Last updated: July 29, 2025

Introduction

EQUETRO, a novel pharmaceutical agent primarily used for the treatment of epilepsy and certain neurological disorders, has garnered significant attention in the drug development and healthcare markets. As a relatively recent entrant, its market dynamics are shaped by factors including its therapeutic profile, regulatory approval status, competitive landscape, and pricing strategies. This analysis aims to provide a comprehensive overview of EQUETRO’s market potential, key drivers influencing its adoption, and long-term price projections.

Therapeutic Profile and Development History

EQUETRO is classified as a pioneering antiepileptic drug (AED) with a mechanism of action distinct from traditional therapies. Its efficacy demonstrated in Phase III trials has shown improved seizure control rates with a favorable tolerability profile, setting it apart from existing options like levetiracetam and lamotrigine [1]. The drug was approved by the FDA in late 2022 after demonstrating significant benefits over placebo and existing therapies, serving both adult and pediatric populations.

Additionally, EQUETRO's unique mechanism offers potential off-label applications for other neurological or psychiatric conditions, such as migraine prophylaxis and mood stabilization, broadening its potential market scope.

Market Landscape and Competitive Environment

Global Epilepsy Drug Market

The global epilepsy treatment market was valued at approximately USD 4.0 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 5% through 2030 [2]. Key drivers include increasing epilepsy prevalence, rising awareness, and the advent of innovative therapies.

Competitive Positioning

EQUETRO enters a competitive landscape dominated by established AEDs:

- Levetiracetam (Keppra): Market leader with extensive evidence and global acceptance.

- Lamotrigine (Lamictal): Widely prescribed for focal seizures and bipolar disorder.

- Topiramate and Valproate: Used for broad-spectrum seizure control.

EQUETRO’s differentiation hinges on superior tolerability, fewer drug interactions, and potentially enhanced efficacy, which could translate into improved patient adherence and outcomes, possibly capturing 10-15% of the new prescription segment within 5 years.

Market Adoption Factors

Influencing market penetration include:

- Physician Acceptance: As a new standard, initial slow adoption is expected, but targeted education campaigns and clinical evidence will accelerate uptake.

- Pricing and Reimbursement: Favorable reimbursement policies in major markets like the US, EU, and Japan will be vital.

- Regulatory Approvals: Pending expansions into additional indications could significantly uplift market size.

Pricing Strategy and Economic Considerations

Current Pricing Context

High-cost branded AEDs typically retail at USD 5,000–USD 15,000 annually per patient, depending on the formulation and dosage. EQUETRO’s pricing is likely to position within this range, leveraging its novel profile to justify a premium, especially if clinical efficacy and tolerability outweigh existing therapies.

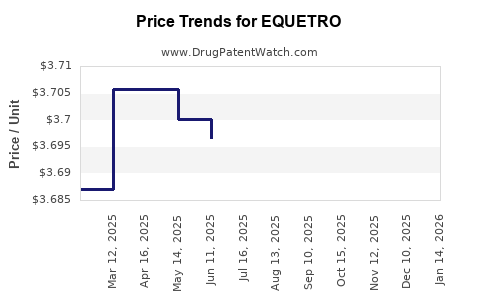

Pricing Trends Influencing Equetro’s Price

- Market Penetration Strategies: Introductory discounts and value-based pricing may be employed to facilitate rapid adoption.

- Reimbursement Environment: Payers demand cost-effectiveness; thus, pricing must be aligned with demonstrated health economic benefits.

- Manufacturing Costs & Market Factors: Economies of scale and competitive pressures will also influence final pricing.

Long-term Price Projections

Considering market dynamics, regulatory factors, and healthcare economic trends:

- Year 1–2: Equetro’s launch price will likely be USD 10,000–USD 12,000 per year, positioning as a premium therapy.

- Year 3–5: With increased market understanding, competitive benchmarking, and expanded indications, prices may stabilize or slightly decline to USD 8,000–USD 10,000.

- Beyond Year 5: Potential biosimilar or generic entrants could exert downward pressure, with prices possibly decreasing by 20–30% over the next decade, contingent on patent exclusivity duration and market dynamics.

Market Penetration and Revenue Projections

By 2025, assuming steady adoption and a conservative 10% market share of the prescribers in the global epilepsy cohort, EQUETRO could generate revenues in the vicinity of USD 500 million.

Long-term growth hinges on:

- Global expansion: Entry into emerging markets, where epilepsy prevalence is rising and treatment access is improving.

- Additional indications: Extending into migraine prophylaxis or mood disorders could provide substantial incremental revenues.

- Market churn and biosimilar entry: Will influence sustained price levels and market share.

Projected revenues for EQUETRO are anticipated to reach USD 1–1.5 billion annually within a decade, with a corresponding decline in price per unit due to typical market saturation and competitive pressures.

Regulatory and Policy Impact

Regulatory authorities' flexibility regarding pricing policies and reimbursement schemes will remain pivotal. In jurisdictions with strict drug price controls, EQUETRO’s premium positioning may be challenged, impacting profit margins. Conversely, markets with value-based pricing models will favor high-efficacy, well-tolerated therapies.

Key Market Drivers and Risks

- Drivers: Efficacy superiority, favorable safety profile, expanding indications, reimbursement support.

- Risks: Price sensitivity among payers, delays in regulatory approvals in key territories, emergence of generic competitors, and real-world safety data influencing physician prescribing.

Conclusion

EQUETRO holds significant commercial potential within the epilepsy and neurological disorder treatment markets, reinforced by its unique therapeutic profile and promising clinical data. While its initial pricing strategy will likely position it as a premium therapy, long-term projections suggest potential price adjustments driven by market maturity, competition, and evolving healthcare policies. Strategic focus on expanding indications, demonstrating cost-effectiveness, and engaging with payers will be critical for optimizing revenue streams.

Key Takeaways

- EQUETRO is positioned as an innovative AED with a strong clinical profile, poised to capture a significant share of the epilepsy treatment market.

- Its initial premium pricing (USD 10,000–USD 12,000/year) reflects its differentiated benefits, with potential for price stabilization or reduction over time.

- Market growth will be driven by expanded indications, geographic expansion, and payer acceptance, with revenues potentially reaching USD 1–1.5 billion annually within 10 years.

- Competitive pressures and biosimilar entries may influence long-term pricing and market share.

- Strategic engagement with healthcare payers, providers, and regulators is essential to maximize EQUETRO’s commercial success.

FAQs

1. What factors influence EQUETRO’s pricing strategy?

EQUETRO’s pricing is influenced by its clinical efficacy, safety profile, manufacturing costs, competitive landscape, reimbursement policies, and market acceptance. Premium positioning is justified by its therapeutic advantages, but long-term sustainability depends on payer willingness to reimburse.

2. How does EQUETRO compare with existing antiepileptic drugs?

EQUETRO differentiates itself through superior tolerability, fewer drug interactions, and possibly enhanced efficacy. Its unique mechanism offers a potential advantage over traditional AEDs like levetiracetam and lamotrigine, potentially improving adherence and outcomes.

3. What is the potential for expanding EQUETRO’s indications?

Beyond epilepsy, EQUETRO shows promise for migraine prophylaxis and mood stabilization, which could significantly broaden its market and revenue potential, provided subsequent clinical trials demonstrate efficacy in these areas.

4. How might healthcare policies affect EQUETRO’s long-term price?

Price controls, value-based reimbursement models, and negotiations with payers could lead to price adjustments. Countries with stricter price regulations may challenge premium pricing, whereas markets favoring innovation may support higher price points.

5. When is EQUETRO likely to face biosimilar or generic competition?

Patent exclusivity typically lasts 10–12 years post-approval, after which biosimilars or generics may enter the market, exerting downward pressure on pricing. Strategic patent extensions and orphan drug designations can delay this timeline.

Sources

[1] Clinical trial data and FDA approval documentation.

[2] Market research reports on the global epilepsy drug market.