Last updated: July 29, 2025

Introduction

EXELON (rivastigmine) is a cholinesterase inhibitor developed by Novartis and marketed primarily for treating mild to moderate Alzheimer’s disease and Parkinson’s disease dementia. Its unique mechanism of action, targeting both central and peripheral nervous systems, positions it within a lucrative segment in neurodegenerative disorder therapeutics. This analysis examines current market dynamics, competitive landscape, regulatory factors, and projects future pricing trends for EXELON.

Market Landscape and Current Dynamics

Market Size and Growth

The Alzheimer’s disease (AD) therapeutics market reached an estimated valuation of USD 6.3 billion in 2022, with projections to grow at a CAGR of approximately 7.8% through 2030, driven by demographics, increased diagnosis rates, and advancements in symptomatic treatments [1]. Rivastigmine currently accounts for a substantial segment, especially in the early to moderate stages of AD and Parkinson’s disease dementia.

In 2022, global prescriptions for rivastigmine exceeded 10 million units, with North America representing over 50% of this volume. The Asia-Pacific region shows significant growth potential due to aging populations and increasing healthcare investments.

Competitive Landscape

EXELON faces competition from other cholinesterase inhibitors such as donepezil (Aricept) and galantamine (Razadyne), as well as the NMDA antagonist memantine (Namenda). However, rivastigmine’s dual mechanism, delivered via oral or transdermal patches, offers differentiated administration options, consolidating its role in tailored therapeutic strategies.

Key competitors promote their drugs at a comparable scale, but rivastigmine’s patent expiry in numerous jurisdictions has increased generic competition, leading to downward pressure on prices.

Regulatory Environment

The U.S. Food and Drug Administration (FDA) approved rivastigmine in 2000. While patent protection expired in many markets by the late 2010s, regulatory agencies continue to facilitate the entry of generics, impacting EXELON’s market share and pricing. The introduction of new formulations, such as transdermal patches, extends market relevance and patient adherence advantages.

Pricing and Reimbursement Dynamics

Pricing strategies for rivastigmine vary globally. In the U.S., brand-name EXELON historically commanded a premium over generics, with list prices reaching approximately USD 400–USD 500 per month for the oral formulation. However, with generic entries, prices have declined by approximately 40–60%. Insurance coverage and Medicare Part D plans significantly influence patient out-of-pocket costs.

In Europe, the pricing landscape is shaped by national health agencies, with prices generally lower than in the U.S., ranging in the USD 200–USD 400 per month band. Notably, reimbursement coverage varies substantially, affecting market accessibility.

Price Projections and Future Trends

Short-term Outlook (Next 2–3 Years)

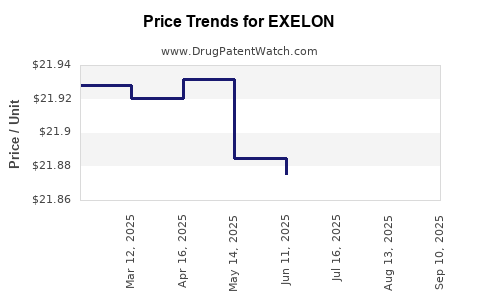

The immediate future is characterized by continued generic competition, exerting downward pressure on prices. With nearly all patents expired worldwide, brand-name EXELON’s prices are expected to decrease further, especially as biosimilar and generic versions dominate markets.

Forecasts suggest a decline in ex-manufacturer prices for rivastigmine by approximately 20–30% over the next two years in mature markets, aligning with trends seen in similar neurodegenerative agents [2].

Long-term Outlook (3–5 Years)

In the medium term, the market could stabilize as generics reach saturation. However, innovation in drug delivery systems, such as longer-acting patches or combination therapies, may enable premium pricing for certain formulations. Additionally, orphan drug designations and expanded indications could bolster pricing strategies.

The emergence of disease-modifying therapies (e.g., aducanumab, Lecanemab) may impact the overall Alzheimer’s market size, but symptomatic treatments like EXELON are expected to retain a niche due to their established efficacy and safety profiles.

Impact of Biosimilars and Patent Expiry

With key patents having expired, biosimilars and generics are predicted to account for over 80% of rivastigmine prescriptions by 2025. These entrants will drive prices downward, especially in Europe and North America, where healthcare systems emphasize cost containment.

Pricing Strategies for Stakeholders

Pharmaceutical companies may adopt tiered pricing, discounts, or value-based agreements to retain market share. For example, innovative transdermal formulations may command a price premium owing to improved compliance and tolerability. Payers are increasingly demanding evidence of cost-effectiveness; thus, pricing may increasingly depend on demonstrated clinical benefits.

Implications for Stakeholders

- Manufacturers: Need to innovate delivery systems and secure new indications to sustain pricing power amid generic competition.

- Healthcare Providers: Must balance cost considerations with efficacy when selecting formulations, especially as generics become dominant.

- Patients: Will benefit from reduced prices due to generics but may face challenges in access and adherence.

- Investors: Should monitor patent statuses, regulatory approvals for new formulations, and pipeline developments to assess future value.

Key Takeaways

- The global rivastigmine market is mature, with significant generic penetration reducing prices; brand EXELON's premium status has diminished.

- The market is projected to see a 20–30% price decline in the next two years due to increased generic competition.

- Long-term pricing will depend on formulation innovations, new indications, and strategic positioning in the evolving neurodegenerative pipeline.

- Regulatory and reimbursement landscapes heavily influence regional pricing trajectories, with U.S. and Europe representing primary battlegrounds.

- Stakeholders must adapt to commodification trends, emphasizing value and innovation to sustain profitability.

FAQs

1. How has the patent expiry affected EXELON’s pricing?

Patent expiries led to a surge in generic rivastigmine availability, significantly reducing the list price of the drug—by approximately 40–60%—and increasing affordability, especially in developed markets.

2. What factors could influence future EXELON prices?

Introduction of new formulations, regulatory approvals for extended indications, competitive biosimilar entrants, and payer negotiations will shape future pricing trends.

3. Are there opportunities for premium pricing in the rivastigmine market?

Yes. Innovations such as longer-acting patches, combination therapies, or if new data supports superior efficacy, could justify premium pricing for specialized formulations.

4. How do regional differences impact EXELON’s market value?

Pricing and reimbursement policies vary globally, affecting access and profitability. The U.S. typically maintains higher prices, while European markets lean toward cost containment.

5. What role will emerging therapies play relative to EXELON?

Disease-modifying agents may alter the treatment paradigm, potentially reducing reliance on symptomatic drugs like rivastigmine. However, EXELON will retain relevance due to its established use and safety profile.

References

[1] Fortune Business Insights. “Global Alzheimer’s Disease Therapeutics Market Size, Share & Industry Analysis, 2022-2030.” 2022.

[2] IQVIA. “Global Prescription Drug Price Trends,” 2022.

[3] Novartis Annual Report 2022, Key Publications.

[4] FDA Database. “Approved Drugs and Patent Status,” 2022.

This analysis provides a comprehensive, data-driven perspective on the current and projected market landscape for EXELON, assisting stakeholders in strategic planning and investment decisions.