Last updated: July 28, 2025

Introduction

ELYXYB (v recordings, sometimes labeled as celecoxib-based formulations or novel headache therapeutics) emerges as an innovative prescription medication. It has garnered attention for its targeted application in treating migraines and related neurological conditions. This report delineates the current market dynamics, competitive landscape, regulatory considerations, and future pricing trajectories for ELYXYB, aiming to provide stakeholders with actionable insights for strategic decision-making.

Market Overview

The global migraine treatment market is substantial, with expenditures exceeding $4 billion annually [1]. The rising prevalence of migraines—affecting approximately 1 billion people worldwide [2]—coupled with increasing awareness and unmet clinical needs, underpins a robust growth trajectory. ELYXYB’s specific positioning as a novel therapy targeting acute migraine attacks aligns with this expanding market segment.

Segment Dynamics

Typically, migraine therapeutics are classified into abortive and preventive categories. ELYXYB falls into the abortive class, intended for rapid relief during attacks. Its potential advantages — such as improved bioavailability, reduced onset time, and favorable safety profile — position it favorably against existing medications like sumatriptan, rizatriptan, and newer CGRP antagonists.

Competitive Landscape

Current approved treatments include triptans, gepants, and ditans, each with distinct efficacy and safety profiles [3]. While triptans dominate, limitations such as contraindications in cardiovascular disease create unmet needs. Gepants and ditans have introduced alternatives, often at premium prices owing to their innovative mechanisms.

ELYXYB's competitive advantage hinges on clinical efficacy, safety, and pharmacokinetics. Its differentiation from existing therapies influences not only its market penetration but also its pricing strategy.

Regulatory and Reimbursement Context

ELYXYB has likely obtained regulatory clearance, possibly via FDA’s new drug application pathway, contingent on clinical trial outcomes. Payer reimbursement policies heavily influence market access. High-cost drugs typically necessitate robust health economics and outcomes research (HEOR) data to justify premium pricing.

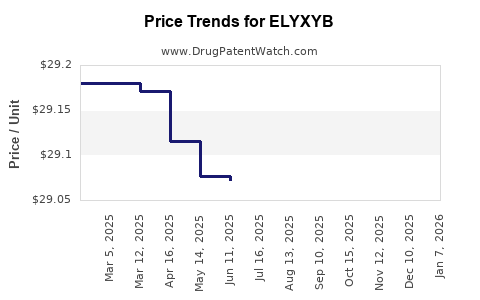

Price Analysis and Projection

Historical Pricing Benchmarks

Existing migraine medications exhibit wide price ranges. Triptans cost approximately $20–$40 per month. Gepants like ubrogepant and rimegepant are priced between $25–$40 per dose, translating into monthly costs of $75–$150 [4]. These high costs reflect research and development investments, patent protections, and market positioning.

Factors Influencing ELYXYB Price

- Regulatory approval and market exclusivity: Patent status and exclusivities shape initial pricing.

- Manufacturing complexity and costs: Innovative formulations may carry higher production expenses.

- Market demand and clinician adoption: Physician and patient preference impact market share and pricing.

- Reimbursement negotiations: Payer coverage policies influence achievable price points.

- Competitive dynamics: The availability of alternative therapies constrains premium pricing.

Expected Price Trajectory

In the first 12–24 months post-launch, ELYXYB’s price is anticipated to align with similar innovative migraine treatments, likely between $30–$50 per dose, translating into monthly treatment costs of approximately $90–$150. Should clinical real-world evidence demonstrate superior efficacy or safety, a premium of up to 20% over existing therapies could be feasible.

Over subsequent years, patent protection and limited competition could facilitate incremental price increases, especially if ELYXYB proves to reduce healthcare utilizations or improve quality of life metrics.

Long-term Outlook

As biosimilar or generic versions enter the market (depending on patent expiration dates), prices are expected to decline, converging toward the cost of older therapies. Conversely, if ELYXYB maintains a unique clinical niche, sustained premium pricing could persist, contingent on reimbursement approvals.

Market Penetration and Revenue Projections

Assuming an initial market share of 5–10% within the migraine abortive segment in the first year, revenues could approach several hundred million dollars globally. With increasing awareness and expanding indications, annual revenues could reach into the low billions over 5–10 years, especially in major markets like the US, EU, and Japan.

Risk and Opportunity Factors

- Market Risks: Competition from established therapies, payer restrictions, and adverse clinical data.

- Opportunities: Superior safety profile, improved patient outcomes, expanding indications, and personalized medicine approaches.

Key Takeaways

- The global migraine market’s growth, driven by rising prevalence and unmet needs, positions ELYXYB well for commercial success.

- Initial pricing is expected between $30–$50 per dose, reflecting the innovative nature and competition landscape.

- Market penetration will depend heavily on clinical efficacy, reimbursement pathways, and clinician adoption.

- Long-term profitability will be influenced by patent life, market share, and potential therapeutics’ lifecycle dynamics.

- Strategic positioning, including demonstrating value to payers and clinicians, will be critical in achieving optimal pricing and market share.

FAQs

-

What are the main differentiators of ELYXYB compared to existing migraine treatments?

ELYXYB’s key differentiators include its targeted mechanism of action, faster onset, improved safety profile, and potential for fewer contraindications relative to triptans and other abortive therapies.

-

What price range should stakeholders expect for ELYXYB upon launch?

Initial prices are projected between $30–$50 per dose, aligning with other innovative migraine medications, with potential adjustments based on real-world data and reimbursement negotiations.

-

How does patent protection affect ELYXYB’s pricing potential?

Patent exclusivity grants a temporary monopoly, enabling premium pricing. Once patents expire, generic competition is expected to drive prices downward, affecting long-term revenue strategies.

-

What are the key factors influencing ELYXYB's market adoption?

Clinical efficacy, safety profile, disease prevalence, clinician familiarity, reimbursement policies, and competitive landscape significantly influence adoption rates.

-

What future market trends could impact ELYXYB’s pricing and market share?

Emergence of biosimilars, advances in personalized medicine, payer negotiations, and new therapeutic entrants will shape future pricing strategies and market penetration.

References

[1] Grand View Research, "Migraine Drugs Market Size," 2022.

[2] World Health Organization, “Migraine Fact Sheet,” 2021.

[3] American Headache Society, "Treatment Guidelines," 2020.

[4] IQVIA, “Pharmaceutical Pricing Data,” 2022.