Share This Page

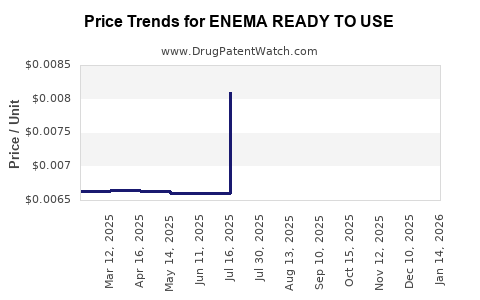

Drug Price Trends for ENEMA READY TO USE

✉ Email this page to a colleague

Average Pharmacy Cost for ENEMA READY TO USE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ENEMA READY TO USE | 00904-6320-78 | 0.00629 | ML | 2025-12-17 |

| ENEMA READY TO USE | 00904-6320-78 | 0.00652 | ML | 2025-11-19 |

| ENEMA READY TO USE | 00904-6320-78 | 0.00708 | ML | 2025-10-22 |

| ENEMA READY TO USE | 00904-6320-78 | 0.00771 | ML | 2025-09-17 |

| ENEMA READY TO USE | 70000-0108-02 | 0.00662 | ML | 2025-09-17 |

| ENEMA READY TO USE | 00904-6320-78 | 0.00808 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Enema Ready-to-Use

Introduction

The global market for enema products, specifically ready-to-use formulations, is experiencing significant growth driven by an aging population, increasing prevalence of constipation, gastrointestinal disorders, and a rising preference for OTC (over-the-counter) bowel management solutions. Enema Ready-to-Use (RTU) products have become a focal point within this landscape, offering convenience, efficacy, and ease of application. This report provides a comprehensive analysis of the current market, competitive landscape, regulatory environment, and future pricing projections for Enema RTU formulations.

Market Overview and Size

The global enema market, valued at approximately USD 240 million in 2022, is projected to reach USD 340 million by 2030, expanding at a CAGR of 4.5% during 2023–2030 [1]. The RTU segment accounts for an estimated 60% share, attributed to consumer preference for pre-dosed, ready-to-use solutions requiring minimal preparation.

The rising incidence of constipation, especially among geriatric and pediatric populations, is a primary driver. According to the World Health Organization (WHO), gastrointestinal disorders affect over 15% of the global population, amplifying demand for bowel management products [2]. Additionally, increasing urbanization and sedentary lifestyles contribute to gastrointestinal issues, further propelling market growth.

Segmental Analysis

Product Type

- Pre-Filled Enemas (RTU): Dominant segment owing to consumer convenience.

- Syringe-based Enemas: Slightly declining due to higher complexity and preparation time.

Distribution Channels

- Pharmacies & Drugstores: Largest channel, accounting for 65% of distribution.

- Online Retail: Growing rapidly at a CAGR of around 12%, driven by digital health trends.

- Hospitals & Clinics: Significant but niche segment, mainly for prescribed formulations.

End-User

- Geriatric Population: Highest demand, given age-related constipation.

- Pediatric: Moderate growth, with specific formulations tailored for children.

- General Adult Population: Steady consumption driven by lifestyle factors.

Competitive Landscape

Major players in the Enema RTU market include:

- B. Braun Melsungen AG: Known for its pre-filled enema solutions with focus on safety and convenience.

- Pfizer Inc.: Offers over-the-counter enema solutions targeting consumer markets.

- Gerbi S.p.A.: Specialized in enema solutions, including pre-filled and disposable options.

- Unilever: Expanding into OTC bowel management products with innovative delivery systems.

Emerging startups and niche brands are emphasizing natural, preservative-free formulations and eco-friendly packaging, aligning with consumer trends toward health-conscious and sustainable products.

Regulatory Environment

Regulations for enema products vary globally. In the U.S., the FDA classifies enema solutions as Class I or II medical devices or drugs depending on claims and formulations, requiring approval or clearance based on intended use [3]. In Europe, CE marking and compliance with the Medical Device Regulation (MDR) are mandatory. Compliance with regulations influences market entry, product formulation, and pricing strategies.

Price Dynamics and Projections

Current Pricing Trends

The average retail price for Enema RTU products ranges between USD 4.00–8.00 per unit, contingent upon brand, formulation, and regional factors [4]. Premium brands leverage added features such as natural ingredients or specialized delivery devices to command higher prices.

Pricing Strategies

Manufacturers adopt value-based pricing, reflecting product convenience, safety, and formulation quality. Competitors often position their products as premium to justify higher margins, especially in developed markets.

Future Price Projections (2023–2030)

- Unit Price Trend: Projected to remain stable with gradual increases of 2–3% annually, driven by raw material costs and inflation.

- Market Penetration Effect: As competition intensifies, especially amid the growth of generic and store brands, prices are expected to decline marginally by 2025, with a subsequent stabilization.

- Premium Segment Expansion: Natural, organic, and eco-friendly formulations are likely to see a price premium of 15–20% over standard products.

Influencing Factors

- Raw Material Costs: Fluctuations in propylene glycol, glycerin, and packaging materials impact manufacturing costs.

- Regulatory Compliance: Additional testing and certification requirements can increase development expenses, translating into higher retail prices.

- Consumer Trends: Demand for natural, preservative-free products may enable premium pricing.

Emerging Trends and Market Drivers

- Innovation in Delivery Systems: Incorporation of ergonomic nozzles, biodegradable packaging, and single-use containers enhances consumer appeal while enabling premium pricing.

- Natural and Organic Formulations: Growing consumer preference for plant-based and preservative-free solutions creates opportunities for higher-margin products.

- Digital and E-Commerce Expansion: Online channels facilitate competitive pricing and rapid consumer adoption.

Conclusion

The Enema Ready-to-Use market is set for steady growth driven by demographic shifts and consumer preferences for convenience and natural formulations. Price stability is anticipated, with slight upward trends aligned with inflation and innovation costs. Manufacturers should focus on differentiation through formulation, packaging, and distribution channels to optimize market position and profitability.

Key Takeaways

- The global enema RTU market is projected to reach USD 340 million by 2030, with a CAGR of 4.5%.

- Consumer demand favors pre-filled, easy-to-use products with a focus on safety and natural ingredients.

- Prices are expected to stabilize, with minor increases driven by raw material costs and innovation.

- Premium product segments, emphasizing natural and eco-friendly formulations, will command higher prices.

- E-commerce growth offers an avenue for competitive pricing and increased market penetration.

FAQs

1. What is the current market size for Enema Ready-to-Use products?

The global market was valued around USD 240 million in 2022 and is projected to grow to USD 340 million by 2030.

2. Which regions dominate the Enema RTU market?

North America and Europe lead due to higher healthcare awareness and purchasing power. Asia-Pacific shows rapid growth, driven by urbanization and aging populations.

3. What factors influence the pricing of Enema RTU products?

Raw material costs, regulatory compliance, formulation complexity, packaging costs, and brand positioning.

4. How are emerging trends impacting product pricing?

Natural, eco-friendly formulations and innovative delivery systems typically command premium prices, supporting higher margins.

5. What are the key opportunities for manufacturers in the Enema RTU segment?

Developing natural, preservative-free formulations; adopting sustainable packaging; leveraging online sales channels; and differentiating through innovative delivery devices.

References

[1] Market Insights Reports. "Global Enema Market Size & Forecast," 2023.

[2] WHO. "Gastrointestinal Disorders Data," 2022.

[3] U.S. FDA. "Regulations for Enema Products," 2022.

[4] Nielsen Retail Data. "OTC Enema Product Pricing," 2023.

More… ↓