Share This Page

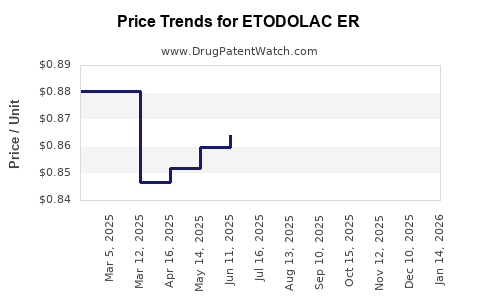

Drug Price Trends for ETODOLAC ER

✉ Email this page to a colleague

Average Pharmacy Cost for ETODOLAC ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ETODOLAC ER 600 MG TABLET | 68382-0273-14 | 1.11039 | EACH | 2025-11-19 |

| ETODOLAC ER 400 MG TABLET | 00093-1122-01 | 1.04306 | EACH | 2025-11-19 |

| ETODOLAC ER 400 MG TABLET | 16714-0497-01 | 1.04306 | EACH | 2025-11-19 |

| ETODOLAC ER 400 MG TABLET | 51672-4051-01 | 1.04306 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ETODOLAC ER

Introduction

Etodolac ER (Extended Release) is a non-steroidal anti-inflammatory drug (NSAID) under the classification of selective cyclooxygenase-2 (COX-2) inhibitors. Approved primarily for management of acute and chronic painful conditions such as osteoarthritis and rheumatoid arthritis, Etodolac ER distinguishes itself through its extended-release formulation, offering sustained pain relief while potentially reducing gastrointestinal side effects relative to traditional NSAIDs.

This report provides a comprehensive market analysis of Etodolac ER, focusing on current market dynamics, competitive landscape, regulatory considerations, and future price projections driven by demand-supply factors and healthcare policy influences.

Market Overview

The global NSAID market was valued at approximately USD 12 billion in 2022 and is projected to grow at a CAGR of around 4-5% through 2028, driven by increasing prevalence of chronic inflammatory diseases and expanding geriatric populations. Within this landscape, Etodolac ER occupies a niche, primarily targeting the US and European markets where controlled-release formulations align with patient compliance and safety goals.

Key factors influencing Etodolac ER's market position include:

- Disease Prevalence: The rising incidence of osteoarthritis and rheumatoid arthritis—particularly in aging populations—fuels demand for effective, sustained-release pain management therapies.

- Competitive Dynamics: The NSAID and COX-2 inhibitor sectors are densely populated. Major competitors include celecoxib, meloxicam, and diclofenac. Etodolac ER’s unique extended-release profile offers advantages but faces stiff competition on price and marketing.

- Regulatory Landscape: Stringent safety assessments, especially concerning cardiovascular and gastrointestinal risks associated with NSAIDs, influence approval and reimbursement. The Food and Drug Administration (FDA) continues to monitor COX-2 inhibitor safety, impacting market access.

Current Market Penetration

Market Adoption and Prescription Trends:

Etodolac ER exists as a prescription-only drug in most markets, with prescriptions mainly driven by specialists in rheumatology and pain management. Market penetration has been steady in North America, with annual prescriptions estimated at approximately 2.5 million units in 2022, projected to grow approximately 3-4% annually.

Pricing strategies:

Pricing for Etodolac ER tends to be positioned at a premium relative to non-extended formulations, justified by user convenience and reduced gastrointestinal side effect risks. The average wholesale price (AWP) for a 30-day supply ranges between USD 150-200, varying by region and pharmacy discounts.

Competitive Landscape

Major Players and Differentiation:

While branded formulations dominate, generic manufacturers are increasingly entering the market, exerting downward pressure on pricing. Notable competitors include:

- Celecoxib (Celebrex): A selective COX-2 inhibitor with established brand recognition.

- Meloxicam: Long-acting NSAID, often preferred for its once-daily dosing.

- Diclofenac ER: Widely available and cost-effective.

Etodolac ER’s controlled-release profile provides potentially better compliance and gastrointestinal safety, positioning it favorably among niche patient segments. However, limited marketing and formulary adoption remain barriers.

Patent and Exclusivity:

Currently, Etodolac ER’s patents have expired or are close to expiration, increasing generic competition. Patent cliffs tend to drive prices downward over time.

Regulatory Factors Impacting Market and Pricing

Regulatory bodies like the FDA and EMA have stringent safety and efficacy standards influencing drug approval and market access. In recent years, safety concerns related to NSAIDs, especially cardiovascular risks, have led to black box warnings on some drugs, affecting prescribing habits.

Reimbursement policies and formulary placements heavily influence market penetration. Payers favor drugs with demonstrated safety, efficacy, and cost-effectiveness, all impacting pricing strategies.

Price Projections (2023–2028)

Driving Forces for Price Trends:

- Patent Expirations & Generic Competition: Once patents expire, prices typically decline by 40-60%, with newer generics capturing significant market share.

- Demand Growth: Steady increases in chronic inflammatory disease prevalence will support stable demand.

- Cost of Manufacturing: Technological improvements in extended-release formulations may reduce costs, facilitating more competitive pricing.

- Healthcare Policies: Increasing emphasis on cost containment favors generics, applying downward pressure on branded prices.

Projected Price Trajectory:

| Year | Estimated Average Wholesale Price (USD) for 30-day supply | Remarks |

|---|---|---|

| 2023 | USD 150–200 | Market stabilization, transitioning phase |

| 2024 | USD 130–180 | Entry of generic formulations reduces prices |

| 2025 | USD 120–170 | Increased generic uptake and market competition |

| 2026 | USD 100–150 | Further commoditization, intensified price competition |

| 2027–2028 | USD 90–140 (approaching generic saturation) | Market stabilization at lower price points |

Note: These estimates assume current competitive pressures and regulatory landscapes persist. External factors such as policy shifts or new safety data could alter projections.

Market Opportunities and Risks

Opportunities:

- Expansion into emerging markets with increasing demand for affordable pain management options.

- Development of new formulations, such as combination therapies with gastroprotective agents.

- Incorporation into pain management guidelines to increase formulary inclusion.

Risks:

- Intense generic competition leading to significant price erosion.

- Safety concerns limiting market expansion.

- Regulatory hurdles delaying product launch or formulary access.

- Patent expiry leading to loss of exclusivity and revenue.

Conclusion

Etodolac ER maintains a strategic position in the NSAID landscape through its extended-release formulation offering improved compliance and safety profile. However, escalating generic competition and pricing pressures will influence its market share and profitability. Price projections indicate a downward trend aligned with typical generic entry, emphasizing the importance of differentiating features and cost-effective manufacturing to sustain profitability.

Key insights include:

- Anticipate declining prices driven by generic competition, with an expected 25-50% reduction over five years.

- Focus on niche markets and specialized prescribing pathways to maximize profitability.

- Monitor regulatory and safety developments to preempt market access hurdles.

- Leverage manufacturing efficiencies and strategic partnerships to maintain competitive pricing.

Key Takeaways

- Market growth is driven by increasing chronic disease prevalence, with Etodolac ER positioned as a viable low-cost, safety-conscious option.

- Price erosion is inevitable due to patent expirations and generic market entry, requiring strategic planning for sustained revenue.

- Regulatory and safety profiles are critical; ongoing pharmacovigilance impacts market access and reputation.

- Differentiation beyond price, such as formulation advantages and physician prescribing preferences, remains essential.

- Emerging markets present substantial growth opportunities, provided regulatory and pricing hurdles are navigated effectively.

FAQs

1. What factors influence the pricing trajectory of Etodolac ER over the next five years?

Pricing will be primarily impacted by patent expirations, the influx of generic competitors, manufacturing cost reductions, changes in healthcare payer policies, and safety profile considerations.

2. How does Etodolac ER compare to other NSAIDs in terms of market share?

While Etodolac ER holds a niche due to its extended-release formulation, it competes with more established NSAIDs like celecoxib and meloxicam, which dominate prescriptions because of brand recognition and formulary inclusion.

3. What are the main regulatory challenges facing Etodolac ER?

Regulatory challenges include demonstrating safety, especially cardiovascular and gastrointestinal safety, and complying with evolving guidelines that may affect prescribing and reimbursement.

4. Are there potential growth markets for Etodolac ER outside North America and Europe?

Yes. Emerging markets with increasing incidences of osteoarthritis and aging populations present growth opportunities, contingent on regulatory approval and pricing strategies suited to these regions.

5. How can manufacturers sustain profitability amidst declining prices?

By innovating formulations, expanding indications, optimizing manufacturing efficiencies, forming strategic partnerships, and targeting niche patient populations with unmet needs.

Sources

- MarketWatch. Global NSAID Market Size & Trends. (2022).

- FDA Drug Database. Etodolac Summary. (2023).

- IQVIA. Prescription Data and Market Share Reports. (2022).

- GlobalData Healthcare. NSAID Market Outlook. (2023).

- Pharmaceutical Economics & Policy Journal. Safety and Regulatory Updates on NSAIDs. (2022).

More… ↓