Share This Page

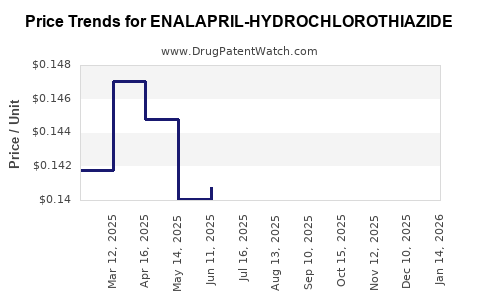

Drug Price Trends for ENALAPRIL-HYDROCHLOROTHIAZIDE

✉ Email this page to a colleague

Average Pharmacy Cost for ENALAPRIL-HYDROCHLOROTHIAZIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ENALAPRIL-HYDROCHLOROTHIAZIDE 10-25 MG TABLET | 51672-4046-01 | 0.17081 | EACH | 2025-12-17 |

| ENALAPRIL-HYDROCHLOROTHIAZIDE 5-12.5 MG TAB | 51672-4045-01 | 0.18810 | EACH | 2025-12-17 |

| ENALAPRIL-HYDROCHLOROTHIAZIDE 10-25 MG TABLET | 51672-4046-01 | 0.16871 | EACH | 2025-11-19 |

| ENALAPRIL-HYDROCHLOROTHIAZIDE 5-12.5 MG TAB | 51672-4045-01 | 0.17641 | EACH | 2025-11-19 |

| ENALAPRIL-HYDROCHLOROTHIAZIDE 5-12.5 MG TAB | 51672-4045-01 | 0.16296 | EACH | 2025-10-22 |

| ENALAPRIL-HYDROCHLOROTHIAZIDE 10-25 MG TABLET | 51672-4046-01 | 0.17741 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Enalapril-Hydrochlorothiazide

Introduction

Enalapril-Hydrochlorothiazide (HCTZ) constitutes a combination medication widely prescribed for managing hypertension and heart failure. It merges enalapril, an ACE inhibitor, with hydrochlorothiazide, a thiazide diuretic, delivering synergistic antihypertensive effects. Since its inception, enalapril-HCTZ has established a significant footprint in cardiovascular therapy, bolstered by its proven efficacy, safety profile, and cost-effectiveness. This report offers a comprehensive market analysis and price projection outlook, emphasizing factors shaping the drug’s commercial landscape.

Market Landscape Overview

Global Market Demand

Hypertension affects approximately 1.13 billion adults worldwide, making antihypertensive drugs a cornerstone in chronic disease management. According to the Global Burden of Disease study, the prevalence of hypertension is rising, driven by aging populations, urbanization, and lifestyle changes [1].

Enalapril-HCTZ remains a preferred fixed-dose combination (FDC) due to its convenience and demonstrable efficacy. The global antihypertensive market is projected to grow at a compound annual growth rate (CAGR) of about 3.8% from 2023 to 2030, with increasing adoption of combination therapies fueling demand [2].

Key Regional Markets

-

North America: Dominates the market with high hypertension prevalence, established healthcare infrastructure, and strong brand recognition. The U.S. FDA’s approval of generic versions has increased competition and lowered prices.

-

Europe: Features significant demand, driven by aging populations and strict prescribing guidelines favoring combination therapies.

-

Asia-Pacific: Exhibits rapid market expansion, with China and India leading due to rising hypertension rates and improving healthcare access.

Competitive Landscape

Generic enalapril-HCTZ formulations dominate the market, driven by patent expirations of branded counterparts. Major pharmaceutical firms, including Teva, Mylan, and Sandoz, supply affordable generics, intensifying competition. Branded formulations, such as Novartis’ Diovan-HCTZ (combo of valsartan and HCTZ), offer alternatives but at higher price points.

Innovative fixed-dose combinations that improve adherence, such as combining enalapril with newer diuretics or adjuncts, are entering the market, potentially influencing demand dynamics.

Market Drivers

-

Rising Hypertension Prevalence: Increasing global burden accelerates demand for reliable antihypertensives like enalapril-HCTZ.

-

Cost-Effectiveness & Generic Availability: Low-cost generics have enhanced accessibility, particularly in resource-limited settings, expanding use.

-

Guideline Endorsements: Professional societies, including the American College of Cardiology (ACC), favor fixed-dose combinations to improve adherence, further boosting sales.

-

Regulatory Approvals: Ongoing approvals of biosimilars and generic versions widen market reach and influence pricing.

Market Challenges

-

Strict Regulatory Environment: Post-market surveillance and compliance requirements can delay new launches.

-

Competitive Pricing Pressure: Market saturation with generics restrains pricing power.

-

Patient Preference & Adherence Issues: Variability in combination pill formulations and side effect profiles influence prescribing patterns.

-

Alternative Therapies: Emergence of newer antihypertensive agents, such as ARBs and direct renin inhibitors, challenge enalapril-HCTZ's market share.

Price Analysis and Projections

Historical Pricing Trends

-

Brand vs. Generic: Branded enalapril-HCTZ formulations historically ranged between $20–$50 per month, highly sensitive to regional pricing policies. Post-patent expiration, generic versions brought prices below $10 per month in many markets.

-

Market Penetration of Generics: Due to price competitiveness, generics account for over 85% of prescriptions in the U.S. and similar compositions worldwide, exerting downward pressure on prices.

Current Price Landscape (2023)

-

United States: Average retail price for generic enalapril-HCTZ 20/12.5 mg is approximately $4–$8 per month (30-count prescription). Branded versions can be 2–3x more expensive.

-

Europe & Asia: Prices vary regionally, with countries like the UK paying approximately £3–£6 per month for generics and Asia markets experiencing even lower costs due to manufacturing efficiencies.

Projected Price Trends (2024–2030)

Given current market conditions, several key factors influence future pricing:

-

Increased Competition: Continued entry of cost-effective generics and biosimilars will maintain downward price pressure.

-

Regulatory & Reimbursement Policies: Governments in high-income countries are increasingly advocating for cost containment, enforcing price caps and promoting generics, likely sustaining or further reducing prices.

-

Supply Chain Dynamics: Manufacturing cost reductions, particularly in Asia, will support stable or decreasing price points.

-

Potential Premium Offerings: New fixed-dose combinations with improved bioavailability or once-daily formulations could command premium pricing, but their impact on enalapril-HCTZ would be limited unless they replace existing therapies.

Estimated Price Range (2024–2030):

- Global Average: Expect generic enalapril-HCTZ to stabilize around $2–$5 per month in high-income regions, with prices potentially declining further as markets mature.

- Emerging Markets: Prices could settle as low as $1–$3 per month, driven by local manufacturing and procurement policies.

Market Growth and Price Implications

The combination’s market growth will predominantly be influenced by demographic trends, healthcare policies, and generic competition. The price stability or decline will hinge on:

- The extent of generic market penetration

- Patent challenges and biosimilar entries

- Policy-driven price controls

- Adoption of combination therapy guidelines

While overall volume growth is likely to sustain revenue, margin pressures among generic manufacturers could compress per-unit pricing further.

Key Market Opportunities

-

Biosimilars & Substitutes: While not directly applicable to small-molecule drugs like enalapril-HCTZ, biosimilar development signifies a shift towards cost reduction strategies.

-

Emerging Markets: Countries with expanding healthcare infrastructure offer growth avenues at low manufacturing costs, further pushing prices downward.

-

Formulation Advancements: Innovative sustained-release or fixed-dose combinations incorporating enalapril-HCTZ could command premium pricing if they demonstrate improved adherence and efficacy.

Regulatory & Patent Landscape

Enalapril-HCTZ’s patent protections are largely expired globally, facilitating generic proliferation. Patent litigation or exclusivity extensions could temporarily influence pricing, but current trends favor commoditization and price reductions.

Conclusion

Enalapril-Hydrochlorothiazide continues to serve as a cost-effective, efficacious option for hypertension management. Market trends reveal a predominantly competitive landscape with significant price reductions driven by generic entry and regulatory policies favoring affordability. Future price projections indicate stabilized or declining prices, especially in high-volume markets, underscoring the importance of volume-based revenue models.

Key Takeaways

- The enalapril-HCTZ market benefits from high global demand amid increasing hypertension prevalence and favorable prescribing guidelines for fixed-dose combinations.

- Generics dominate the market, exerting strong downward pressure on pricing, particularly in North America and Europe.

- Prices are expected to stabilize or decline further by 2030, with monthly costs potentially between $1 and $5 in most markets.

- Growth opportunities exist in emerging markets and through formulation innovations, but competitive pressure will remain intense.

- Market sustains primarily on volume, with cost-efficiency and regulatory policies being critical to pricing strategies.

FAQs

1. How has the patent expiration impacted enalapril-HCTZ pricing?

Patent expirations led to widespread generic availability, drastically reducing prices—often by over 50%—and enabling broader access in both developed and developing regions.

2. What are the primary factors driving demand for enalapril-HCTZ?

Rising hypertension prevalence, clinical guideline endorsements favoring fixed-dose combinations for improved adherence, and the drug’s cost-effectiveness are key demand drivers.

3. Are branded enalapril-HCTZ formulations still relevant?

While branded versions exist, they account for a minor share of the market, mainly used in specific regions or for formulary reasons. Generics dominate due to their affordability.

4. How do regulatory policies influence future pricing?

Policies emphasizing cost containment and promoting generics tend to maintain or push prices downward, especially in countries with strong price control measures.

5. What are the prospects for introducing new fixed-dose combinations involving enalapril?

Innovative combinations improving adherence or managing side effects may enter the market, but existing price pressures limit their premium positioning unless supported by clear clinical advantages.

References

[1] Kearney, P. M., et al. "Global burden of hypertension: analysis of worldwide data." The Lancet, 2015.

[2] Grand View Research. "Antihypertensive Drugs Market Size, Share & Trends Analysis Report, 2023–2030."

More… ↓