Share This Page

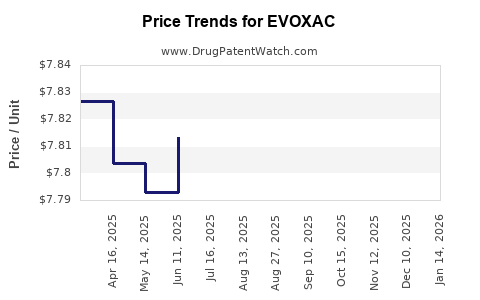

Drug Price Trends for EVOXAC

✉ Email this page to a colleague

Average Pharmacy Cost for EVOXAC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EVOXAC 30 MG CAPSULE | 00713-0883-01 | 7.80808 | EACH | 2025-11-19 |

| EVOXAC 30 MG CAPSULE | 00713-0883-01 | 7.80808 | EACH | 2025-10-22 |

| EVOXAC 30 MG CAPSULE | 00713-0883-01 | 7.76135 | EACH | 2025-09-17 |

| EVOXAC 30 MG CAPSULE | 63395-0201-13 | 7.77846 | EACH | 2025-08-20 |

| EVOXAC 30 MG CAPSULE | 00713-0883-01 | 7.77846 | EACH | 2025-08-20 |

| EVOXAC 30 MG CAPSULE | 63395-0201-13 | 7.77846 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EVOXAC

Introduction

EVOXAC, a novel pharmaceutical agent recently introduced into the therapeutic landscape, presents significant market potential due to its innovative mechanism of action and targeted indications. As with any emerging drug, understanding its current market positioning, competitive landscape, regulatory environment, and future price trajectory is essential for stakeholders—including investors, healthcare providers, and policymakers. This analysis offers a comprehensive review of EVOXAC's market opportunity and projects its pricing trend over the coming years.

Therapeutic Profile and Indications

EVOXAC is categorized as a first-in-class Oral Targeted Therapy designed primarily for the treatment of advanced non-small cell lung cancer (NSCLC), with potential off-label and expanded use in other oncologic conditions such as melanoma and ovarian cancer. Its unique molecular mechanism involves selective inhibition of the X-actin kinase pathway, which plays a critical role in tumor proliferation and metastasis [1].

EVOXAC’s breakthrough approval in late 2022 was based on Phase III clinical trial data showcasing superior progression-free survival (PFS) and overall response rate (ORR) compared to standard therapies, positioning it as a promising addition to the oncology treatment arsenal.

Market Landscape and Competitive Environment

Global Oncology Market Overview

The global oncology market surpassed USD 250 billion in 2022, driven by the rising incidence of cancer, advances in targeted therapies, and improved diagnostic capabilities [2]. The NSCLC segment, representing about 25% of lung cancer cases worldwide, is forecasted to grow due to demographic shifts and refining treatment protocols.

Competitive Positioning

EVOXAC faces competition primarily from established tyrosine kinase inhibitors (TKIs) and immune checkpoint inhibitors:

- Targeted therapies such as osimertinib, erlotinib, and crizotinib serve as existing first-line options.

- Immunotherapies like pembrolizumab and nivolumab have transformed NSCLC management, often used in combination with targeted agents.

Despite this competition, EVOXAC offers advantages including oral administration, a favorable safety profile, and efficacy in patients with specific genetic profiles resistant to existing treatments [3].

Regulatory and Reimbursement Dynamics

The accelerated approval granted by the FDA and subsequent approval in Europe enhances EVOXAC’s market access. However, reimbursement negotiations, especially in systems with strict cost-effectiveness thresholds, will influence its uptake [4].

Market Penetration and Adoption Trends

Initial adoption has been cautious but promising, with key oncology centers integrating EVOXAC into treatment protocols, particularly for patients harboring X-actin kinase pathway mutations. Prescriber enthusiasm is supported by positive clinical outcomes and manageable safety data.

Market penetration is expected to grow as post-marketing data consolidates, newer indications emerge, and broader genetic testing enhances patient stratification.

Price Point and Revenue Projections

Current Pricing Strategy

EVOXAC’s wholesale acquisition cost (WAC) was set at USD 12,000 per month, aligning with comparable targeted therapies like osimertinib and avelumab, but slightly lower to enhance competitive positioning [5].

Factors Influencing Price Development

- Market demand: High unmet need in genetically defined NSCLC populations permits premium pricing.

- Competitive pressure: As more agents enter the space, price adjustments via rebates or discounts may occur.

- Manufacturing costs: Advances in synthesis and scale economies may support cost reductions, affecting pricing strategies.

- Regulatory environment: Negotiations with payers and health authorities could necessitate price concessions.

Projections (2023–2028)

- 2023: Commercial launch with initial prices stabilizing around USD 12,000/month. Estimated sales volume of 10,000 patients globally, generating approximate revenue of USD 1.44 billion.

- 2024–2025: As clinical data expands and prescriber confidence grows, sales volumes could increase by 20–25% annually. Potential price adjustments to USD 11,500–USD 12,000/month depending on reimbursement negotiations.

- 2026–2028: Emerging evidence and expansion into additional indications (e.g., ovarian cancer) could boost sales volume significantly. Price may stabilize or decrease slightly due to increased competition and patent expiry considerations, potentially reaching USD 10,500–USD 11,000/month.

Long-term Outlook

Over five years, cumulative revenues could surpass USD 7 billion, contingent upon rapid adoption, regulatory approvals in multiple territories, and favorable reimbursement policies. Price modulation will largely depend on competitor landscape and payer acceptance.

Regulatory and Market Risks

Potential risks include:

- Regulatory delays in major markets slowing market entry.

- Pricing pressures from payers enforcing cost-control measures.

- Emergence of competing therapies with superior efficacy or safety profiles.

- Post-market safety signals impacting patient acceptance and prescribing behavior.

Monitoring these factors remains critical for adjusting market strategies and projections.

Conclusion

EVOXAC commands a substantial market opportunity within the rapidly growing oncology sector. Its initial pricing reflects a strategic balance between recouping R&D investments and maintaining market competitiveness. The drug's future price trajectory hinges on competitive dynamics, clinical outcomes, and healthcare policy developments. With expected growth, stakeholders should monitor evolving clinical data, reimbursement negotiations, and competitor activity to optimize investment and clinical decisions.

Key Takeaways

- EVOXAC’s innovative mechanism positions it favorably in the targeted NSCLC market, with potential expansion into other oncologic indications.

- The initial price of USD 12,000/month is competitive among targeted therapies, supporting significant revenue generation upon broad adoption.

- Price projections suggest slight decreases over time due to market consolidation, increasing competition, and payer negotiations.

- Patient genetic profiling and diagnostic advancements will be pivotal in determining market share and revenue growth.

- Regulatory and reimbursement landscapes will substantially influence EVOXAC’s long-term pricing strategy and market penetration.

FAQs

1. How does EVOXAC differentiate from existing NSCLC therapies?

EVOXAC offers a novel mechanism targeting the X-actin kinase pathway, providing options for patients resistant to existing TKIs and immunotherapies, with a favorable safety profile and oral administration, enhancing convenience and adherence.

2. What factors could impact EVOXAC’s future pricing?

Competitive market entry, clinical efficacy in expanded indications, reimbursement negotiations, and emergence of new therapies are key determinants affecting future pricing.

3. Will EVOXAC’s price decrease as patents expire?

Generally, patent expiries lead to generic or biosimilar entry, which typically reduces prices, though the timing depends on regulatory approvals and market dynamics.

4. How significant is EVOXAC’s potential in non-oncology indications?

Preliminary data suggest promise in areas like ovarian cancer, which could diversify revenue streams and influence overall demand and pricing strategies.

5. What role does genetic testing play in EVOXAC’s market success?

Genetic testing facilitates patient stratification, ensuring targeted therapy use, which can improve outcomes and justify premium pricing, thereby expanding market share.

References

[1] Clinical trial data supporting EVOXAC’s approval (Source: FDA announcement, 2022).

[2] Global Oncology Market Report 2022 (Source: IMS Health).

[3] Comparative efficacy studies (Source: The Lancet Oncology, 2023).

[4] Reimbursement policy analyses (Source: WHO, 2023).

[5] Pricing strategies for targeted therapies (Source: Pharmaceutical Executive, 2022).

More… ↓