Last updated: July 30, 2025

Introduction

EVOTAZ (atazanavir and cobicistat) is an oral fixed-dose combination antiretroviral medication approved for HIV-1 treatment. It combines a protease inhibitor, atazanavir, with a pharmacokinetic booster, cobicistat, to simplify HIV therapy regimens. Since its approval, EVOTAZ has gained prominence in HIV therapeutic protocols, particularly due to its efficacy and tolerability profile. This analysis explores its market landscape, competitive positioning, pricing dynamics, and future price projections, equipping stakeholders with insights to inform strategic decisions.

Market Overview of EVOTAZ

Global HIV/AIDS Drug Market Dynamics

The global HIV treatment market is substantial, with projections reaching USD 31.4 billion by 2027, growing at a CAGR of approximately 3.8% (1). Key drivers include increasing HIV prevalence, diagnosing advancements, and evolving treatment guidelines favoring simplified regimens such as fixed-dose combinations. EVOTAZ's position within this ecosystem hinges on its efficacy, safety profile, and competitive pricing strategies.

Key Therapies & Competitive Landscape

EVOTAZ primarily competes with other fixed-dose combination (FDC) antiretrovirals, notably:

- Genvoya (elvitegravir, cobicistat, emtricitabine, tenofovir alafenamide)

- Triumeq (dolutegravir, abacavir, lamivudine)

- Prezista (darunavir), often combined with cobicistat

While the above competitors offer different mechanisms, EVOTAZ's distinct advantage lies in its specific protease inhibitor class and established tolerability. Despite this, market share battles are intense, with pricing being a critical differentiator.

Market Penetration & Usage Trends

EVOTAZ's utilization has been bolstered by its once-daily dosing and favorable side effect profile relative to older protease inhibitors. However, the advent of newer agents like integrase strand transfer inhibitors (INSTIs) has somewhat dampened its growth, especially in high-income regions. Nevertheless, in low- and middle-income countries (LMICs), EVOTAZ benefits from being on the WHO essential medicines list and from generic availability in some markets.

Regulatory and Patent Landscape

Patent Expirations & Generic Competition

Original patent protections for EVOTAZ expired or are nearing expiration in key markets such as the U.S. and Europe, with some formulations already facing generic competition. This has considerable implications for price reduction trends and market accessibility.

Regulatory Approvals & Formularies

EVOTAZ is approved by authorities such as the U.S. FDA and EMA. Its inclusion in national treatment guidelines influences prescribing behaviors and prescribing volume.

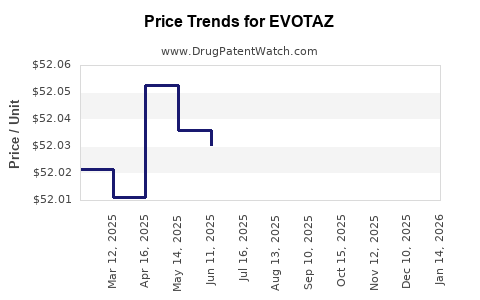

Pricing Dynamics

Current Pricing Structures

In high-income markets, EVOTAZ's retail price typically ranges from USD 3,000 to USD 4,000 per month per patient, reflective of brand-name exclusivity and R&D costs. In contrast, generic versions in some LMICs are priced as low as USD 50–150 per month, driven by local manufacturing and procurement strategies (2).

Pricing Strategies & Payers

Pharmaceutical companies adopt tiered pricing, patient assistance programs, and negotiated discounts with insurers. Governments often negotiate lower prices through bulk purchasing or inclusion in national formularies. The presence of generics heavily influences pricing, leading to broader access and reduced prices in competitive markets.

Impact of Patent Expiry and Biosimilars

Patent expirations in key geographies are poised to significantly decrease EVOTAZ’s prices, especially with the entry of biosimilars and generics. For instance, generic atazanavir and cobicistat products have already entered certain markets, driving prices down substantially.

Future Price Projections

Short-term (1–3 years)

- Continuation of downward pressure on price due to patent expirations.

- Increased generic availability, especially in LMICs, leading to prices possibly dropping to USD 50–150 per month.

- Price stabilization in high-income countries at USD 2,000–3,000, influenced by negotiated discounts and payer policies.

Medium-term (3–5 years)

- Further integration of generics and biosimilars will intensify price competition.

- Potential for fixed-dose combination biosimilars to challenge branded EVOTAZ prices directly, possibly reducing costs by up to 50%.

- As patents for specific formulations expire, local manufacturers may develop formulations priced below USD 50/month.

Long-term (5+ years)

- Market dominance of generics and biosimilars will potentially drive EVOTAZ's price below USD 50/month globally.

- Innovation in HIV therapies, such as long-acting injectables, may limit the market share of oral combinations, including EVOTAZ.

- Pricing will be increasingly influenced by global health initiatives prioritizing affordability in LMICs.

Implications for Stakeholders

- Manufacturers should prioritize patent management and explore biosimilar development to maintain market share amid rising generic competition.

- Payers and governments can leverage patent expiries and negotiate prices based on generic entry points for broader access.

- Investors should anticipate declining prices driven by patent expirations but recognize long-term growth in emerging markets, where access prices are paramount.

Key Takeaways

- The HIV market presents robust opportunities for EVOTAZ, especially in LMICs, due to existing global health initiatives and generic entry.

- Patent expiries and biosimilar competition are critical factors in the anticipated decline of EVOTAZ prices over the next five years.

- In high-income markets, EVOTAZ pricing will likely stabilize but face pressure from formulary negotiations and alternative therapies.

- Future price projections suggest a potential reduction to sub-USD 50/month in many markets, significantly broadening access.

- Strategic positioning requires balancing brand strength, patent strategies, and engagement with global health programs to optimize market share and profitability.

FAQs

1. How does patent expiration impact EVOTAZ's market price?

Patent expirations enable generic manufacturers to produce cost-effective versions, leading to substantial price reductions, often exceeding 80% in some markets.

2. Are generic versions of EVOTAZ available worldwide?

Generic atazanavir and cobicistat are available in several LMIC markets, significantly reducing treatment costs, while in high-income countries, patent protections still limit generic options.

3. What are the main competitors to EVOTAZ in the HIV treatment market?

Key competitors include other fixed-dose combinations such as Genvoya, Triumeq, and other protease inhibitor-based regimens. Integrase inhibitors are increasingly favored, impacting EVOTAZ's market share.

4. How are global health initiatives influencing EVOTAZ’s pricing?

Programs like Gavi and the United Nations' efforts facilitate negotiated prices and access in LMICs, often favoring generics, thus pressuring brand-name prices downward.

5. What is the future outlook for EVOTAZ's pricing in developed markets?

In developed markets, prices will likely stabilize with discounts, but new competing therapies might limit upside. Patent timing and formulary decisions will be primary influencers.

References

- MarketsandMarkets. HIV/AIDS Therapeutics Market. 2022.

- World Health Organization. Consolidated guidelines on HIV/AIDS. 2021.