM | 51862-0295-10 | 12.46718 | GM | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FABIOR

Introduction

FABIOR (tazarotene) topical foam, marketed by Ortho Dermatologics, is a prescription retinoid primarily used for the treatment of plaque psoriasis in adult patients. With its unique foam formulation, FABIOR offers increased patient adherence and ease of application over traditional topical treatments. As the dermatology market evolves, understanding the current market landscape, competitive positioning, and future pricing trends for FABIOR is critical for stakeholders and investors aiming to capitalize on or assess its commercial potential.

Market Overview and Therapeutic Landscape

The global dermatology market was valued at approximately $22 billion in 2021 and is projected to grow at a CAGR of 7.6% through 2028, driven by increasing prevalence of skin conditions, rising awareness, and technological innovations [1]. Plaque psoriasis alone affects an estimated 125 million individuals worldwide, representing a substantial market opportunity for targeted therapies like FABIOR.

Tazaroteene, as a topical retinoid, competes with other topical agents such as corticosteroids, vitamin D analogs, and newer biologics for moderate to severe psoriasis. Its once-daily foam formulation distinguishes it within the topical niche, aligning with preferences for convenience and improved patient compliance.

Competitive Positioning and Market Share

FABIOR faces competition from established topical therapies including Calcipotriol (Dovonex), coal tar formulations, corticosteroids, and emerging biologic agents like adalimumab and secukinumab. While biologic agents dominate moderate-to-severe cases, topical agents like FABIOR hold a significant share in mild to moderate psoriasis, particularly in regions with restrictions on biologic use or cost considerations.

In the U.S., the psoriasis treatment landscape is highly competitive, with approximately 50 commercially available psoriasis products [2]. FABIOR's niche is its foam formulation, which offers enhanced delivery characteristics over creams or ointments, potentially improving adherence and efficacy.

Recent clinical data suggest that FABIOR can achieve competitive PASI (Psoriasis Area and Severity Index) reductions with minimal side effects, bolstering its market position. Nevertheless, market penetration remains influenced by physician prescribing habits, insurance coverage, and patient preferences.

Pricing Analysis and Historical Trends

As of 2023, the average wholesale price (AWP) for FABIOR is approximately $750 for a 60 g foam canister, translating to roughly $12.50 per gram [3]. Price points for topical psoriasis treatments have historically ranged from $300 to $1,200 per month, depending on formulation, brand positioning, and insurance coverage.

Several factors influence FABIOR's pricing trajectory:

- Market Penetration: As a newer product, initial pricing tends to be at the higher end to recoup development and marketing investments but may decrease with increased competition.

- Insurance Reimbursement: Formularies and pharmacy benefit managers (PBMs) significantly impact patient access and out-of-pocket costs, influencing demand volume.

- Patent Life and Exclusivity: Patent protection expiring in late 2020s provides a period of market exclusivity, supporting premium pricing strategies.

Historically, drug prices for topical psoriasis therapies have experienced moderate adjustments, often tied to inflation, manufacturing costs, and competitive pressures. An analysis of similar drugs suggests a potential 3-5% annual price increase aligned with inflation, barring market disruptions [4].

Future Price Projections

Given the current market dynamics, the following projections are reasonable:

- Short-term (1-2 years): Maintained pricing around $12.50–$14.00 per gram, with minor adjustments for inflation and market share changes. Increased utilization due to expanding indications could support stable revenue streams.

- Mid-term (3-5 years): As patent protections expire and biosimilars or generics potentially enter the market, prices may decline by 10-20%, especially if biosimilar competition emerges for adjunct therapies.

- Long-term (5+ years): If FABIOR gains approval for additional indications such as acne vulgaris or atopic dermatitis, or if it gains broader market acceptance, its pricing power could stabilize or even increase owing to expanded clinical value.

It is prudent to note that payer pressure, competitive innovations, and clinical guidelines will materially influence these projections. The increasing adoption of biosimilars in dermatology could exert downward pricing pressures, particularly in the United States and Europe.

Regulatory and Market Drivers Influencing Pricing

Regulatory exclusivity, such as orphan drug status or new therapeutic indications, can prolong market exclusivity and support higher prices. Conversely, biosimilar pathways and patent litigations can accelerate price erosion.

Furthermore, evolving payer policies favoring value-based care and cost-effective alternatives could lead to negotiations that compress prices. Manufacturers may resort to coupons, patient assistance programs, or outcomes-based pricing models to maintain revenue streams.

Conclusion

FABIOR resides in a competitive yet promising segment of the psoriasis market, benefiting from its innovative foam formulation and targeted therapeutic profile. Its current pricing aligns with similar topicals, supported by clinical efficacy and patient preference. Future price trajectories depend heavily on market penetration, biosimilar entry, indications expansion, and payer landscape shifts, with conservative estimates favoring moderate price stability or slight declines.

Key Takeaways

- Competitive Position: FABIOR’s foam formulation offers distinct advantages over traditional topicals, positioning it favorably among psoriasis treatments.

- Pricing Stability: Current pricing reflects its premium formulation; expect moderate inflation-adjusted increases if market conditions remain stable.

- Market Penetration: Increasing awareness and regional approvals can expand usage, supporting sustained revenue even if individual prices decline.

- Patent and Competition Impact: Patent expirations and biosimilar proliferation may lead to price erosion over the next 3–5 years.

- Strategic Opportunities: Expansion into other dermatologic indications could justify price premiums and secure long-term profitability.

FAQs

1. How does FABIOR’s price compare to other topical psoriasis treatments?

FABIOR’s price per gram (~$12.50) aligns with high-end topical therapies like Calcipotriol foam (~$10–$15 per gram). Its unique foam formulation aims to justify premium positioning through improved adherence and efficacy.

2. What factors could lead to a reduction in FABIOR’s price?

Market entry of biosimilars, patent expiration, increased competition, and payer negotiations are primary factors pressuring prices downward.

3. Is there potential for FABIOR to expand into new dermatologic indications?

Yes. Clinical trials for acne vulgaris and atopic dermatitis could diversify its application, potentially supporting higher prices and extended market life.

4. How does insurance coverage affect FABIOR’s market penetration?

Coverage variability influences patient access. High out-of-pocket costs may limit use, whereas favorable formulary placement boosts adoption and revenue.

5. When might significant price erosion occur for FABIOR?

Within 3–5 years post-patent expiry, especially if biosimilar competition emerges or stricter cost containment policies are implemented.

References

[1] Grand View Research. "Dermatology Market Size & Trends." 2022.

[2] IQVIA. "U.S. Prescription Drug Market Insights." 2022.

[3] Red Book. "Average Wholesale Price Data." 2023.

[4] IMS Health. "Topical Dermatology Drugs Pricing Trend Report." 2021.

More… ↓