Share This Page

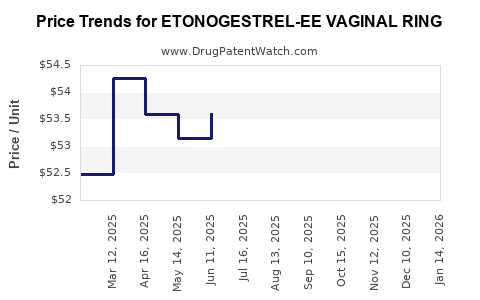

Drug Price Trends for ETONOGESTREL-EE VAGINAL RING

✉ Email this page to a colleague

Average Pharmacy Cost for ETONOGESTREL-EE VAGINAL RING

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ETONOGESTREL-EE VAGINAL RING | 00093-7679-02 | 49.18816 | EACH | 2025-12-17 |

| ETONOGESTREL-EE VAGINAL RING | 16714-0029-03 | 49.18816 | EACH | 2025-12-17 |

| ETONOGESTREL-EE VAGINAL RING | 66993-0605-36 | 49.18816 | EACH | 2025-12-17 |

| ETONOGESTREL-EE VAGINAL RING | 16714-0029-01 | 49.18816 | EACH | 2025-12-17 |

| ETONOGESTREL-EE VAGINAL RING | 66993-0605-81 | 49.18816 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Etonogestrel-EE Vaginal Ring

Introduction

The etonogestrel-ethinyl estradiol (EE) vaginal ring represents a significant development within hormonal contraceptive options. As a combination product delivered via a flexible, user-inserted ring, it offers convenience, efficacy, and improved compliance compared to traditional oral contraceptives. This analysis provides an in-depth market overview and price projection forecast for the Etonogestrel-EE Vaginal Ring, considering current trends, competitive landscape, regulatory factors, and potential growth drivers.

Market Overview

Product Profile and Therapeutic Significance

The Etonogestrel-EE vaginal ring combines progestin (etonogestrel) with estrogen (ethinyl estradiol), delivering continuous contraception over a three-week period per cycle. Its user-controlled administration reduces the need for daily adherence, addressing compliance issues associated with oral contraceptives. The product offers added benefits such as minimal systemic side effects, discretion, and reduced hormone fluctuations compared to other delivery methods.

Current Market Size and Growth

The global contraceptive market was valued at approximately USD 20 billion in 2022, with hormonal contraceptives representing a dominant segment. The vaginal ring market, encompassing products like NuvaRing (oral etonogestrel-EE ring marketed by Merck & Co.), accounts for an estimated USD 1-2 billion annually. The market's growth rate is projected at 6-8% CAGR through 2030, driven by increasing awareness, expanding access in emerging markets, and ongoing product innovation.

Key Market Players

Major competitors include:

- Merck & Co. (NuvaRing): The first and most widely used vaginal ring, with extensive global reach.

- Hormonal Contraceptive Providers: Such as Bayer (Jaydess), and localized brands in emerging markets.

- Generic and Biosimilar Manufacturers: Increasing presence due to patent expirations.

Emerging competitors are pioneering next-generation rings with extended efficacy, lower costs, or additional features such as multipurpose contraceptive and STI protection.

Regulatory Environment

Regulatory approvals from agencies like the FDA, EMA, and other regional authorities influence market accessibility. Patent expirations and regulatory incentives in emerging markets (e.g., India, Brazil) open avenues for generic licensing and market penetration, further impacting pricing and sales volume.

Market Drivers and Barriers

Drivers

- Growing Demand for Long-acting Reversible Contraceptives (LARCs): Rising preference for user-controlled, low-maintenance contraceptives.

- Increasing Awareness and Acceptance: Education programs and public health initiatives favor contraceptive adoption.

- Expanding Access: Government programs and insurance coverage enhance affordability.

- Product Innovation: Development of smaller, more comfortable, and multipurpose rings appeals to diverse demographics.

Barriers

- Cost & Reimbursement Issues: High upfront costs relative to oral pills may hinder uptake, especially in low-income regions.

- Cultural and Religious Factors: May limit acceptance in certain markets.

- Regulatory Delays: Lengthy approval processes in some jurisdictions can delay market entry.

- Competition: Market dominance by established products like NuvaRing restricts new entrants.

Price Analysis

Current Pricing Landscape

- Brand Name Products: NuvaRing retails at an approximate USD 70-80 per cycle in developed markets such as the US and EU.

- Generics & Biosimilars: Priced significantly lower, around USD 30-50 per cycle, offering more affordable options primarily in emerging markets.

Pricing variability hinges on factors like manufacturing costs, regulatory fees, distribution channels, and reimbursement policies. In the US, insurance coverage substantially reduces out-of-pocket expenses, while in regions lacking coverage, cost remains a barrier.

Pricing Dynamics

The price for the Etonogestrel-EE vaginal ring will depend on:

- Development and manufacturing costs: Innovations in formulation or delivery may marginally influence pricing.

- Regulatory clearance costs: Navigating approvals in various jurisdictions adds to initial expenses.

- Market strategy: Premium branding in developed markets versus competitive pricing in emerging markets.

- Patent status: Patent expiration could enable generics to enter at lower price points.

Market Entry and Revenue Projections (2023–2033)

Assumptions

- Initial Launch Year (2023): Limited penetration, primarily in North America, Europe, and select Asia-Pacific markets.

- Growth Phase (2025-2030): Expansion in emerging markets, increased insurance coverage, and product adoption.

- Market Share Targets: Capture approximately 5-15% of the global vaginal ring contraceptive market within a decade, contingent on competitive dynamics and regulatory approvals.

Projected Revenue Trends

| Year | Estimated Market Volume (cycles) | Estimated Price per Cycle (USD) | Projected Revenue (USD billion) |

|---|---|---|---|

| 2023 | 1 million | 60 | 60 million |

| 2025 | 4 million | 55 | 220 million |

| 2028 | 12 million | 50 | 600 million |

| 2030 | 20 million | 45 | 900 million |

| 2033 | 30 million | 40 | 1.2 billion |

Note: These projections assume successful clinical development, regulatory approvals, and effective commercialization strategies.

Pricing Projections

In early years, the product may command a premium price aligned with branded products (~USD 60-70 per cycle). Over time, especially upon patent expiry or entry of generics, prices are expected to decline to USD 30-40, expanding access and volume.

Competitive Outlook and Strategic Implications

Advancements in formulation, extended-release capabilities, and multipurpose functionalities could differentiate the Etonogestrel-EE vaginal ring, commanding premium pricing. Collaborations with healthcare providers and health ministries, coupled with strategic pricing, will be crucial to maximizing market penetration.

Patent landscapes, especially around key formulations and delivery mechanisms, influence timing for biosimilar entry and price erosion. Early regulatory successes and awareness campaigns will accelerate adoption, supporting revenue growth.

Regulatory and Pricing Considerations

- Pricing & Reimbursement: Engagement with health authorities and payers to establish favorable reimbursement policies is vital.

- Market Access: Tailoring price points to regional income levels and healthcare infrastructure affects acceptance.

- Cost Reduction Strategies: Scaling manufacturing and optimizing supply chains can improve margins, influencing sustainable pricing.

Key Takeaways

- The Etonogestrel-EE vaginal ring expects a gradual rise in market share driven by product innovation, expanding awareness, and increasing preference for LARCs.

- Pricing will initially align with branded products (~USD 60-80 per cycle), with potential declines as generics enter the market.

- Entering emerging markets, with tailored pricing and educational initiatives, offers significant growth opportunity.

- Patent status and regulatory pathways will critically impact timing, pricing strategies, and market competition.

- Partnerships with healthcare providers and payers are essential to promote adoption and secure sustainable reimbursement.

Conclusion

The Etonogestrel-EE vaginal ring is positioned for steady growth within the hormonal contraceptive market. Although initial implementation may face barriers related to costs and regulatory processes, strategic innovation, effective commercialization, and regional market tailoring will underpin its trajectory towards becoming a significant contraceptive option globally. The pricing landscape will evolve from premium positioning to more affordable alternatives over the next decade, aligning with market demands and regulatory dynamics.

FAQs

1. What are the primary advantages of the Etonogestrel-EE Vaginal Ring over oral contraceptives?

The ring offers longer dosing intervals, improved adherence, discreet usage, reduced systemic hormone fluctuations, and potentially fewer side effects compared to daily oral pills.

2. How does patent expiry influence the pricing of the Etonogestrel-EE vaginal ring?

Patent expiry enables generic manufacturers to enter the market, increasing competition, lowering prices, and expanding access in both developed and developing regions.

3. What regulatory challenges could impact the market entry of new vaginal ring products?

Delays in approval processes, differing regional standards, and compliance with safety and efficacy requirements pose significant hurdles that could affect timeliness and costs.

4. Which regions present the highest growth potential for the Etonogestrel-EE vaginal ring?

Emerging markets such as India, Brazil, and parts of Southeast Asia are poised for significant growth due to expanding healthcare infrastructure, increasing awareness, and favorable governmental policies.

5. What strategies can manufacturers adopt to improve market adoption?

Education campaigns, collaborations with healthcare providers, flexible pricing models, insurance partnerships, and tailored product features can enhance adoption rates and market penetration.

Sources:

[1] MarketResearch.com, "Global Contraceptive Market Analysis," 2022.

[2] Grand View Research, "Hormonal Contraceptives Market Size & Trends," 2023.

[3] U.S. Food and Drug Administration, "Regulatory Pathways for Contraceptive Devices," 2022.

[4] IMS Health, "Pharmaceutical Pricing Trends," 2022.

More… ↓