Share This Page

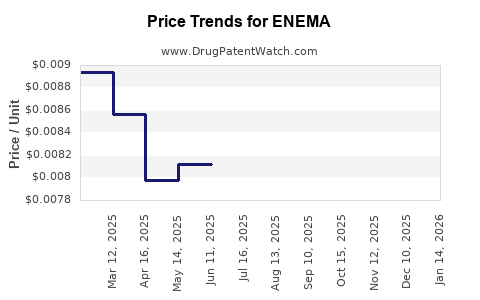

Drug Price Trends for ENEMA

✉ Email this page to a colleague

Average Pharmacy Cost for ENEMA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ENEMA | 00536-7415-51 | 0.00629 | ML | 2025-12-17 |

| ENEMA READY TO USE | 00904-6320-78 | 0.00629 | ML | 2025-12-17 |

| ENEMA | 00536-7415-51 | 0.00652 | ML | 2025-11-19 |

| ENEMA READY TO USE | 00904-6320-78 | 0.00652 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Enema Drugs

Introduction

Enema products are a class of medicinal and consumer devices used primarily for bowel cleansing, relief of constipation, or medication delivery. The global enema market is intertwined with the broader gastrointestinal (GI) therapeutics and OTC (over-the-counter) laxative sectors. As healthcare systems evolve and consumer preferences shift, understanding market dynamics and pricing trajectories enables pharmaceutical and medical device companies to make strategic decisions. This analysis examines current market conditions, competitive landscape, regulatory factors, and future price projections for enema products.

Market Overview

Scope and Segmentation

The enema market encompasses various formulations, including:

- Prescription Enemas: Typically used for medical conditions like severe constipation, bowel preparation before procedures, or opioid-induced constipation.

- OTC Enemas: Widely accessible for consumer use, including popular brands like Fleet, Dulcolax, and generic options.

- Delivery Devices: Ranging from simple bulb-style devices to advanced, pre-filled, single-use applicators.

Market Size and Growth Trends

The global enema market valued approximately USD 1.2 billion in 2022, with an expected compound annual growth rate (CAGR) of around 4% through 2030 [1]. The growth drivers include the aging population, increasing awareness of gastrointestinal health, and expanding access to OTC bowel management products.

Regionally, North America dominates, driven by high healthcare expenditure, widespread OTC medication use, and aging demographics. Europe follows, with increasing adoption of enema solutions for both medical and wellness applications. Emerging markets in Asia-Pacific are slated for rapid growth owing to rising urbanization, improved healthcare infrastructure, and increased prevalence of GI disorders.

Key Market Drivers

- Aging Population: Elderly patients frequently experience chronic constipation, spurring demand for reliable bowel management solutions.

- Chronic GI Conditions: Rising incidences of irritable bowel syndrome (IBS), Crohn's disease, and related conditions heighten the need for enema-based treatments.

- Lifestyle Factors: Sedentary habits, dietary patterns, and medication side effects contribute to constipation prevalence.

- Medical Procedures: Enemas are staple pre-surgical preparations, especially in hospitals and clinics.

Challenges

- Competition from other laxatives (oral pills, suppositories) limits market penetration.

- Consumer preferences for natural or alternative remedies.

- Regulatory hurdles concerning delivery device safety standards.

Competitive Landscape

Major players include:

- Becton Dickinson (Fleet brand)

- Pfizer (Dulcolax enema)

- Kimberly-Clark

- Medline Industries

- Generic manufacturers and private labels

Innovation focuses on ergonomic device design, pre-filled single-dose options, and formulations with enhanced safety profiles. The market exhibits a fragmented structure, with numerous regional and local brands influencing pricing strategies.

Regulatory Environment

Enema products, especially those used for medical purposes, are regulated by agencies such as the U.S. FDA, EMA in Europe, and other national bodies. Product approval hinges on safety, efficacy, and manufacturing standards. Regulatory pathways influence market entry and influence pricing, especially for new or biosimilar enema formulations.

Price Analysis and Projections

Current Pricing Dynamics

Enema product prices vary significantly across regions and formulations. For OTC single-use enema kits, retail prices generally range from USD 2 to USD 10 per unit, with branded products tending to command higher prices. Prescription enema solutions, often compounded or specifically formulated, can range from USD 5 to USD 20 per treatment, influenced by brand, formulation complexity, and healthcare setting.

Bulk institutional procurement may benefit from discounts, with hospital-grade enema solutions priced between USD 8 and USD 15 per unit, depending on volume and supplier contracts.

Pricing Trends

Factors influencing pricing include:

- Product Innovation: Pre-filled, ergonomic, and disposable devices command premium prices.

- Regulatory Compliance: Enhanced safety and efficacy standards increase manufacturing costs, often reflected in retail prices.

- Market Competition: Price erosion occurs with generic entries and market saturation.

Future Price Projections (2023-2030)

- Short-Term (2023-2025): Expect modest price stabilization, with some downward pressure due to generic competition and increased manufacturing efficiencies.

- Mid to Long-Term (2026-2030): Prices are projected to decline by approximately 5-8% in mature markets due to market saturation but may increase in emerging markets driven by regulatory changes and product innovations.

Specialized enema formulations with added features (e.g., soothing agents, natural ingredients) may sustain premium pricing, with projected annual increases of 2-3%.

Impact of Market Disruptors

Innovations such as biodegradable, single-use devices, or enema products incorporating pharmaceuticals (e.g., microbeads or probiotic formulations) could alter pricing structures significantly. Moreover, digital health integrations (e.g., app-controlled enema systems) may command higher prices, targeting tech-savvy consumers.

Opportunities and Strategic Outlook

- Emerging Markets: Investment in local manufacturing and distribution could capitalize on rapid market growth.

- Product Diversification: Developing formulations tailored to specific patient populations (elderly, pediatric) can justify premium pricing.

- Regulatory Engagement: Navigating approval pathways to introduce innovative, safer products will create competitive barriers.

- Consumer Education: Marketing campaigns emphasizing safety and efficacy will support higher price points and brand loyalty.

Key Takeaways

- The global enema market is projected to grow steadily at a CAGR of approximately 4% through 2030, driven by demographic trends and increased GI health awareness.

- Price points vary regionally, with current retail prices for OTC enema kits averaging USD 2-10, and prescription solutions ranging USD 5-20 per dose.

- Short-term price stability is expected, with a gradual decline due to generic competition and manufacturing efficiencies.

- Innovations and emerging market growth may enable premium pricing for specialized enema products.

- Strategic focus on product differentiation, regulatory compliance, and regional expansion can capitalize on market opportunities.

FAQs

-

What factors influence the pricing of enema products globally?

Prices are affected by formulation complexity, device ergonomics, regulatory costs, competition from generics, and regional economic factors. -

How will aging populations impact enema market growth?

An increasing elderly demographic with chronic constipation issues will sustain demand, expanding both prescription and OTC segments. -

Are natural or organic enema products gaining market share?

Yes. Consumer preferences for natural remedies are leading to a rise in formulations with herbal or organic ingredients, often commanding higher prices. -

What regulatory challenges might impact future enema market prices?

Regulatory agencies emphasize safety, efficacy, and manufacturing standards, which can increase compliance costs but also elevate product credibility and pricing. -

What innovations could disrupt current enema pricing trends?

Smart delivery devices, biodegradable single-use applicators, and combination medicinal formulations could create premium segments and alter traditional pricing models.

References:

[1] Grand View Research, "Gastrointestinal Disorders Market Size & Trends," 2022.

More… ↓