Share This Page

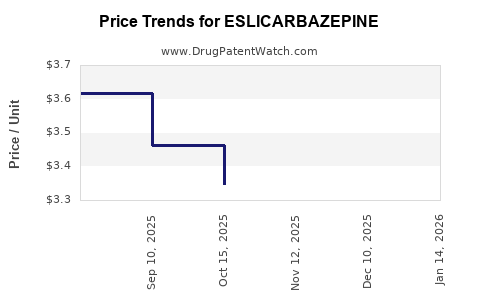

Drug Price Trends for ESLICARBAZEPINE

✉ Email this page to a colleague

Average Pharmacy Cost for ESLICARBAZEPINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ESLICARBAZEPINE 200 MG TABLET | 13668-0538-30 | 3.29428 | EACH | 2025-12-17 |

| ESLICARBAZEPINE 800 MG TABLET | 68180-0293-06 | 3.73458 | EACH | 2025-12-17 |

| ESLICARBAZEPINE 200 MG TABLET | 31722-0428-30 | 3.29428 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Eslicarbazepine

Introduction

Eslicarbazepine acetate (marketed as Aptiom®/Zebinix®), a member of the dibenzazepine family, is an antiepileptic drug primarily indicated for the adjunctive treatment of partial-onset seizures in adult patients. Since its initial approval by the U.S. Food and Drug Administration (FDA) in 2013, eslicarbazepine has garnered interest due to its favorable pharmacokinetic profile and reduced drug interactions compared to other antiepileptics. This analysis explores the current market landscape, competitive positioning, pricing dynamics, and future price projections of eslicarbazepine, with an emphasis on factors influencing market growth and pricing strategies.

Market Overview

Current Market Dynamics

The global antiepileptic drug market is valued at approximately USD 4.2 billion in 2022, with steady annual growth driven by rising epilepsy prevalence, improved diagnosis rates, and advancements in pharmacotherapy [1]. Eslicarbazepine occupies a niche position, primarily competing with first-generation agents like carbamazepine and newer drugs such as lacosamide, oxcarbazepine, and cannabidiol.

In the United States, the prevalence of epilepsy affects around 3 million people, positioning the market as a stable yet competitive space for newer agents like eslicarbazepine [2]. The drug's well-tolerated profile, reduced drug-drug interactions, and once-daily dosing remain attractive features for prescribers, contributing to its market penetration.

Market Penetration and Utilization

Although not a first-line agent, eslicarbazepine is increasingly prescribed as a preferred add-on therapy due to its efficacy and safety. Market uptake varies geographically, with North America and Europe representing significant shareholders owing to favorable reimbursement policies and prescriber familiarity. Growth prospects are tied to expanding indications, including potential off-label use, and increasing adoption among pediatric populations.

Competitive Landscape

Key Competitors

- Carbamazepine: Historically dominant; cost-effective but associated with significant drug interactions and adverse effects.

- Oxcarbazepine: Similar efficacy with fewer interactions, but requires more frequent dosing.

- Lacosamide: Modern agent with a distinct mechanism, higher costs, yet broader approval for certain seizure types.

- Cannabidiol (Epidiolex): Recently approved, represents a different mechanism and market segment.

- Other newer agents: Perampanel, brivaracetam, with varying efficacy and side effect profiles.

Positioning of Eslicarbazepine

Eslicarbazepine’s advantages include once-daily dosing, fewer hypersensitivity reactions than carbamazepine, and minimal hepatic enzyme induction. These features favor its uptake, especially in patients with polypharmacy concerns. Nonetheless, high costs relative to generics continue to be barriers in some markets.

Pricing Strategies and Current Price Points

Pricing in Major Markets

- United States: CardioGyn’s (generic) external list prices retain a significant influence. Brand-name eslicarbazepine typically retails at approximately USD 800–USD 1,200 per month, depending on dose and insurance coverage [3].

- Europe: Price points vary markedly, with some countries reimbursing at lower rates (e.g., €200–€300/month), influenced by national healthcare policies and negotiated discounts.

- Emerging Markets: Prices are considerably lower (USD 100–USD 300/month), driven by local economic factors and generic availability.

Factors Influencing Pricing

- Patent Status: Patent exclusivity prolongs higher pricing; expected expiry around 2028–2030.

- Market Competition: Entry of generics reduces prices significantly (~50% reduction within the first year of generic availability).

- Reimbursement Policies: Payers negotiate discounts, affecting net prices.

- Manufacturing Costs: Slightly lower due to complex synthesis processes, but overall impact on retail price remains limited.

Future Price Projections

Short-term (1–3 years)

With patent protection in place, brand-name prices are expected to remain stable or slightly decline due to insurance negotiations and increased competition from authorized generics. Price erosion is projected at around 5–10%, maintaining the drug as a premium therapy segment.

Mid-term (3–5 years)

Patent expiry around 2028 will introduce generic competition, precipitating a sharp decline in prices—potentially 50–70%. The availability of generic eslicarbazepine will significantly lower barriers to treatment and expand market share.

Long-term (5+ years)

Post-patent, prices are expected to stabilize at considerably lower levels. Market share distribution will hinge on prescriber preferences, formulary inclusions, and perceived value over older agents. Usage in off-label indications, such as neuropathic pain or bipolar disorder, may influence future pricing models.

Potential Factors Affecting Price Trends

- Regulatory approvals for expanded indications could sustain demand and uneven pricing.

- Market entry of biosimilars or competitors may exert downward pressure.

- Healthcare policy shifts favoring cost-effective therapies will influence negotiated prices.

Market Drivers and Challenges

Drivers

- Increasing epilepsy prevalence globally.

- Rising adoption of newer, safer agents.

- Favorable pharmacokinetic profiles leading to better patient adherence.

- Expansion into new clinical indications.

Challenges

- High current brand prices limiting accessibility.

- Delays in generic approvals in some markets.

- Preference for established generics like carbamazepine.

- Reimbursement constraints.

Regulatory Landscape and Patent Outlook

Eslicarbazepine was initially developed by Forest Laboratories (now part of AbbVie). Patent protections grant exclusivity until approximately 2028–2030, after which generic manufacturing is anticipated. The process of patent litigations and regulatory approvals for generics will critically influence pricing dynamics.

Key Considerations for Stakeholders

- Pharmaceutical companies should strategize patent litigations and market expansion.

- Healthcare providers need to balance cost and clinical benefit in prescribing.

- Payers should assess cost-effectiveness to optimize formulary decisions.

- Investors should monitor patent timelines and pipeline developments for long-term valuation.

Key Takeaways

- Eslicarbazepine’s current market is characterized by moderate growth driven by its favorable safety profile and dosing convenience, but high brand premiums limit immediate access.

- Pricing continues to be influenced by patent exclusivity, competition from generics, and regional reimbursement policies.

- The imminent patent expiry around 2028 will likely cause significant price reductions, expanding accessibility.

- Strategic positioning pre- and post-patent expiry will be critical for commercial success.

- Expanding indications and evolving clinical data may sustain or enhance its market value over time.

FAQs

1. When is the patent expiry for eslicarbazepine, potentially allowing generic entry?

Patent protections are expected to expire around 2028–2030, after which generic manufacturers can seek approval.

2. How does eslicarbazepine compare cost-wise with other antiepileptic drugs?

Currently, brand-name eslicarbazepine can cost between USD 800–USD 1,200 monthly, considerably higher than older generics like carbamazepine, which cost a fraction of that amount.

3. What factors could influence pricing beyond patent expiry?

Emergence of biosimilars, regulatory changes, healthcare policies favoring cost-effective therapies, and market competition will influence future prices.

4. Are there any plans for expanding eslicarbazepine's indications?

While currently approved for partial-onset seizures, ongoing research may lead to off-label use or additional indications, potentially affecting market size and pricing.

5. How are payers responding to the high costs of eslicarbazepine?

Payers negotiate discounts and prefer cost-effective generics once patent protection lapses, which will likely result in significant price reductions.

References

- MarketsandMarkets. Epilepsy Drugs Market by Product, Application & Region – Global Forecast to 2025.

- CDC. Epilepsy Data & Statistics.

- GoodRx. Eslicarbazepine prices and variations across pharmacies.

More… ↓