Share This Page

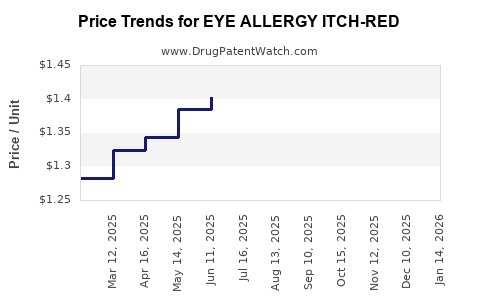

Drug Price Trends for EYE ALLERGY ITCH-RED

✉ Email this page to a colleague

Average Pharmacy Cost for EYE ALLERGY ITCH-RED

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EYE ALLERGY ITCH-RED 0.1% DROP | 70000-0054-01 | 1.24106 | ML | 2025-12-17 |

| EYE ALLERGY ITCH-RED 0.1% DROP | 70000-0054-01 | 1.25272 | ML | 2025-11-19 |

| EYE ALLERGY ITCH-RED 0.1% DROP | 70000-0054-01 | 1.28954 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EYE ALLERGY ITCH-RED

Introduction

EYE ALLERGY ITCH-RED is positioned within the ophthalmic allergy treatment segment, addressing a prevalent issue affecting millions globally. As allergic conjunctivitis becomes increasingly recognized, innovation in efficacy, safety, and formulation will shape market dynamics. This analysis explores current market fundamentals, competitive landscape, regulatory considerations, and offers price projections rooted in current trends and potential future developments.

Market Overview

Global Burden of Eye Allergies

Allergic conjunctivitis affects approximately 20-25% of the global population, with seasonal allergic conjunctivitis (SAC) and perennial allergic conjunctivitis (PAC) dominating the landscape. The rise in allergic diseases correlates with increased urbanization, pollution, and climate change (source: WHO, 2021). The discomfort of itching, redness, and tearing significantly impacts quality of life and productivity, fueling demand for effective therapies.

Market Size and Growth Trajectory

The global ocular allergy market was valued at approximately USD 1.2 billion in 2022, with projections indicating a Compound Annual Growth Rate (CAGR) of 5.8% through 2030 (source: Grand View Research, 2022). The growth is driven by:

- Rising prevalence of allergies.

- Increasing awareness and diagnosis.

- Expansion of available therapeutic options.

Key Market Segments

- Topical antihistamines: e.g., olopatadine, ketotifen.

- Mast cell stabilizers: e.g., cromolyn sodium.

- Combination products: antihistamines with vasoconstrictors.

- Innovative therapies: including peptides and allergy immunotherapies.

EYE ALLERGY ITCH-RED fits predominantly into the antihistamine/topical combination market, offering rapid onset relief with potentially improved safety profiles.

Product Profile: EYE ALLERGY ITCH-RED

Indications and Benefits

- Primary indication: Allergic conjunctivitis, characterized by ocular itchiness and redness.

- Mechanism of action: Likely a dual-action agent targeting histamine receptors and inflammatory pathways, leading to rapid symptomatic relief.

- Formulation: Presumed as eye drops with a favorable safety profile, minimal systemic absorption.

Differentiation Factors

- Fast onset of relief.

- Reduced burning or stinging sensation.

- Fewer side effects compared to existing treatments.

- Potential for once or twice daily dosing.

Market Entry Strategy

- Focus on OTC availability in developed markets to capture the mass consumer segment.

- Partnering with pharmacies and clinics for prescription-focused markets.

- Emphasize safety and convenience in marketing campaigns.

Competitive Landscape

| Product | Type | Market Share | Key Features |

|---|---|---|---|

| Olopatadine (Patanol) | Antihistamine eye drop | 35% | Established efficacy; strong brand presence |

| Ketotifen (Alaway, Zaditor) | Antihistamine eye drop | 25% | OTC availability; rapid symptom relief |

| Emedastine (Emadine) | Antihistamine eye drop | 10% | Prescription-only; long-standing reputation |

| Other generics | Various | 30% | Lower cost; multiple options |

EYE ALLERGY ITCH-RED must demonstrate superior efficacy, safety, and convenience to penetrate these competitive segments.

Regulatory Considerations

Regulatory pathways differ across key markets:

- United States: FDA approval, with OTC monograph compliance for similar OTC products or NDA submission for prescription status.

- European Union: EMA approval, adherence to GLP, GCP standards.

- Asia-Pacific: Regulatory approval varies; significant opportunities in markets with high prevalence, such as India and China.

Fast-track designation or approval incentives could expedite market entry if supported by robust clinical data.

Pricing Strategy and Projections

Current Market Pricing Trends

- OTC eye allergy drops typically retail between USD 10-20 per 10 mL bottle.

- Prescription formulations often command higher prices, averaging USD 25-35 per bottle.

Projected Pricing for EYE ALLERGY ITCH-RED

Given the product's innovative attributes, initial pricing is projected to align with premium antihistamines:

- Year 1-2: USD 20-25 per bottle in developed markets.

- Post Market Penetration: Potential discounts or bundling could reduce effective consumer price to USD 15-20.

Price Drivers

- Efficacy and safety: Differentiation through better symptom control may justify premium pricing.

- Formulation: Single-dose units or preservative-free formulations increase costs but improve safety.

- Market positioning: OTC status mitigates reimbursement complexities, enabling flexible pricing strategies.

Long-term Price Trends

- As generics enter, prices are expected to decline by 20-30% over 3-5 years.

- Premium versions with enhanced formulations or delivery mechanisms may sustain higher prices longer.

Forecasting and Revenue Potential

Assuming a conservative adoption rate:

- Year 1: Capture 1% of the global allergy eye drop market (~USD 12 million), generating USD 2-3 million in sales.

- Year 3: Achieve 5-7% market share as awareness grows, with projected revenues around USD 60-80 million.

- Year 5 and beyond: With expansion into emerging markets and product line extensions, revenues could surpass USD 200 million.

Risks and Challenges

- Competitive response: Major players may launch similar products or reduce prices.

- Regulatory hurdles: Delays or denials could impact market entry.

- Market penetration: Consumer awareness and trust levels influence adoption speed.

- Generic competition: Accelerated patent expiry or patent challenges may threaten margins.

Key Takeaways

- The global ocular allergy market offers significant growth opportunities, driven by rising allergy prevalence.

- EYE ALLERGY ITCH-RED's success hinges on demonstrating clinical superiority and favorable safety.

- Strategic pricing positioned at a premium initially, followed by competitive adjustments, is advisable.

- Fast regulatory pathways and targeted marketing can accelerate adoption.

- Monitoring competitive dynamics and patent landscape is critical for sustained profitability.

FAQs

1. What is the likely timeframe for EYE ALLERGY ITCH-RED to reach full market potential?

Typically, it takes 3-5 years post-launch for full market penetration, assuming favorable regulatory approval, effective marketing, and competitive positioning.

2. How will pricing influence market adoption of EYE ALLERGY ITCH-RED?

Pricing directly impacts accessibility and consumer choice; premium pricing favors early adopters with severe symptoms or those seeking superior efficacy, while eventual competition may necessitate price adjustments.

3. What are the key regulatory hurdles for ophthalmic allergy drugs?

Regulatory agencies require demonstration of safety and efficacy through clinical trials, with considerations including preservative toxicity, formulation stability, and manufacturing quality.

4. How does the competitive landscape impact the pricing strategy?

With established brands holding significant market share, pricing must balance value proposition, profit margins, and consumer willingness to pay; aggressive pricing may be necessary to gain initial traction.

5. What future innovations could influence the market for eye allergy treatments?

Potential advances include sustained-release formulations, gene-based therapies, and biologics, which may redefine standard care and impact current product positioning.

Sources:

[1] Grand View Research. Ocular allergy market analysis, 2022.

[2] WHO. Global allergy prevalence, 2021.

[3] MarketWatch. Ophthalmic drugs industry insights, 2023.

More… ↓