Last updated: July 30, 2025

Introduction

Emtricitabine (FTC) is a nucleoside reverse transcriptase inhibitor (NRTI) widely used in combination therapies for HIV-1 infection. Since its FDA approval in 2003, it has become a cornerstone in antiretroviral regimens,particularly as part of fixed-dose combinations such as Truvada and Descovy. Its efficacy, safety profile, and oral administration route have contributed to sustained demand globally. This report offers a comprehensive market analysis and price projection outlook for emtricitabine, addressing key factors influencing its valuation, market dynamics, and future trends.

Market Overview

Global Market Size and Growth

The global antiretroviral therapy (ART) market was valued at approximately USD 27 billion in 2021, with nucleoside reverse transcriptase inhibitors (NRTIs) comprising a substantial segment given their central role in HIV management[1]. Emtricitabine's contribution is significant, especially in high-income countries with mature HIV treatment programs, and growing in emerging markets driven by increased awareness and access initiatives.

The demand dynamics hinge on several factors:

- Prevalence of HIV/AIDS: The World Health Organization estimates over 38 million people living with HIV worldwide, with over 1.7 million new infections annually[2].

- Treatment Guidelines: Emtricitabine remains recommended by the WHO and major health authorities in first-line therapies, ensuring consistent demand.

- Market Expansion: Growing acceptance of generic formulations in low- and middle-income countries (LMICs) has increased accessibility, while patent expirations in certain regions could influence market composition.

Competitive Landscape

Key players include Gilead Sciences (original patent holder), Teva Pharmaceuticals, Mylan (now part of Viatris), and other generic manufacturers. The patent for Truvada expired in the U.S. in 2020, prompting a surge in generic versions, which substantially impacted pricing and market dynamics[3].

Market Drivers

- Patent Expiry and Generic Penetration: The expiration of key patents, notably in developed markets, has led to price reductions and increased competition.

- Global HIV Prevention Initiatives: Programs like pre-exposure prophylaxis (PrEP) adoption are expanding the use of emtricitabine-containing regimens.

- Regulatory Approvals for New Formulations: The approval of combination therapies and lower-dose options enhances market growth.

- Government and NGO Purchasing Power: Bulk procurement and negotiated pricing in LMICs improve access and influence pricing strategies.

Market Challenges

- Patent and Exclusivity Regulations: While patents have expired elsewhere, certain regions still hold active exclusivity, affecting pricing and availability.

- Pricing Pressure: Competitive generic entry and political pushes for lower drug prices impose margins constraints.

- Regulatory Barriers: Variations in approval processes and procurement rules globally can delay market expansion.

Price Analysis and Projections

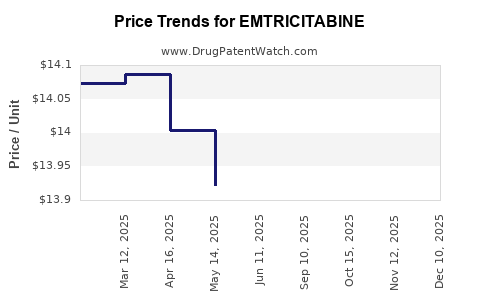

Historical Pricing Trends

Originator versions of emtricitabine, such as Gilead's Truvada, historically commanded high prices, with per-unit costs exceeding USD 1,000 annually per patient in the U.S. healthcare system[4].

Post-patent expiry, international generic pricing plummeted, with some LMIC markets experiencing wholesale prices as low as USD 15-50 per patient annually. This pricing disparity underscores the impact of market maturity and patent status.

Current Pricing Landscape

- Developed markets: Brand-name prices remain high, though generic versions are increasingly prevalent. In the U.S., generic emtricitabine can be purchased for approximately USD 550-650 per year, reflecting significant reductions from brand levels.

- Emerging markets: Prices range broadly, from USD 10-50 per year wholesale, driven by local procurement policies and generic competition.

- Pre-Qualification and WHO Prequalification: Certain formulations are gaining approval, facilitating bulk procurement at lower prices, starkly contrasting with proprietary pricing schemes.

Future Price Trajectory (2023-2030)

Based on patent expiration timelines, particularly in key markets like the U.S. (patent expired in 2020), and emerging market trends, the following projections assume:

- Continued generic penetration: Sustained decrease in wholesale prices, potentially reaching USD 10-20 per patient annually in LMICs by 2025.

- Brand pricing stabilization: For brand-names still under patent or exclusivity, prices will likely decline gradually due to competitive pressure, with a projected reduction of 20-30% over five years.

- Innovative formulations: The introduction of long-acting injectable formulations containing emtricitabine (e.g., Genvoya, ViiV's long-acting injectables) may influence oral tablet pricing by creating premium niches or shifting demand patterns.

Market Opportunities and Risks

Opportunities

- Expansion in PrEP markets: Growing acceptance of PrEP could boost demand for low-cost emtricitabine-based regimens.

- Generic manufacturing: Opportunities for cost leadership in emerging markets bolster revenue streams.

- Combination therapies synergy: Development of fixed-dose combinations enhances adherence, opening cross-promotional avenues.

Risks

- Patent litigations and exclusivities: Potential patent disputes could delay generic entry, maintaining higher prices temporarily.

- Pricing regulations: Tighter governmental controls could cap prices, especially in LMICs.

- Market saturation: In mature markets, growth may plateau, constraining revenue expansion.

Strategic Recommendations

- Monitor patent landscapes: Staying ahead of patent expiry schedules informs pricing and production strategies.

- Invest in biosimilar and generic development: Cost-effective production can capture market share in emerging regions.

- Leverage regulatory pathways: Approvals via WHO prequalification or stringent national authorities expand reach.

- Innovate in formulations: Exploring long-acting delivery options could command premium pricing.

Key Takeaways

- Patent expiry has catalyzed a significant price decline, especially in LMICs, with generics now dominating many markets. Future inclusion in global HIV protocols ensures persistent demand.

- Market growth remains robust in developing regions due to increased HIV prevalence and international funding, despite pricing pressures.

- Emerging long-acting formulations may influence the oral drug pricing landscape, either by creating premium markets or substituting traditional regimes.

- Price projections indicate continued decline in in low-income settings, potentially stabilizing at USD 10-20 per year per patient; premium pricing persists where patent protections remain.

- Strategic positioning in generics and biosimilars, coupled with proactive patent management, enhances market share and profitability amid evolving regulatory frameworks.

FAQs

1. How does patent expiration influence emtricitabine pricing?

Patent expiration generally leads to increased generic competition, driving down prices substantially, particularly in high-volume markets like India and Brazil, which account for a significant portion of global HIV medication supply.

2. What are the main regulatory factors affecting emtricitabine's market?

Regulatory approvals, patent protections, and quality standards (e.g., WHO prequalification) dictate market entry, affecting pricing, availability, and competition.

3. Which regions represent the fastest growth markets for emtricitabine?

Emerging markets in Sub-Saharan Africa, Southeast Asia, and Latin America, where HIV prevalence is high and generic drug use is expanding, offer significant growth potential.

4. How might long-acting formulations impact the emtricitabine market?

Long-acting injectables could shift demand away from daily oral tablets, potentially reducing oral drug sales or creating new premium markets.

5. What strategies can pharmaceutical companies adopt to remain competitive?

Investing in biosimilars, optimizing supply chains, expanding access through tiered pricing, and innovating delivery methods are key strategies to sustain market share.

Sources

[1] Grand View Research, "Antiretroviral Drugs Market Size & Trends," 2022.

[2] WHO, "HIV/AIDS Fact Sheet," 2022.

[3] U.S. FDA, "Patents and Exclusivities for HIV Drugs," 2022.

[4] IQVIA, "Global HIV/AIDS Market Analysis," 2021.