Share This Page

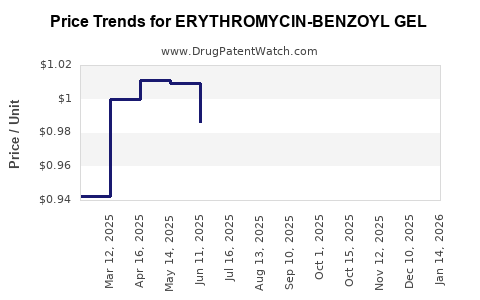

Drug Price Trends for ERYTHROMYCIN-BENZOYL GEL

✉ Email this page to a colleague

Average Pharmacy Cost for ERYTHROMYCIN-BENZOYL GEL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ERYTHROMYCIN-BENZOYL GEL | 64980-0328-02 | 0.96215 | GM | 2025-12-17 |

| ERYTHROMYCIN-BENZOYL GEL | 64980-0328-01 | 1.55693 | GM | 2025-12-17 |

| ERYTHROMYCIN-BENZOYL GEL | 64980-0328-01 | 1.48085 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Erythromycin-Benzoyl Gel

Introduction

Erythromycin-Benzoyl Gel represents a topical combination therapy primarily aimed at managing acne vulgaris. It combines erythromycin, an antibiotic, with benzoyl peroxide, a potent keratolytic agent. As the global prevalence of acne escalates and demand for effective dermatological treatments surges, understanding the market landscape and pricing trajectory becomes critical for stakeholders investing in or competing within this segment.

Market Overview

Global Acne Therapeutics Landscape

The acne treatment market was valued at approximately USD 4.3 billion in 2022, with dermatological therapies accounting for a significant share. Growth is driven by increasing acne incidence among adolescents and adults, coupled with rising awareness of dermatological aesthetics. The demand for combination therapies, such as erythromycin-benzoyl gel, highlights a shift towards targeted, effective, and reduced-side-effect formulations [[1]].

Key Drivers

- Rising Prevalence of Acne: Globally, over 85% of adolescents and many adults suffer from acne, fostering consistent demand for topical antibiotics and adjunct therapies [[2]]].

- Rise in Antibiotic Resistance: The emergence of resistant strains prompts the development of combination therapies designed to minimize resistance, supporting the adoption of erythromycin-benzoyl gels.

- Advancements in Formulation Technologies: Improved topical formulations enhance patient compliance and efficacy, boosting market growth.

- Growing Cosmetic Consciousness: Aesthetic considerations fuel consumer preference for effective acne treatments, encouraging innovation and product proliferation.

Major Market Players

The market has notable pharmaceutical companies such as:

- Galderma: Market leader with Erythromycin-Benzoyl formulations under dermatological brands.

- Mylan (now part of Viatris): Provides generic erythromycin-benzoyl products with competitive pricing.

- Sandoz: Focuses on generic topical antibiotics, expanding access.

- Local and regional manufacturers: Increasing competition in emerging markets.

Regulatory and Market Access Considerations

- Regulatory approvals vary globally but predominantly follow stringent dermatological guidelines. The combination products often require specific efficacy and safety data.

- Patent Status: In many jurisdictions, erythromycin-benzoyl gels face patent expirations, opening avenues for generics.

- Reimbursement Policies: Insurance coverage and formulary inclusion significantly influence sales, especially in developed markets.

Market Trends and Forecasts

Growth Projections (2023-2030)

- The erythromycin-benzoyl gel segment is projected to grow at a CAGR of roughly 5-7% over the next seven years, driven by increased acne prevalence and shifting preferences toward combination therapies.

- Market Share Evolution: Generics are expected to dominate due to patent expirations, reducing prices and increasing accessibility.

Regional Outlook

- North America: Mature, with high adoption rates and strong healthcare infrastructure. Growth driven by innovation and resistance management.

- Europe: Similar trends as North America, with gradual shifts towards generic options.

- Asia-Pacific: Fastest-growing due to rising acne prevalence, expanding dermatology markets, and increasing access to healthcare. Market growth rates could reach 8-10% annually.

Pricing Dynamics of Erythromycin-Benzoyl Gel

Current Price Range

- In developed markets, proprietary erythromycin-benzoyl gels typically retail between USD 15-30 for a 30-gram tube.

- Generic versions, especially in emerging markets, range from USD 5-10 per 30 grams, reflecting competitive pressures.

Factors Influencing Price

- Patent Status: Patent expiration significantly reduces prices by enabling generics.

- Manufacturing Costs: Advances in manufacturing and sourcing reduce costs, enabling price competition.

- Regulatory Environment: Stringent approval processes can increase development costs, impacting retail pricing.

- Market Competition: The proliferation of generics intensifies price competition and accelerates downward pricing pressure.

Projected Price Trends

- As generics dominate after patent expiry around 2025-2026, prices are expected to decrease by approximately 20-30%, reaching USD 3-8 per 30 grams in markets like India and China.

- In developed markets, prices may stabilize around USD 10-20 due to regulatory and trademark protections for branded formulations, though discounts and promotional pricing will influence actual consumer prices.

Competitive Landscape

Generic manufacturers are poised to benefit from increased adoption due to reduced prices. Differentiation strategies, such as improved formulations or combination packaging, will be critical. Additionally, new entrants focusing on biodegradable or enhanced delivery systems could disrupt existing price points and market shares.

Conclusion

Erythromycin-Benzoyl Gel is a resilient segment within the acne therapeutics market, supported by global dermatological needs and evolving treatment paradigms. The expiration of patents will catalyze price reductions, expand accessibility, and intensify competition among generic providers. Strategic players should monitor innovation trends, regulatory developments, and regional market dynamics to optimize entry and growth strategies.

Key Takeaways

- The global erythromycin-benzoyl gel market is poised for steady growth at a CAGR of around 5-7%, driven by increasing acne prevalence, resistance management needs, and consumer demand.

- Generics will dominate post-patent expiration (expected around 2025-2026), leading to significant price declines of approximately 20-30%.

- Regional variations will influence pricing; in emerging markets, prices could fall below USD 5 per 30g, while in developed countries, stabilized prices will remain higher due to branding and patent protections.

- Innovation in formulation and delivery systems remains essential for differentiation amid increasing commoditization of generic versions.

- Regulatory landscape shifts and patent expirations will present both opportunities and challenges; companies should strategize accordingly.

FAQs

1. When is the patent expiration for the proprietary erythromycin-benzoyl gel formulations, and how will it impact the market?

Patent expirations are anticipated around 2025-2026 in major jurisdictions. This will open the market to generics, significantly reducing prices and increasing accessibility but intensifying competition among manufacturers.

2. How does resistance management influence the demand for erythromycin-Benzoyl gels?

Growing antibiotic resistance issues prompt clinicians to prefer combination therapies like erythromycin-benzoyl gels, which can reduce the risk of resistance development compared to monotherapies.

3. What are regional differences affecting product pricing and adoption?

Developed markets maintain higher prices due to branding and regulatory barriers, while price-sensitive regions like Asia-Pacific and Latin America see rapid adoption of generics at significantly lower price points.

4. Are there any innovative formulations emerging in the erythromycin-benzoyl gel segment?

Yes. Advances include biodegradable carriers, sustained-release formulations, and combination therapies integrating additional actives, aiming to improve compliance and efficacy.

5. What strategic steps should companies take to succeed in this competitive market?

Focusing on formulation innovation, building robust regulatory pathways, strategic alliances, and regional market penetration are key to gaining competitive advantage post patent expiry.

References

- Market Research Future. "Acne Therapeutics Market Analysis." 2022.

- World Health Organization. "Adolescent Acne Prevalence Report." 2021.

More… ↓