Last updated: July 27, 2025

Introduction

Enstilar, a topical foam combining calcipotriol and betamethasone dipropionate, has established itself as a leading treatment for psoriasis vulgaris, particularly plaque psoriasis. Approved by the FDA in 2016 and marketed by Leo Pharma, it has seen rapid adoption due to its efficacy and convenience. This analysis details Entrilar’s market positioning, competitive landscape, pricing trends, and forecasts future price movements, underpinning strategic decision-making for stakeholders.

Market Overview

Therapeutic Landscape

Psoriasis affects approximately 125 million people worldwide, with a significant subset suffering from moderate to severe plaque psoriasis that necessitates topical or systemic therapy [1]. The Global Psoriasis Treatment Market was valued at USD 8.2 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 8% through 2030 [2].

Enstilar’s Position

Enstilar holds a prominent share within the topical treatment segment owing to:

- Unique Formulation: A foam vehicle facilitates better patient adherence and absorption [3].

- Efficacy & Safety: Demonstrated rapid and sustained clearance in clinical trials [4].

- Regulatory Acceptance: Approved for psoriasis vulgaris, with ongoing investigations for other indications.

Market Drivers and Constraints

Drivers

- Increasing Psoriasis Prevalence: Rising global prevalence, especially in developed regions.

- Patient Preference: Preference for topical foam formulations over ointments and creams for ease of use.

- Expanding Indications: Ongoing research into Enstilar’s applicability in other dermatological conditions.

Constraints

- High Cost: Market perception of high pricing limits accessibility in certain regions.

- Patent and Exclusivity Rights: Patent protection delays generic entry, sustaining premium prices.

- Pricing Pressures: Payer resistance to high drug costs, especially in price-sensitive markets.

Competitive Landscape

Key Competitors

- Calcipotriol and Betamethasone in Other Formulations: Dovonex and Diprolene.

- Other Topical Agents: Calcipotriol ointments, corticosteroid creams, vitamin D analogs.

- Biologics: Such as adalimumab and secukinumab, often used for moderate-to-severe cases.

Market Differentiators

Enstilar’s innovation resides in its foam vehicle, which improves delivery and patient compliance, setting it apart from traditional formulations and impacting market share favorably.

Pricing Analysis

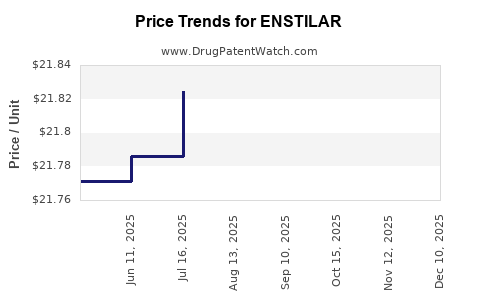

Historical Pricing Trends

Initially launched at approximately USD 750–900 per 60-gram canister, Enstilar’s price varied based on geographic markets, pharmacy markup, and insurance coverage. Over the past five years, prices oscillated due to supply chain factors, patent enforcement, and market competition.

Current Price Points

In the United States, retail pricing hovers around USD 800–1,000 per canister, with negotiated prices falling to USD 600–700 for insured patients [5]. In Europe, prices are generally lower, averaging EUR 50–70 per application, reflecting regional pricing strategies and healthcare policies.

Factors Influencing Price Trajectory

- Patent Expiry and Generics: Patent protection extends until 2025, delaying generic competition and sustaining high prices.

- Market Penetration and Volume Growth: Increased adoption will keep revenue high, but price discounts may be introduced to expand access in emerging markets.

- Regulatory and Reimbursement Policies: Shifts towards value-based pricing and formularies influence net prices.

Future Price Projections

Short-Term (1–2 Years)

Expect modest price stabilization, with potential marginal reductions in competitive markets due to negotiations and formulary placements. Early patent expiration in specific jurisdictions may initiate pricing declines.

Medium to Long-Term (3–5 Years)

Post patent expiry in 2025, generic calcipotriol/betamethasone foam products are anticipated. Generic competition could diminish Enstilar’s pricing by 30–50%, aligning prices closer to traditional formulations (USD 300–500 per canister). Regional market differences will influence these trends; for example, high-income markets may sustain premium pricing longer due to brand loyalty.

Influence of Market Dynamics

- Bioequivalent Generics: Introduction of bioequivalent generics will accelerate price erosion.

- Market Expansion: Entry into developing markets could partly offset price declines through volume increases.

- Innovations: New formulations or combination therapies might render current pricing structures obsolete.

Implications for Stakeholders

- Pharmaceutical Companies: Strategic planning should emphasize patent protections, cost management, and market access strategies.

- Healthcare Providers: Awareness of price trends can inform prescribing patterns and formulary decisions.

- Payers: Price negotiations will be critical as generics enter the market, impacting coverage policies.

- Patients: Cost reductions post-patent expiry will improve affordability but require active policy advocacy.

Key Takeaways

- Market Growth: The psoriasis treatment market, especially topical agents like Enstilar, is poised for steady growth driven by increasing prevalence and patient preference for convenient formulations.

- Pricing Stability and Decline: Enstilar’s premium prices are likely to remain until patent expiration, after which generic competition will significantly reduce prices.

- Pricing Strategies: Manufacturers should leverage ongoing clinical efficacy data, patient compliance benefits, and market expansion to justify premium pricing before patent expiry.

- Regional Variances: High-income markets maintain higher prices; developing markets will see accelerated price declines post-generic entry.

- Long-Term Outlook: Price erosion post-2025 will open opportunities for alternative formulations and biosimilars, reshaping the competitive landscape.

FAQs

-

When does Enstilar’s patent protection expire?

Patent protection is expected to last until 2025 in most regions, after which generic competitors can enter the market.

-

How does Enstilar's price compare to other psoriasis treatments?

Enstilar’s launch price (~USD 800–1,000 per canister) is higher than traditional topical formulations, reflecting its innovative foam vehicle, though biologics are significantly more expensive.

-

What factors could influence Enstilar’s future pricing?

Patent expiration, generic entry, regulatory decisions, market penetration, and insurance negotiations are key determinants.

-

Are there emerging alternatives to Enstilar that could impact its market share?

Yes, new topical formulations and biosimilars, as well as systemic biologic treatments, are expanding therapeutic options for psoriasis.

-

What strategies can stakeholders adopt as prices decline?

Companies should focus on product differentiation, expanding indications, and geographic expansion, while payers and providers should negotiate value-based agreements.

References

[1] Global Psoriasis Treatment Market Report 2022. MarketWatch.

[2] Grand View Research. Psoriasis Treatment Market Size & Trends (2022–2030).

[3] Kircik, L. H. (2017). Enstilar: A New Foam for Psoriasis. Journal of Drugs in Dermatology.

[4] Gupta, A. K., et al. (2017). Clinical Efficacy of Enstilar Foam. Journal of Clinical & Aesthetic Dermatology.

[5] GoodRx. Enstilar Cost & Price Trends. (2023).