Share This Page

Drug Price Trends for EXENATIDE

✉ Email this page to a colleague

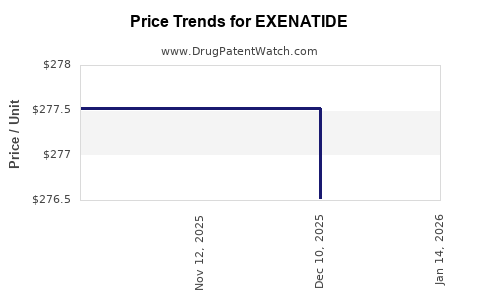

Average Pharmacy Cost for EXENATIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EXENATIDE 10 MCG DOSE PEN INJ | 70121-1686-01 | 276.51759 | ML | 2025-12-17 |

| EXENATIDE 10 MCG DOSE PEN INJ | 70121-1686-01 | 277.52014 | ML | 2025-11-19 |

| EXENATIDE 10 MCG DOSE PEN INJ | 70121-1686-01 | 277.52014 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Exenatide

Introduction

Exenatide, marketed under brand names such as Byetta and Bydureon, is a glucagon-like peptide-1 (GLP-1) receptor agonist primarily utilized in managing type 2 diabetes mellitus (T2DM). Approved initially by the FDA in 2005, exenatide has gained widespread adoption due to its efficacy in glycemic control and its beneficial effects on weight reduction. As the diabetes treatment landscape evolves, understanding the market dynamics and pricing trajectories for exenatide is crucial for stakeholders, including pharmaceutical companies, investors, healthcare providers, and policymakers.

This analysis explores current market conditions, competitive forces, regulatory influences, and future price projections for exenatide, providing actionable insights into its commercial trajectory over the upcoming years.

Market Overview and Demand Drivers

Global Diabetes Prevalence and Growth

The global prevalence of T2DM is escalating, with estimates suggesting over 537 million adults affected worldwide in 2021, projected to reach approximately 693 million by 2045 [1]. This burgeoning patient pool significantly fuels demand for effective hypoglycemic agents such as exenatide.

Therapeutic Profile and Positioning

Exenatide's unique benefits—potent HbA1c reduction, weight loss, and low hypoglycemia risk—position it favorably within the GLP-1 receptor agonist class. Despite the advent of newer agents (e.g., semaglutide, dulaglutide), exenatide remains a prescribed treatment, especially in markets prioritizing cost-effective options or where newer agents face delayed regulatory approval.

Market Penetration and Customer Segments

- Type 2 Diabetic Patients Unresponsive to Oral Agents: Exenatide is primarily prescribed when patients inadequately respond to first-line oral medications.

- Combination Therapy: It is frequently used alongside metformin, sulfonylureas, or insulin.

- Geographic Distribution: North America and Europe dominate the market, driven by high diabetes prevalence and advanced healthcare infrastructure, though emerging markets show expanding adoption.

Competitive Landscape

Key Players and Products

- Novo Nordisk: The leading manufacturer with Byetta and Bydureon.

- Others: Companies developing biosimilar and newer agents, including semaglutide (Ozempat, Rybelsus) and dulaglutide (Trulicity).

Innovation and Pipeline Developments

The pipeline includes once-weekly formulations, oral GLP-1 receptor agonists, and combination injectable products, potentially impacting exenatide’s market share.

Market Share Analysis

Exenatide's share has declined slightly with the rise of newer GLP-1 agents; however, its low cost and established safety profile continue to sustain its presence, especially in cost-sensitive markets.

Pricing Dynamics and Cost Factors

Current Pricing Benchmarks

- Brand Name Products: Exenatide’s average list price in the U.S. ranges from $300 to $500 per month [2].

- Generic and Biosimilar Competition: No biosimilars for exenatide currently exist, but patent expirations and regulatory pathways could open avenues for lower-cost alternatives.

Reimbursement and Insurance Impact

Reimbursement policies heavily influence retail pricing, with insurers favoring GLP-1 therapies with proven cost-effectiveness. Patient out-of-pocket costs remain variable, affected by formulary decisions.

Pricing Trends

Over time, exenatide prices have experienced modest reductions driven by:

- Market Competition: Introduction of new GLP-1s, some with improved dosing intervals or oral formulations.

- Regulatory Pressures: Emphasis on biosimilars may foster price competition.

- Payer Negotiations: Health plans increasingly negotiate discounts and rebates, thereby influencing net pricing.

Regulatory and Market Influences

Regulatory Approvals and Expirations

Patent protections and exclusivity periods influence pricing strategies. The expiration of patents around 2025 may permit biosimilar entrants, exerting downward pressure on exenatide prices.

Reformulation and Delivery Methods

Development of oral formulations (e.g., exenatide oral) and long-acting injectables could broaden usage and impact pricing by increasing patient convenience and adherence.

Healthcare Policy and Cost-Containment Measures

Global initiatives focusing on reducing diabetes management costs may promote generic/biosimilar adoption and price reductions further.

Price Projections (2023–2030)

Baseline Scenario

- Short-Term (2023–2025): Stabilization of prices with slight reductions (~5–10%) due to market saturation and payer negotiations.

- Mid-Term (2026–2028): Introduction of biosimilars post-patent expiration could reduce exenatide prices by 20–35%.

- Long-Term (2029–2030): Further declines anticipated as biosimilars gain market share; total reductions approximating 40–50% from peak prices.

Influence of New Formulations

- Oral and Long-Acting Injectables: Expected to coexist with traditional formulations. While potentially priced higher initially, increased competition may equilibrate costs.

Potential Market Expansion

Emerging markets and increasing adoption due to improved access and affordability strategies will support sustained demand, possibly maintaining or slightly elevating exenatide's market cap despite price pressures.

Economic Impact and Strategic Considerations

The expected trajectory indicates a gradual decline in exenatide's unit prices influenced by biosimilar entry, formulary negotiations, and evolving treatment standards. Stakeholders should consider:

- Investment in Biosimilar Development: Early entry could capitalize on market share before generics saturate.

- Innovation in Delivery: Developing more convenient formulations could sustain or increase utilization.

- Pricing Strategies: Balancing profitability with competitive positioning in a commoditized landscape.

Key Takeaways

- The global rise in T2DM prevalence sustains a baseline demand for exenatide.

- The current market is characterized by moderate growth, facing increasing competition from newer GLP-1 agents.

- Prices are projected to decline progressively due to biosimilar competition, with reductions up to 50% by 2030.

- Strategic investments in formulation innovation and biosimilar production can buffer revenue declines.

- Regulatory and policy developments will significantly influence future pricing and market penetration.

FAQs

Q1: How will biosimilar entry impact exenatide’s market price?

Biosimilar entrants are expected to cause significant price reductions—approximately 20–35%—by 2026–2028, increasing price competition and accessibility.

Q2: Are there any alternative therapies that threaten exenatide’s market share?

Yes, newer GLP-1 receptor agonists like semaglutide (Ozempic) and dulaglutide (Trulicity) offer improved dosing convenience and efficacy, challenging exenatide's market dominance.

Q3: Will the development of oral GLP-1 formulations affect exenatide’s market?

Potentially. Oral GLP-1 formulations could expand patient access, pressuring injectable exenatide prices and marketing strategies.

Q4: How do healthcare policies influence exenatide’s pricing?

Policies promoting cost containment and generic substitution encourage price reductions and formulary restrictions favoring lower-cost options.

Q5: What strategic steps can pharmaceutical companies take to optimize revenue?

Investing in innovative delivery systems, biosimilar development, and expanding into emerging markets can sustain revenue streams amid declining prices.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 10th Edition, 2021.

[2] GoodRx. Exenatide (Brand Name: Byetta, Bydureon) Price and Coupons. 2023.

More… ↓