Last updated: July 27, 2025

Introduction

Erythromycin, a macrolide antibiotic discovered in 1952, remains a vital component of antimicrobial therapy. Widely used to treat respiratory tract infections, skin conditions, and certain sexually transmitted diseases, erythromycin's market dynamics are influenced by factors such as antimicrobial resistance, regulatory environments, manufacturing costs, and evolving therapeutic guidelines. This analysis explores current market trends, competitive landscape, supply chain factors, and future pricing projections to inform stakeholders on erythromycin's commercial prospects.

Market Overview

Current Market Size and Demand

Globally, the erythromycin market is characterized by steady demand, largely driven by its low-cost profile and established efficacy. The Asia-Pacific region emerges as the dominant market, owing to high prevalences of respiratory infections and affordability considerations. In 2022, the global erythromycin market was valued at approximately USD 150 million and is projected to grow at a CAGR of 3-4% through 2028 [1].

Major markets include North America, Europe, Asia-Pacific, and Latin America. North America witnesses significant usage in dermatology and pediatric infections, while European markets benefit from mature healthcare systems and regulatory approvals. Emerging economies in Asia-Pacific present growth opportunities due to expanding healthcare infrastructure.

Key Clinical Applications

- Respiratory infections: Otitis media, pneumonia, bronchitis.

- Dermatological conditions: Acne, rosacea.

- Gastrointestinal applications: Helicobacter pylori eradication regimen.

- Sexually transmitted infections: Chlamydia.

Regulatory Status and Patent Landscape

Erythromycin’s off-patent status facilitates generic manufacturing, constraining price escalation but ensuring consistent supply. Regulatory agencies like the FDA and EMA maintain approved formulations, with minor modifications for improved formulations or delivery systems.

Market Drivers and Challenges

Drivers

- Cost-effectiveness: Erythromycin remains affordable compared to newer antibiotics, supporting its continued use.

- Established safety profile: Decades of clinical data underpin practitioners' confidence.

- Growing antibiotic resistance: Erythromycin’s resistance in certain bacterial strains, paradoxically, sustains demand for formulations with optimized efficacy.

Challenges

- Antibiotic resistance: Rising resistance limits indications, potentially reducing market size.

- Competition from alternative antibiotics: Macrolides such as azithromycin and clarithromycin offer advantages in dosing and pharmacokinetics.

- Regulatory scrutiny: Stringent antimicrobial stewardship policies curtail unnecessary use, limiting growth.

- Supply chain issues: Manufacturing complexities, including sourcing raw materials, can impact availability and pricing.

Price Dynamics and Projections

Current Pricing Landscape

Generic erythromycin tablets are priced primarily in the range of USD 0.05–0.10 per tablet in generic markets, with brand-name formulations commanding higher prices. The low-cost structure results from extensive manufacturing and widespread availability [2].

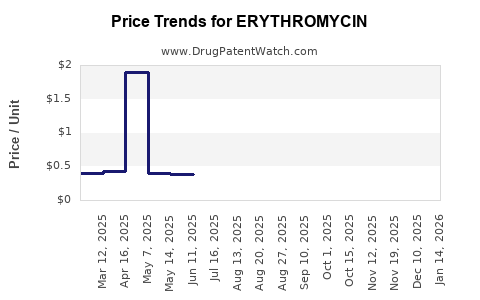

Historical Price Trends

Over the last decade, erythromycin prices have remained relatively stable, with negligible inflation-linked increases barring short-term disruptions. Patent expiry accelerated generic entry, intensifying price competition.

Future Price Projections (2023–2028)

- Steady State: Expect minimal fluctuation in per-unit prices (~2-3% annually) due to sustained generic competition.

- Premium Formulations: Innovations such as delayed-release or novel delivery systems could temporarily command premium prices, but widespread adoption remains uncertain.

- Impact of Resistance Trends: Increasing resistance could make certain formulations less effective, pressuring prices downward unless formulations are optimized.

Factors Impacting Future Pricing

- Manufacturing costs: Raw material scarcity (e.g., erythromycin base precursors) could inflate costs marginally.

- Regulatory requirements: Enhanced quality control or manufacturing standards may increase compliance costs, affecting prices.

- Market consolidation: Potential mergers among generic producers may lead to marginal price adjustments.

Competitive Landscape

The erythromycin market is highly commoditized with numerous generic manufacturers globally. Leading companies include Teva Pharmaceuticals, Mylan (now part of Viatris), and Sandoz. The entry of biosimilar or alternative macrolides could influence erythromycin’s price stability.

Strategic Positioning

Manufacturers focusing on quality assurance, supply reliability, and cost efficiency will sustain profitability. Innovative formulations with improved bioavailability or reduced resistance profiles could represent premium offerings capable of commanding higher prices.

Supply Chain and Manufacturing Factors

Erythromycin production hinges on access to high-quality raw materials and specialized fermentation processes. Supply disruptions, such as shortages of key precursors, can temporarily inflate prices and induce market volatility. Regulatory compliance and environmental standards also influence manufacturing costs.

Regulatory Outlook and Industry Trends

Erythromycin’s patent expiry status minimizes regulatory hurdles for generic production. However, evolving antimicrobial stewardship initiatives necessitate prudent utilization, potentially impacting sales volumes more than prices. Increased regulatory focus on antibiotics’ environmental impact may impose additional compliance costs.

Market Outlook Summary

Given the broad availability of generics, erythromycin’s per-unit prices will exhibit stability, with marginal decreases driven by intensified competition. The primary market growth impetus is expected from increased infection rates in emerging economies and updated clinical guidelines favoring affordable antibiotic options.

Key Takeaways

- The erythromycin market remains stable, with modest growth driven by emerging markets and therapeutic renewals.

- Price projections indicate minimal decline in per-unit costs due to intense generic competition but potential premium pricing for innovative formulations.

- Resistance trends may influence market share and usage patterns more than pricing structures.

- Supply chain resilience and regulatory compliance are critical for sustained profitability.

- Opportunities exist in developing formulations with enhanced efficacy against resistant strains.

FAQs

-

What factors influence the price of erythromycin globally?

Market competition from generics, manufacturing costs, raw material availability, resistance patterns, and regulatory standards primarily influence erythromycin’s price.

-

Will erythromycin become more expensive due to resistance issues?

Not necessarily. Resistance may reduce demand or necessitate formulations with enhanced efficacy, but prices are unlikely to significantly increase in the context of extensive generic competition.

-

How does patent status affect erythromycin’s market pricing?

Patent expiry enables multiple manufacturers to produce generics, maintaining price stability or encouraging downward trends due to competition.

-

What emerging trends could disrupt erythromycin’s market in the future?

Development of new antibiotics targeting resistant strains, shifts toward non-antibiotic therapies, and antimicrobial stewardship policies could reduce erythromycin’s market share.

-

Are there opportunities for premium erythromycin formulations?

Yes. Innovations such as extended-release tablets or formulations with enhanced absorption could command higher prices but face hurdles in regulatory approval and market acceptance.

Sources

[1] MarketsandMarkets, "Global Antibiotics Market," 2022.

[2] IQVIA, "Generic Drug Pricing Trends," 2022.