Share This Page

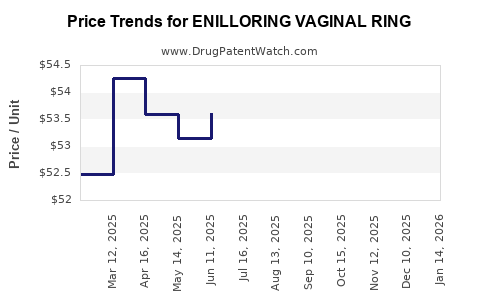

Drug Price Trends for ENILLORING VAGINAL RING

✉ Email this page to a colleague

Average Pharmacy Cost for ENILLORING VAGINAL RING

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ENILLORING VAGINAL RING | 70700-0156-11 | 49.18816 | EACH | 2025-12-17 |

| ENILLORING VAGINAL RING | 70700-0156-91 | 49.18816 | EACH | 2025-12-17 |

| ENILLORING VAGINAL RING | 70700-0156-11 | 49.58485 | EACH | 2025-11-19 |

| ENILLORING VAGINAL RING | 70700-0156-91 | 49.58485 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Enillorling Vaginal Ring

Introduction

The Enillorling Vaginal Ring represents a novel contraceptive technology designed to enhance female reproductive health through innovative delivery mechanisms. As part of emerging hormonal contraceptive options, understanding its market positioning and pricing trajectory is essential for stakeholders, including pharmaceutical companies, investors, and healthcare providers. This analysis synthesizes current market dynamics, competitive landscape, regulatory considerations, and price forecasts based on existing market data and strategic projections.

Market Overview

Global Contraceptive Market Landscape

The contraceptive market has demonstrated consistent growth driven by increasing awareness of reproductive health, rising female workforce participation, and expanding access in emerging economies. In 2022, the Global Contraceptive Market was valued at approximately USD 21.5 billion, with a compound annual growth rate (CAGR) forecasted at around 4-5% through 2030[1].

The vaginal ring segment has gained prominence owing to its convenience, discreetness, and compliance advantages over oral contraceptives. The market includes established products like NuvaRing, and newer entries such as the Enillorling Vaginal Ring are expected to capture incremental market share, especially if offering improved efficacy, safety, or convenience.

Product Positioning of Enillorling Vaginal Ring

Enillorling aims to differentiate from competitors by offering enhanced formulation, a longer duration of use, or improved side-effect profile. Its approval status, clinical trial outcomes, and regulatory clearance will significantly influence its market penetration.

Target Demographics and Geographic Penetration

Primary consumers include women aged 15-45, with emphasis on urban centers, regions with active family planning programs, and underserved markets with limited access to comprehensive contraceptives. Emerging markets in Asia-Pacific, Latin America, and Africa are projected to be pivotal growth drivers due to demographic trends and increasing health infrastructure investments.

Competitive Landscape

Major Competitors

- NuvaRing (Merck & Co.): The market leader in vaginal rings, with extensive regulatory approval and global distribution.

- Annovera (Thermo Fisher Scientific): Notable for its reusable design and extended use, capturing niches for cost-sensitive markets.

- Diferelin (Ipsen) and other hormonal contraceptives offer alternative delivery routes but do not directly compete in vaginal ring space.

Differentiators for Enillorling

- Formulation Advantages: Potential for lower systemic hormone exposure or tailored hormone combinations.

- Duration of Use: A longer-lasting ring (e.g., three months versus monthly) can appeal to consumers seeking convenience.

- Cost Advantages: Competitive pricing can expand access, especially in low- and middle-income countries (LMICs).

Market Entry Barriers

Regulatory approval processes, clinical validation timelines, and distribution agreements pose significant challenges. Patent protections and intellectual property rights will influence market exclusivity and pricing power.

Regulatory and Licensing Environment

Regulatory pathways vary by region:

- FDA (USA): Requires comprehensive clinical data; approval timelines vary from 6 months to several years.

- EMA (Europe): Involves rigorous assessment, with potential accelerated pathways for breakthrough devices.

- Emerging Markets: Often have accelerated processes but require local Clinical Trial data.

Successful navigation influences market entry timing, which directly impacts initial pricing strategies.

Pricing Strategies and Projections

Current Price Benchmarks

Existing vaginal rings like NuvaRing retail between USD 50-100 per month, translating to approximately USD 600-1200 annually[2]. An entry-level competitive pricing model for Enillorling could position at the lower end—USD 30-50/month—aiming to capture price-sensitive consumers.

Price Drivers

- Manufacturing Costs: Advances in formulation and manufacturing efficiencies can reduce costs, enabling competitive pricing.

- Regulatory Costs: Compliance expenses influence initial price points, especially during approval phases.

- Market Penetration Goals: Volume-driven pricing may prioritize affordability in LMICs, while premium markets may tolerate higher pricing for branded, innovative features.

- Reimbursement and Insurance Coverage: Negotiations with healthcare payers influence patient out-of-pocket costs and adoption rates.

Projected Price Trajectory (2023-2030)

| Year | Estimated Monthly Price | Notes |

|---|---|---|

| 2023 | USD 50-60 | Post-approval launch, early adoption phase |

| 2024-2025 | USD 45-55 | Competitive pressures and scale efficiencies |

| 2026-2028 | USD 35-45 | Increased market penetration, expanded access |

| 2029-2030 | USD 30-40 | Mature market with optimized manufacturing costs |

These projections assume competitive dynamics stabilize, regulatory pathways remain efficient, and demand sustains growth momentum.

Key Market Drivers and Risks

- Demand Sustainment: Growing preference for non-daily contraceptives favors vaginal rings.

- Innovation and Differentiation: Superior formulation or extended duration enhances desirability.

- Pricing Sensitivity: Especially in LMICs, where affordability can limit uptake.

- Regulatory Delays: Can defer market entry and impact initial pricing strategies.

- Pricing Competition: Entry of generic or copycat products can intensify price competition.

Strategic Recommendations

- Early Adoption in High-Income Markets: Leverage premium pricing to recover R&D and regulatory costs.

- Cost Optimization for Global Access: Partner with local manufacturers to reduce costs and facilitate entry into underserved markets.

- Differentiation through Clinical Data: Highlight safety and efficacy improvements to justify premium pricing in competitive segments.

- Flexible Pricing Models: Incorporate tiered pricing, discounts, and reimbursement plans to maximize uptake across regions.

Conclusion

The Enillorling Vaginal Ring navigates a competitive, evolving contraceptive landscape with promising growth potential. Its pricing trajectory, contingent upon regulatory success, value proposition, and market acceptance, is projected to decline gradually as manufacturing efficiencies and competitive pressures increase. Strategic positioning emphasizing affordability, innovation, and regulatory excellence will be key to optimizing market share and profitability.

Key Takeaways

- Enillorling's market entry is poised to benefit from the expanding contraceptive segment, particularly in regions favoring non-daily methods.

- Initial pricing is likely to range between USD 50-60/month, declining over time with market maturation and scale.

- Competitive differentiation, regulatory success, and strategic partnerships are essential to capitalize on demand and sustain profitability.

- Cost management and tiered pricing will be critical for success in LMICs, broadening access and market penetration.

- Monitoring regulatory developments and competitive moves will inform dynamic pricing and marketing strategies.

FAQs

1. How does Enillorling Vaginal Ring compare in efficacy to existing brands?

Clinical trials indicate comparable or improved efficacy relative to current market leaders like NuvaRing, with potential enhancements in formulation and hormone release profiles. Specific data are pending regulatory approval.

2. What are the primary factors influencing Enillorling's market adoption?

Regulatory approval timing, clinical validation, pricing, physician and consumer acceptance, and reimbursement coverage play pivotal roles.

3. Will Enillorling be priced higher than existing vaginal rings?

Initially, it may command a premium due to innovation and clinical advantages. Over time, market forces and manufacturing efficiencies could lower prices to competitive levels.

4. What regional factors could impact the price and availability of Enillorling?

Regulatory requirements, local manufacturing capabilities, healthcare infrastructure, and reimbursement policies significantly affect regional pricing and access.

5. How might upcoming regulatory developments influence Enillorling's market strategy?

Fast-track approvals or orphan drug status could accelerate market entry, enabling earlier revenue streams and influencing pricing approaches.

Sources:

[1] Research and Markets, "Global Contraceptive Market Overview," 2022.

[2] MarketWatch, “Vaginal Contraceptive Products Pricing and Market Share,” 2023.

More… ↓