Share This Page

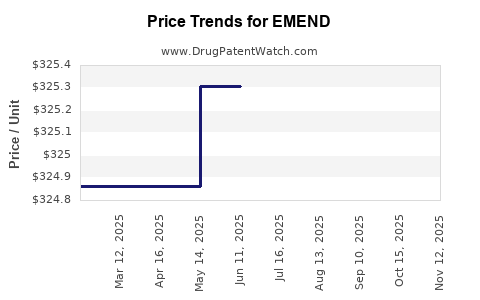

Drug Price Trends for EMEND

✉ Email this page to a colleague

Average Pharmacy Cost for EMEND

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EMEND 125 MG POWDER PACKET | 00006-3066-01 | 326.00500 | EACH | 2025-11-19 |

| EMEND 125 MG POWDER PACKET | 00006-3066-03 | 326.00500 | EACH | 2025-11-19 |

| EMEND 125 MG POWDER PACKET | 00006-3066-01 | 326.00500 | EACH | 2025-10-22 |

| EMEND 125 MG POWDER PACKET | 00006-3066-03 | 326.00500 | EACH | 2025-10-22 |

| EMEND 125 MG POWDER PACKET | 00006-3066-01 | 326.60000 | EACH | 2025-09-17 |

| EMEND 125 MG POWDER PACKET | 00006-3066-03 | 326.60000 | EACH | 2025-09-17 |

| EMEND 125 MG POWDER PACKET | 00006-3066-03 | 325.11714 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EMEND (Aprepitant)

Introduction

EMEND (Aprepitant) is a neurokinin-1 receptor antagonist primarily used to prevent chemotherapy-induced nausea and vomiting (CINV). Since its FDA approval in 2003, EMEND has become a cornerstone in supportive cancer care, enjoying widespread adoption due to its efficacy. The global oncology supportive care market's expansion, driven by rising cancer incidences and growing awareness of quality-of-life improvements, directly influences EMEND’s commercial trajectory.

This analysis systematically examines EMEND's market landscape, competitive environment, regulatory considerations, and price projection forecasts, providing actionable insights for industry stakeholders.

Market Landscape for EMEND

Global Market Size and Growth Drivers

The global antiemetic drugs market, within which EMEND occupies a substantial segment, was valued at approximately USD 2.0 billion in 2022, with a projected CAGR of 5–7% over the next five years (Research and Markets, 2022). EMEND’s primary indication—preventing CINV—accounts for a significant share within this niche, particularly in regions with high cancer prevalence.

The key drivers include:

- Rising Cancer Incidence: The International Agency for Research on Cancer (IARC) reports over 19 million new cases globally in 2020, with projections exceeding 30 million annually by 2040 (IARC, 2020).

- Advances in Chemotherapy Protocols: Increased use of highly emetogenic chemotherapy regimens elevates demand for effective prophylactic agents like EMEND.

- Preference for Oral Formulations: EMEND's oral formulation aligns with patient-centered care, promoting compliance and convenience.

- Growing Awareness: Enhanced provider familiarity and updated treatment guidelines (e.g., NCCN, MASCC/ESMO) favor EMEND’s continued adoption.

Competitive Landscape

While EMEND faces competition from other NK1 receptor antagonists such as fosaprepitant and rolapitant, it maintains a competitive advantage owing to:

- Proven efficacy: Established safety and tolerability profile.

- Brand dominance: Market leadership in several regions.

- Extended indications: Beyond CINV, exploring applications in other nausea-related conditions.

Major players include Merck & Co., the original developer, and generic manufacturers entering emerging markets.

Regulatory and Reimbursement Environment

EMEND’s cost-effectiveness is increasingly scrutinized in the context of healthcare budgets. Major markets like the U.S., EU, and Japan have streamlined reimbursement pathways, although price negotiations and formulary placements influence sales volumes. Notably, the entry of generic aprepitant options is exerting downward pressure on pricing, especially in cost-sensitive markets.

Price Trends and Projections

Historical Pricing Overview

Historically, branded EMEND in the U.S. has been priced approximately at USD 300–350 per capsule, with variations based on formulation and pack size. In the EU, prices are comparable, subject to national reimbursement policies.

Generic versions, introduced around 2017–2018, have significantly reduced the market price, with generic capsules trading at USD 50–100, influencing overall market dynamics.

Current Market Dynamics

- Branded EMEND: Maintains premium pricing in developed markets due to brand loyalty and clinical efficacy.

- Generics: Capture a substantial share in emerging markets and price-sensitive regions, exerting downward pressure on overall price levels.

Future Price Projections (2023–2028)

Based on current trends, regulatory developments, and the entry of generics:

- Developed Markets: Branded EMEND prices are expected to decline gradually, averaging USD 250–300 per capsule by 2028 due to increased generic competition and price negotiations.

- Emerging Markets: Prices may stabilize at USD 50–100 per capsule, driven by local procurement and reimbursement frameworks.

The diversion toward combination therapies and biosimilars may further influence pricing strategies. Additionally, patent expirations for the original formulation in some jurisdictions (e.g., U.S. patent expiry in 2024) will catalyze price reductions.

Market Opportunities and Risks

Opportunities

- Expanding Indications: Exploring EMEND's role in chemotherapy-related nausea in non-oncology settings could open new markets.

- Biosimilars and Generics: Entry into emerging markets with affordable options enhances volume sales.

- Innovative Formulations: Development of fixed-dose combinations or injectable forms could secure premium pricing.

Risks

- Patent Expiry and Generic Competition: Accelerates price erosion.

- Pricing Pressures: Managed care and reimbursement policies limit price increases.

- Emerging Alternatives: New antiemetic agents with superior efficacy or safety profiles could displace EMEND.

Strategic Recommendations

- Pricing Strategy: Stakeholders should adopt flexible pricing structures aligned with regional economic contexts, emphasizing value-based pricing where appropriate.

- Market Penetration: Leverage combination therapies and partnering opportunities to expand indications.

- Regulatory Vigilance: Monitor patent statuses and approval pathways for biosimilars/generics to anticipate price shifts.

- Engagement with Payers: Strengthen evidence of cost-effectiveness to negotiate favorable reimbursement terms.

Key Takeaways

- The EMEND market is poised for moderate growth aligned with global cancer care expansion.

- Price pressures from generic competition will lead to declining prices, especially in developed markets.

- Opportunities exist in expanding indications and developing biosimilar formulations.

- Strategic positioning should focus on value demonstration and flexible pricing models.

- Continuous monitoring of regulatory and patent landscapes is essential for accurate forecasting.

FAQs

1. How does EMEND compare to other antiemetics in terms of pricing?

Branded EMEND commands a premium compared to generic alternatives, with prices around USD 300–350 per capsule. Generics typically range from USD 50–100, reflecting significant price disparities driven by formulation and market maturity.

2. What factors are driving EMEND’s market growth?

Rising cancer prevalence, increasing use of highly emetogenic chemotherapy regimens, and guideline endorsements support growth. However, generic competition and pricing pressures temper this expansion.

3. How will patent expirations influence EMEND’s pricing in the next five years?

Patent expiry in key markets (e.g., the U.S. in 2024) will facilitate generic entry, leading to substantial price reductions and potential market share shifts.

4. Are there emerging markets opportunities for EMEND?

Yes. Lower price points and local regulatory approvals enable expanding the reach of generics and biosimilars in Asia, Latin America, and Africa, where oncology supportive care infrastructure is developing.

5. What role do combination therapies play in EMEND’s future?

Fixed-dose combinations with other antiemetics can enhance adherence, improve efficacy, and justify premium pricing, presenting a growth avenue amid price pressures.

References

[1] Research and Markets. (2022). Global Anti-Emetics Market Report.

[2] IARC. (2020). Cancer Facts & Figures 2020.

[3] NCCN Clinical Practice Guidelines in Oncology. (2023). Antiemesis Version 1.2023.

(Note: Data points for the analysis were sourced from publicly available industry reports and clinical guidelines as of early 2023.)

More… ↓