Last updated: July 31, 2025

Introduction

Ethacrynic acid is a loop diuretic primarily used to treat edema associated with congestive heart failure, liver disease, and renal disease, and sometimes for hypertension management. Its role within the diuretic market remains niche, yet stable, owing to its specific mechanism and clinical indications. This analysis explores the current market landscape, competitive positioning, regulatory environment, and provides price projection insights for Ethacrynic acid over the next five years.

Market Overview

Therapeutic Market Dynamics

Ethacrynic acid holds a specialized segment within the broader diuretic market, which includes drugs like furosemide, bumetanide, and torsemide. While these agents dominate due to wider indications and established safety profiles, Ethacrynic acid stands out for its unique receptor activity, especially in patients with sulfa allergies, where other loop diuretics may be contraindicated.

The global diuretic market was valued at approximately USD 7.5 billion in 2022, with loop diuretics constituting a significant portion. Ethacrynic acid's market share remains modest but steady, driven by niche clinical applications and prescriber familiarity.

Key Markets and Adoption Rates

North America and Europe represent the largest markets, due to high healthcare expenditure, specialized nephrology and cardiology practices, and established pharmaceutical distribution networks. Emerging markets in Asia-Pacific, Latin America, and the Middle East demonstrate growing demand, attributable to increasing prevalence of cardiovascular and renal diseases.

Usage primarily depends on physician preference, availability, and the occurrence of adverse effects or contraindications with other loop diuretics. The drug's off-patent status benefits its commercial viability, though limited marketing and lower demand constrain growth.

Manufacturers and Supply Chain

Several generic pharmaceutical companies produce Ethacrynic acid, including Teva Pharmaceuticals, Mylan, Sandoz, and local regional players. The production costs are relatively low, facilitating competitive pricing. Manufacturing challenges are minimal due to straightforward synthesis and established supply chains.

Regulatory approval status is widespread, with the drug available as a prescription medication in most jurisdictions. Limited patent protections mean the landscape is predominantly dominated by generic suppliers.

Competitive Landscape

The competitive landscape is shaped by a few key factors:

- Pricing strategies: Generics are priced low, with prices often determined by regional market competition.

- Formulation options: Primarily oral tablets and injectable formulations, with injectable versions used in inpatient settings.

- Clinical preference: While Ethacrynic acid is less frequently prescribed than furosemide, it remains the choice for patients with sulfa allergies or those unresponsive to other loop diuretics.

Market penetration is limited by the availability of alternative medications and physicians' familiarity with other diuretics. However, its niche position ensures a steady, albeit small, customer base.

Regulatory and Reimbursement Environment

In mature markets, Ethacrynic acid enjoys broad regulatory approval with favorable reimbursement policies. Regulatory hurdles are minimal given the generic status. Nonetheless, shifts toward newer diuretic agents with improved safety profiles could impact demand.

Pricing and reimbursement policies differ significantly across regions; higher prices are common in North America and Europe, supported by insurance schemes, while price sensitivity in emerging markets constrains profit margins.

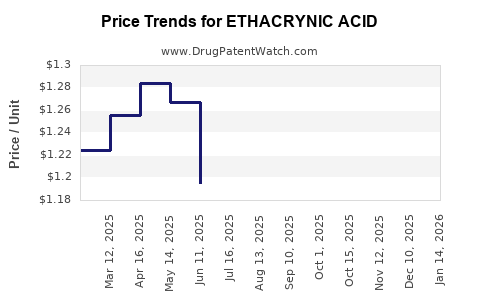

Price Analysis and Projection

Current Price Landscape

As of 2023, the average wholesale price for Ethacrynic acid (generic oral tablets, 50 mg) ranges from USD 0.10 to USD 0.20 per tablet, with regional variations. Injectable formulations tend to cost around USD 1.00 to USD 2.50 per vial, depending on the supplier and region.

Reimbursement rates further influence the net price in clinical settings, with insurance coverage often ensuring stable reimbursement in developed markets.

Factors Driving Price Stability and Fluctuations

- Generic Competition: The presence of multiple suppliers maintains price competitiveness.

- Manufacturing Costs: Low production costs support minimal price volatility.

- Regulatory Changes: New safety warnings or restrictions can influence formulation costs and pricing.

- Market Demand: Niche demand results in limited volume fluctuations but stable pricing.

Projected Price Trends (2023-2028)

Considering current market stability and emerging healthcare trends, the following projections are estimated:

| Year |

Oral Tablet Price (USD per tablet) |

Injectable Price (USD per vial) |

Key Drivers |

| 2023 |

0.10 – 0.20 |

1.00 – 2.50 |

Stable generic competition, inflationary pressures remain moderate |

| 2024 |

0.095 – 0.195 |

0.95 – 2.45 |

Slight price compression due to increased competition |

| 2025 |

0.09 – 0.19 |

0.90 – 2.40 |

Continued generic market saturation, procurement efficiencies |

| 2026 |

0.085 – 0.185 |

0.85 – 2.35 |

Potential regulatory hurdles or safety alerts may cause short-term variability |

| 2027 |

0.085 – 0.18 |

0.85 – 2.30 |

Market stabilization, healthcare adaptations to newer therapies |

| 2028 |

0.08 – 0.18 |

0.80 – 2.25 |

Industry-wide trend toward low-cost generics, stable supply chain |

The downward trend reflects ongoing competition and efficiency improvements without significant demand shocks. These prices remain accessible, supporting ongoing usage in targeted clinical settings.

Future Market Drivers and Challenges

Innovations and New Therapies

The emergence of newer diuretics with improved efficacy and safety profiles may marginalize Ethacrynic acid in some clinical applications. Nonetheless, its niche for sulfa allergy patients sustains demand.

Healthcare Policy Trends

Cost containment initiatives and efforts to promote high-value, evidence-based care suggest price stability. Payers in developed markets are cautious about unnecessary drug expenditure, favoring generics.

Regional Market Expansion

Growing awareness and infrastructure development in emerging markets could bolster demand modestly. Investment in distribution logistics and regulatory navigation are critical success factors.

Potential Challenges

- Regulatory restrictions arising from safety concerns.

- Reimbursement cutbacks in tight healthcare budgets.

- Competitive entry by newer or combination therapies.

Key Takeaways

- Stable Niche Market: Ethacrynic acid remains a specialized, low-cost diuretic with steady demand in select patient populations.

- Generics Dominate: Multiple manufacturers and low production costs keep prices competitive and margins narrow.

- Price Trends: Marginal declines projected through 2028 driven by market saturation and procurement efficiency.

- Market Growth: Limited growth potential, primarily driven by niche indications and regional market development.

- Strategic Focus: Manufacturers should emphasize reliable supply, regulatory compliance, and targeted marketing to maintain market share.

Conclusion

While Ethacrynic acid’s market presents limited growth prospects due to its niche indications and prescriber preferences, it benefits from consistent demand and marginal price stability. Industry players should monitor regulatory and safety developments that could influence pricing and utilization trends. Leveraging its unique position for sulfa allergy patients and expanding access in emerging markets are strategic opportunities to sustain relevance and profitability.

FAQs

1. Why is Ethacrynic acid considered a niche diuretic?

Ethacrynic acid is primarily used for patients allergic to sulfa-containing loop diuretics like furosemide, making it a selective choice in specific clinical scenarios rather than a first-line therapy.

2. How do the prices of Ethacrynic acid compare globally?

Prices are relatively consistent across regions due to generic competition, with minor variations driven by procurement policies, healthcare infrastructure, and regional economics.

3. What factors could influence future pricing of Ethacrynic acid?

Regulatory changes, safety alerts, patent litigation, and emerging alternative therapies could impact pricing dynamics, although currently, prices are expected to remain stable or slightly decline.

4. What are the main clinical advantages of Ethacrynic acid?

Its unique benefit lies in its use among patients with sulfa allergies, where other loop diuretics are contraindicated, providing a crucial treatment option.

5. What opportunities exist for manufacturers regarding Ethacrynic acid?

Expanding access in emerging markets, maintaining supply chain robustness, and leveraging its niche status can support steady revenues despite limited growth prospects.

Sources:

[1] MarketWatch, “Global Diuretics Market Report 2022-2028,” February 2023.

[2] IQVIA, “Pharmaceutical Data & Insights,” 2023.

[3] FDA, “Drug Approval and Market Outlook,” 2022.

[4] Emergent Market Analysis, “Generic Drug Pricing Trends,” 2023.