Share This Page

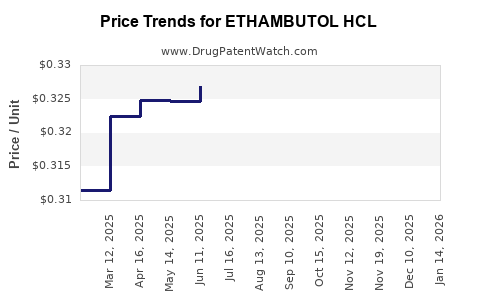

Drug Price Trends for ETHAMBUTOL HCL

✉ Email this page to a colleague

Average Pharmacy Cost for ETHAMBUTOL HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ETHAMBUTOL HCL 400 MG TABLET | 42806-0102-01 | 0.47467 | EACH | 2025-12-17 |

| ETHAMBUTOL HCL 400 MG TABLET | 68084-0280-01 | 0.47467 | EACH | 2025-12-17 |

| ETHAMBUTOL HCL 100 MG TABLET | 68180-0280-01 | 0.35206 | EACH | 2025-12-17 |

| ETHAMBUTOL HCL 400 MG TABLET | 68084-0280-11 | 0.47467 | EACH | 2025-12-17 |

| ETHAMBUTOL HCL 100 MG TABLET | 42806-0101-01 | 0.35206 | EACH | 2025-12-17 |

| ETHAMBUTOL HCL 400 MG TABLET | 68180-0281-01 | 0.47467 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ethambutol HCl

Introduction

Ethambutol hydrochloride (HCl) is a frontline antimycobacterial agent used primarily in the treatment of tuberculosis (TB). As a critical component of multi-drug regimens, understanding its market dynamics and pricing trends is vital for pharmaceutical stakeholders, healthcare providers, and policymakers. This analysis examines ethambutol HCl’s current market landscape, global demand, competitive environment, regulatory factors, and future price projections.

Global Market Overview

Demand Drivers

The global TB burden remains significant, with approximately 10 million new cases annually, according to the World Health Organization (WHO) [1]. Ethambutol HCl's role in first-line TB treatment panels ensures consistent demand, particularly in high-burden regions like Asia, Africa, and Eastern Europe.

The increasing prevalence of multidrug-resistant TB (MDR-TB) attracts continuous demand for effective combination therapies involving ethambutol. Moreover, expanded TB screening programs and improved diagnostic access bolster overall consumption.

Supply Chain and Manufacturing

The majority of ethambutol HCl production is concentrated in low-cost manufacturing hubs, including India, China, and countries within Southeast Asia. These regions benefit from economies of scale and lower export tariffs, fueling competitive pricing.

Global supply stability is influenced by factors such as raw material availability, regulatory compliance costs, and manufacturing capacity. Recently, disruptions due to geopolitical tensions or supply chain bottlenecks have caused temporary price fluctuations.

Market Segments and Key Players

Major pharmaceutical companies involved in ethambutol HCl production include Sun Pharmaceuticals, Lupin, Dr. Reddy’s Laboratories, and Sandoz. Smaller generic manufacturers also contribute significantly, especially in emerging markets.

The market is characterized by high generic penetration, with branded formulations occupying minimal market share due to cost sensitivity and generic efficacy equivalence. Recent entry of biosimilar and value-added formulations remains limited, maintaining price competitiveness.

Regulatory and Policy Environment

WHO recommends ethambutol as part of standardized TB treatment regimens [2]. Many countries enforce strict regulatory standards for antimycobacterial drugs, influencing manufacturing quality and pricing.

Regulatory incentives, such as expedited approval pathways in certain regions (e.g., Emergency Use Authorization), may impact market dynamics. Conversely, patent expirations for formulations have led to increased generic competition and downward price pressures.

Government procurement programs, notably in India’s Central Medical Services, bulk-purchase agreements, and international funding through initiatives like the Global Fund, significantly influence pricing structures.

Current Pricing Trends

Market Prices

The cost of ethambutol HCl varies widely across regions due to factors such as regulatory environment, manufacturing scale, and purchasing power. In high-income countries, the price for a standard 400 mg tablet can range from $0.20 to $0.50 per tablet, whereas in low-income, high TB-burden regions, prices can fall below $0.05 per tablet due to generous subsidies and government procurement.

Pricing Factors

Several factors influence injectable and oral formulations:

- Regulatory approval status, impacting approval costs and market access.

- Volume discounts in bulk procurement tend to reduce unit prices.

- Quality certifications, such as WHO prequalification, can command premium pricing but also expand market access.

Market Challenges

Despite widespread availability, challenges include:

- Price erosion due to counterfeit and substandard formulations flooding markets.

- Supply disruptions caused by manufacturing issues or regulatory sanctions.

- Limited innovation, which restricts premium pricing models and keeps prices predominantly generic.

Pricing Projections (2023-2028)

Short-term Outlook

In the immediate future, ethambutol HCl prices are expected to remain relatively stable, with marginal declines of 2-5%, primarily driven by intensified generic competition and procurement efficiencies. The ongoing COVID-19 pandemic has exerted pressure on supply chains, but recovery measures are stabilizing the market.

Mid-term Outlook

Between 2024 and 2026, global efforts to reduce TB incidence and expand access are anticipated to sustain high volumes of demand, supporting stable prices. However, increased regulation, quality control measures, and efforts to phase out substandard drugs will influence the market.

Price erosion attributable to increased generic competition in India and China may lead to reductions of about 10-15% in unit costs in these regions. In contrast, high-income markets may experience minimal pricing shifts due to regulatory barriers and established supplier relationships.

Long-term Projections (2027-2028)

As novel combination therapies, fixed-dose formulations, and biosimilars emerge, the market is poised for further structural shifts:

- A moderate decline of 10-20% in average prices for bulk generics, primarily driven by technological advances and regulatory reforms.

- The possibility of blockbuster exclusivity for innovative formulations or combination pills could temporarily stabilize or increase prices in certain markets.

- Increased focus on quality assurance and elimination of substandard drugs will likely cement pricing structures in regulated markets, but prices in unregulated, underserved markets will continue to trend downward.

Market Dynamics Influencing Future Prices

- Regulatory reforms and quality standards, including WHO prequalification, will influence supply quality and pricing.

- Patent expiries for some formulations could facilitate further generic entry and price reductions.

- Global health initiatives and donor-funded procurement programs remain pivotal in driving prices downward, especially in resource-limited settings.

- Technological innovations, such as fixed-dose combination (FDC) pills, could standardize treatment and impact pricing, either by increasing efficiency or introducing premium products.

Conclusion

The ethambutol HCl market is shaped by persistent demand driven by TB prevalence, robust generic competition, and regulatory environments favoring cost-effective solutions. Short-term stability is anticipated, with modest price declines expected as generics proliferate and supply chains stabilize. Long-term projections suggest continued price erosion, particularly in low-income markets, although innovation and regulatory advancements may introduce pricing variability.

Key Takeaways

- Demand stability in high TB-burden regions ensures ongoing market presence for ethambutol HCl.

- Price trends are predominantly driven by generic competition, procurement efficiency, and regulatory quality standards.

- Market volatility due to supply chain disruptions and counterfeit drugs warrants vigilant monitoring.

- Long-term outlook indicates gradual price reductions, with potential stabilization for innovative combination formulations.

- Stakeholders should focus on quality assurance, regulatory adherence, and strategic procurement to mitigate pricing risks.

FAQs

-

What are the main factors influencing the cost of ethambutol HCl globally?

Market prices are primarily driven by manufacturing scale, generic competition, regulatory standards, procurement practices, and regional economic factors. -

How does TB prevalence impact ethambutol HCl sales?

Higher TB prevalence leads to increased demand for ethambutol-based regimens, establishing a stable sales volume across endemic regions. -

Are there innovations in ethambutol formulations expected in the next few years?

Yes. Fixed-dose combination pills and formulations with improved bioavailability are being developed, potentially impacting pricing and treatment adherence. -

How do regulatory standards affect ethambutol HCl pricing?

Strict regulatory standards raise production costs and quality assurance expenses, which can increase prices but also expand access through trusted supply chains. -

What impact do global health initiatives have on the market price of ethambutol HCl?

Initiatives like the Global Fund and WHO tend to reduce prices through bulk procurement and subsidy programs, making ethambutol more affordable in resource-limited settings.

References

[1] World Health Organization. Global tuberculosis report 2022.

[2] WHO. Treatment of tuberculosis: Guidelines. 2020.

More… ↓