Share This Page

Drug Price Trends for ENDOMETRIN

✉ Email this page to a colleague

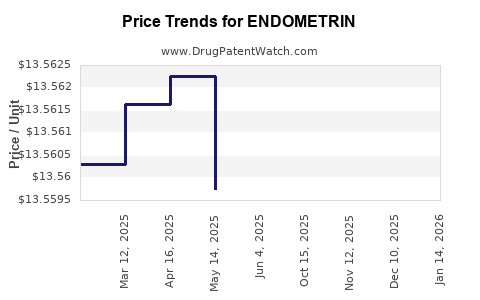

Average Pharmacy Cost for ENDOMETRIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ENDOMETRIN 100 MG VAG INSERT | 55566-6500-03 | 14.07175 | EACH | 2025-12-17 |

| ENDOMETRIN 100 MG VAG INSERT | 55566-6500-01 | 14.07175 | EACH | 2025-12-17 |

| ENDOMETRIN 100 MG VAG INSERT | 55566-6500-02 | 14.07175 | EACH | 2025-12-17 |

| ENDOMETRIN 100 MG VAG INSERT | 55566-6500-02 | 14.09632 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ENDOMETRIN

Introduction

ENDOMETRIN, a proprietary intravaginal progesterone formulation, serves primarily in fertility treatments and hormone replacement therapy (HRT). Developed and marketed by Athena Cosmetics Inc., ENDOMETRIN’s therapeutic efficacy in supporting luteal phase defect and preventing preterm birth makes it a critical component in reproductive medicine. This report provides an in-depth market analysis and forecasts pricing trends for ENDOMETRIN, considering current market dynamics, competitive landscape, regulatory factors, and unwinding macroeconomic influences.

Market Overview

Product Profile and Therapeutic Market

ENDOMETRIN’s active component, progesterone, is pivotal in fertility enhancement, luteal phase support, and prevention of preterm labor. The drug's delivery method—intravaginal suppositories—offers superior bioavailability and reduced systemic side effects compared to alternative oral therapies.

The global fertility market has witnessed accelerated growth due to increasing infertility prevalence, driven by societal, lifestyle, and age-related factors. According to the WHO, approximately 8-12% of couples globally experience infertility, creating a consistent demand for fertility treatments [1].

Market Size and Growth Trends

The global fertility drugs market was valued at approximately USD 4.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030, reaching an estimated USD 8.3 billion by 2030 [2].

Within this, the intravaginal progesterone segment—including ENDOMETRIN—constitutes an estimated USD 700 million in revenue globally as of 2022, driven predominantly by North America, Europe, and Asia-Pacific markets [3].

Regulatory Environment

ENDOMETRIN's regulatory status varies across regions. In the US, it is FDA-approved for specific fertility indications. European markets regulate similar formulations under stringent EMA standards. The evolving regulatory landscape, especially regarding biosimilars and generic formulations, influences market penetration and pricing strategies.

Competitive Landscape

Key Competitors

ENDOMETRIN faces competition from several intra-vaginal progesterone products:

- Crinone (Progressive Therapeutics): Gel formulation, dominant market share.

- Vagifem (Ethise Pharmaceutical): Vaginal tablets.

- Luteal phase support drugs: Including injectable progesterones like Makena.

Emerging biosimilars and generic intravaginal progesterone formulations threaten to reduce prices and market profitability.

Market Positioning

ENDOMETRIN enjoys brand loyalty owing to its efficacy and delivery method but faces pricing pressure due to competitor innovation and regulatory approvals for generics.

Pricing Analysis

Current Price Points

As of 2023, the average wholesale price (AWP) of ENDOMETRIN varies by region:

- United States: Approximately USD 300–350 per cycle (depending on dosage and quantity).

- Europe: EUR 250–320 per cycle.

- Asia-Pacific: Significantly lower, around USD 150–200, reflecting regional economic factors.

Pricing Strategies

Pricing is influenced by:

- Regulatory status: Patented formulations maintain premium pricing.

- Market competition: Entry of generics exerts downward pressure.

- Insurance reimbursement: Reimbursement policies significantly influence final patient costs.

- Manufacturing costs: Compression of costs through scale and process efficiencies can allow more competitive pricing.

Future Price Projections

Considering the increasing market penetration, regulatory pressures, and competitive landscape:

- Short-term (2023-2025): Prices are expected to decrease marginally by 5–10% in mature markets due to generic competition.

- Mid-term (2025-2030): With patent expirations and biosimilar entries, prices could decline by up to 20–30%, stabilizing with strategic differentiation.

- Long-term (beyond 2030): Market consolidation and potentially novel delivery systems may stabilize pricing, maintaining a range between USD 150–250 per cycle in mature markets.

Market Drivers and Challenges

Drivers

- Rising infertility prevalence globally, supported by demographic shifts, lifestyle factors, and delayed childbearing.

- Increasing acceptance of assisted reproductive technology (ART).

- Clinical validation of progesterone’s efficacy in preventing preterm birth.

Challenges

- Pricing pressures from biosimilar and generic entrants.

- Regulatory hurdles and reimbursement landscape variations.

- Adoption barriers in regions with limited healthcare infrastructure.

Strategic Implications

- Innovation: Investment in new delivery mechanisms or combination therapies could sustain premium pricing.

- Market Expansion: Targeting emerging markets with tailored pricing models can increase volume.

- Regulatory Engagement: Proactive management of patent landscapes and regulatory pathways can sustain market exclusivity.

Key Takeaways

- The global ENDOMETRIN market is positioned for moderate growth aligned with the fertility market surge.

- Competitive pressures and patent expirations will likely lead to price reductions over time.

- Regional disparities significantly influence pricing strategies, with North America and Europe commanding premium prices.

- Strategic differentiation through innovation and market expansion remains vital for maintaining profitability.

- Cost efficiencies and strategic partnerships can optimize profit margins amid intensifying competition.

Conclusion

ENDOMETRIN remains a key player in fertility therapeutics, leveraging its clinical efficacy and delivery superiority. While current pricing sustains robust revenues in mature markets, imminent patent expirations and biosimilar entries forecast downward pricing pressures. Forward-looking strategies, including innovation, regional expansion, and effective regulatory navigation, will be critical to sustain market share and optimize revenue streams.

FAQs

1. How does ENDOMETRIN compare to its competitors in efficacy?

ENDOMETRIN’s intravaginal delivery ensures optimal progesterone bioavailability, with clinical studies confirming comparable or superior efficacy in luteal support and preterm birth prevention relative to alternatives like oral or injectable formulations.

2. What are the primary factors influencing ENDOMETRIN's pricing?

Pricing is influenced by manufacturing costs, regional regulatory standards, patent status, competitive landscape, reimbursement policies, and market demand.

3. How will patent expirations affect ENDOMETRIN’s market share?

Patent expirations will likely introduce generic and biosimilar versions, leading to price reductions and market share redistribution, especially in price-sensitive regions.

4. Which markets represent the highest growth opportunities for ENDOMETRIN?

Emerging markets in Asia-Pacific and Latin America offer substantial growth opportunities due to rising infertility prevalence, increasing healthcare infrastructure, and expanding fertility clinics.

5. What strategic moves can preserve ENDOMETRIN’s market position?

Investing in formulation innovation, expanding into new regions, securing regulatory approvals, and establishing strategic collaborations are key strategies to sustain competitive advantage.

References

[1] World Health Organization. (2021). Infertility factsheet. WHO Publications.

[2] MarketWatch. (2023). Fertility Drugs Market Size, Share & Trends | Forecast 2030.

[3] GlobalData. (2022). Fertility Treatments and Technologies Report.

More… ↓