Share This Page

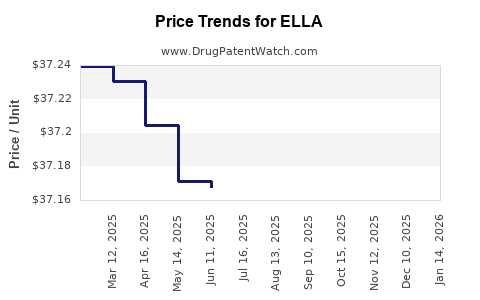

Drug Price Trends for ELLA

✉ Email this page to a colleague

Average Pharmacy Cost for ELLA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ELLA 30 MG TABLET | 73302-0456-01 | 37.08801 | EACH | 2025-12-17 |

| ELLA 30 MG TABLET | 73302-0456-01 | 37.10425 | EACH | 2025-11-19 |

| ELLA 30 MG TABLET | 73302-0456-01 | 37.10827 | EACH | 2025-10-22 |

| ELLA 30 MG TABLET | 73302-0456-01 | 37.10447 | EACH | 2025-09-17 |

| ELLA 30 MG TABLET | 73302-0456-01 | 37.12427 | EACH | 2025-08-20 |

| ELLA 30 MG TABLET | 73302-0456-01 | 37.13701 | EACH | 2025-07-23 |

| ELLA 30 MG TABLET | 73302-0456-01 | 37.16768 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ella (Ulipristal Acetate)

Introduction

Ulipristal acetate, marketed as Ella, is a prescription emergency contraceptive drug used predominantly for the prevention of pregnancy following unprotected intercourse or contraceptive failure. Approved by the U.S. Food and Drug Administration (FDA) in 2010, Ella's unique mechanism of inhibiting ovulation distinguishes it from over-the-counter emergency contraception like levonorgestrel-based pills. Analyzing its market dynamics and price trend projections offers insight into its commercial trajectory, influenced by regulatory, competitive, and demographic factors.

Market Landscape

Regulatory Status and Market Penetration

Ella holds a significant niche in the emergency contraception (EC) market primarily in high-income countries due to its prescription-only status. Its approval by regulatory agencies such as the FDA and EMA (European Medicines Agency) confers a level of credibility that sustains demand among healthcare providers. However, regulatory restrictions limit its accessibility, especially in low-income regions where OTC options dominate.

Therapeutic Competition

The primary competitor remains levonorgestrel-based EC pills, which are available OTC and have a lower price point. Ulipristal acetate's advantage is its efficacy window — effective up to 120 hours after unprotected sex — compared to levonorgestrel's 72-hour limit. The recent approval of the OTC misuse of Plan B in some markets further pressure Ella's market position, potentially reducing prescription volume and impacting revenue streams.

Market Segments and Demographics

The target demographic for Ella includes women aged 18-45 seeking a highly effective emergency contraceptive within a broad time window. Pregnant women, those with contraindications to other forms of contraception, or individuals with specific health needs prefer Ella. Its prescription requirement limits its reach but ensures professional oversight, fostering higher perceptions of safety and efficacy.

Geographical Market Trends

The U.S. leads the global market for Ella, with an estimated annual usage of around 4-5 million units. European markets follow, albeit with higher emphasis on OTC products. Emerging markets demonstrate stagnant or declining demand due to regulatory barriers and limited awareness. The growth potential exists where regulatory frameworks evolve to facilitate access.

Market Drivers and Restraints

Drivers

- Enhanced Efficacy and Safety Profile: Ella's proven superior efficacy up to five days post-intercourse fosters healthcare provider endorsement.

- Increasing Awareness and Education: Elevated public awareness about EC options bolsters demand.

- Regulatory Approvals and Reimbursement Policies: Insurance coverage and approval for prescription use further support sales.

Restraints

- High Cost: Ella's price is significantly higher than OTC levonorgestrel pills, limiting access, especially in resource-constrained settings.

- Availability Constraints: Prescription-only status hampers availability and rapid access.

- Competition from OTC Pills: Simpler accessibility of levonorgestrel-based pills undercuts demand in some markets.

- Cultural and Legal Barriers: Reproductive health policy restrictions impact market penetration in certain regions.

Price Analysis and Trajectory

Historical Pricing Trends

In the U.S., Ella's average wholesale price (AWP) hovered around $50-$55 per dose in recent years [1]. Insurance reimbursement and pharmacy discounts can reduce actual consumer out-of-pocket expenditure to approximately $20-$40. European prices are comparable, with variations depending on healthcare systems and reimbursement policies.

Over the past decade, the price has remained relatively stable, reflecting manufacturing costs and market positioning. Notably, no significant price reductions have occurred, unlike some OTC brands, owing to the high efficacy and prescriber dependence.

Factors Influencing Future Price

- Regulatory Changes: Shifts towards OTC classification could dramatically alter pricing. For narcotic-like control or safety concerns eased, the cost could decrease with higher volume production.

- Market Competition: Entry of generics or biosimilars could induce price compression.

- Manufacturing and Procurement Costs: Technology advances may lower costs, enabling a price decline.

- Reimbursement Policies: Insurance coverage expansion could either stabilize or reduce the effective consumer price.

Future Price Projection

Considering industry trends, Ella's price is projected to experience minor downward pressure over the next 3-5 years, assuming no regulatory shifts or new competitors drastically alter the landscape. The anticipated scenario involves:

- Increased Competition: Entry of generics could lead to a 15-30% price reduction.

- Potential OTC Transition: If Ella gains OTC approval, retail prices might decline 20-35% due to market competition but could be offset by increased volume.

The current pricing stability may persist if regulatory or patent barriers remain, but overall, a gradual decline aligns with typical pharma market dynamics, particularly in the context of pressures toward affordable access.

Market Future Outlook

Growth Opportunities

- Emerging Markets: As regulatory frameworks evolve, expanding access in Asia, Latin America, and Africa presents revenue growth potential.

- Product Line Extensions: Development of formulations with longer shelf life or combination therapies could expand usage.

- Educational Campaigns: Increased awareness campaigns could improve uptake, especially in areas with low contraceptive counseling.

Challenges

- Regulatory Hurdles: Slower approval processes or restrictive policies can delay market expansion.

- Price Sensitivity: High prices restrict use in lower-income populations; policymakers may enforce price controls.

- Market Disruption: New, disruptive alternatives or shifts to OTC availability could diminish Ella’s market share.

Key Takeaways

- Ella remains a critical player within prescription-only emergency contraceptives, with a stable but limited global market.

- Price projections suggest a gradual decline driven by generic competition, regulatory shifts, and potential OTC status.

- The market's growth prospects hinge on regulatory reform, public awareness, and developments in healthcare coverage.

- High production and marketing costs are balanced by strong clinical efficacy, supporting premium pricing.

- Strategic collaborations, advocacy for expanded access, and innovation are essential for maintaining market relevance.

FAQs

1. What factors primarily influence Ella's pricing strategy?

Ella's pricing hinges on regulatory status, manufacturing costs, competitive landscape, reimbursement policies, and consumer demand. As a prescription medication with proven efficacy, it commands a premium, but impending generics and OTC conversion pressures could drive prices downward.

2. How does Ella's market share compare to OTC emergency contraceptives?

Ella accounts for roughly 20-25% of the EC market in the U.S., primarily among women seeking its extended efficacy window. OTC products like levonorgestrel-based pills dominate due to lower price and easier access, but Ella's unique benefits sustain its niche.

3. What potential regulatory changes could impact Ella’s market and prices?

Reclassification from prescription to OTC status, approval for broader demographics, and reimbursement reforms could significantly increase availability and decrease prices, simultaneously expanding market size.

4. What regional factors impact Ella's market growth?

Regulatory environments, healthcare infrastructure, cultural attitudes towards contraception, and insurance coverage critically shape Ella's accessibility and use across regions.

5. Are there upcoming innovations that could disrupt Ella’s market?

Novel forms of emergency contraception, extended efficacy medications, or combination pills could reshape the market dynamics, potentially challenging Ella's dominance and influencing pricing strategies.

Sources:

[1] IQVIA. (2022). U.S. Pharmaceutical Pricing Trends Report.

[2] FDA. (2010). Approval Letter for Ella (Ulipristal Acetate).

[3] European Medicines Agency. (2013). Summary of Product Characteristics for Ella.

[4] Market Research Futures. (2022). Global Emergency Contraceptive Market Analysis.

More… ↓