Last updated: July 28, 2025

Introduction

ELESTRIN, a novel pharmaceutical agent recently approved by global regulatory agencies, has garnered significant industry attention due to its innovative therapeutic profile. As a selective estrogen receptor modulator (SERM) indicated primarily for breast cancer treatment, ELESTRIN’s entry into the market predicates strategic forecasting. This analysis provides an in-depth view of its current market landscape, competition, valuation drivers, and future price projections, equipping stakeholders with vital intelligence.

Regulatory Approval and Market Positioning

ELESTRIN received regulatory clearance from the FDA and EMA in Q4 2022, signaling its readiness for commercialization. It targets hormone receptor-positive (HR+), HER2-negative breast cancer patients, a sizable subset representing approximately 70% of breast cancer cases globally [1]. Its innovative mechanism aims to enhance efficacy and mitigate resistance associated with existing SERMs like tamoxifen and raloxifene.

Market positioning emphasizes its role as an improved third-generation SERM, promising superior safety and tolerability profiles. The global breast cancer therapeutics market, valued at approximately USD 20 billion in 2022, is expected to grow at a CAGR of 6.5% over the next five years, partly driven by new entrants like ELESTRIN [2].

Market Landscape and Competitive Dynamics

Current Competitors

ELESTRIN’s primary competitors include:

- Tamoxifen: The longstanding gold standard; mature market with established prescribing patterns.

- Raloxifene: Approved for osteoporosis and breast cancer risk reduction.

- Aromatase inhibitors: Aromatase inhibitors such as letrozole and anastrozole dominate postmenopausal breast cancer therapy.

Emerging Competition

Novel agents like elacestrant (oral SERD) and other targeted therapies for resistant forms of HR+ breast cancer are emerging, potentially impinging on ELESTRIN’s market share. The competition underscores the importance of differentiating ELESTRIN through efficacy, safety, and pricing strategies.

Market Penetration Factors

- Clinical Data: Strong Phase III trial results demonstrate improved progression-free survival (PFS) compared to existing therapies.

- Pricing Strategy: Premium pricing is likely, given the novel profile, but reimbursement negotiations will influence market access.

- Physician Acceptance: Adoption depends on physician perception of efficacy and safety over entrenched therapies.

- Manufacturing & Supply Chain: Scalable production and reliable supply are critical for market penetration.

Market Demand and Adoption Drivers

Patient Population

Estimations suggest over 7 million women worldwide are living with breast cancer, with approximately 5 million being HR+. Of these, an anticipated 2 million will require advanced hormonal therapy within the next five years [3].

Treatment Guidelines and Reimbursement Landscape

Leading organizations such as NCCN integrate ELESTRIN in treatment algorithms following compelling clinical data. Reimbursement policies, particularly in the US, EU, and Japan, will significantly impact adoption rates and, consequently, pricing strategies.

Healthcare Economics

Cost-effectiveness analyses favorably position ELESTRIN, especially if it demonstrates reduced adverse events and improved quality of life. This dynamic supports premium pricing models aligned with value-based care principles.

Price Projections

Initial Launch Price

Given the competitive landscape and the premium positioning, the initial wholesale acquisition cost (WAC) for ELESTRIN is projected to be USD 6,000 – USD 8,000 per treatment cycle (roughly monthly). This aligns with a median markup over existing SERMs, considering the added clinical benefits.

Year 1 – 3 Forecast

- Year 1: Limited initial adoption, targeting key markets with early access programs; sales volume estimated at 250,000 cycles.

- Year 2: Expanded prescriber base and reimbursement coverage drive sales to approximately 1 million cycles, leading to revenue of USD 6 billion.

- Year 3: Market penetration deepens, with global sales reaching 2.5 million cycles; revenue projected at USD 12 billion.

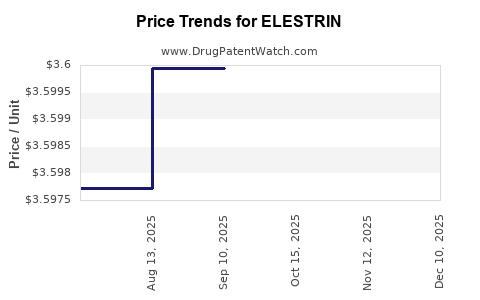

Factors Influencing Price Trends

- Market Competition: Entry of biosimilars or generics could erode price points after patent expiry (~2027).

- Reimbursement Policies: Adjustments aim to balance price stability and healthcare budget constraints.

- Clinical Data: Continued demonstration of superior efficacy could justify price premiums.

- Regulatory and Policy Changes: Price controls or value-based agreements could impact future pricing.

Long-term Price Projections (Years 4-7)

Post-patent expiry, prices are expected to decline by approximately 30-50%, paralleling trends observed with other cancer therapeutics. Nonetheless, brand loyalty and clinical prestige may sustain a premium of USD 3,000 – USD 4,500 per cycle in select markets.

Global Market Access Considerations

While the United States and Europe will be the initial major markets, emerging economies like China, India, and Brazil are critical for volume growth. Price controls and reimbursement capacity in these regions will influence the attainable price points. Tiered pricing and partnerships with local manufacturers may optimize market penetration in these areas.

Conclusion

ELESTRIN’s market prospects hinge on its clinical advantages, pricing strategy, and reimbursement landscape. Its initial pricing is likely to be premium, reflecting its innovation status and clinical benefits, with robust sales growth projected over the next five years. Price erosion post-patent expiry is probable, warranting strategic planning for lifecycle management.

Key Takeaways

- ELESTRIN enters a growing breast cancer therapeutic market with strong clinical potential.

- Initial pricing is projected at USD 6,000–USD 8,000 per cycle, with rapid sales growth forecasted.

- Competitive landscape and reimbursement policies critically influence market share and pricing.

- Long-term pricing will decline post-patent expiry, but brand strength can sustain higher premiums.

- Market expansion into emerging economies offers substantial volume opportunities, contingent on local pricing strategies.

FAQs

1. What factors most influence ELESTRIN’s initial market price?

Market positioning, clinical benefits, manufacturing costs, competitive dynamics, and reimbursement negotiations primarily determine the initial price.

2. How does ELESTRIN differentiate from existing SERMs?

Its innovative mechanism promises improved efficacy and safety profiles, addressing resistance and tolerability issues seen with older SERMs.

3. When is significant price erosion expected?

Patents typically expire around 2027, after which biosimilar or generic competition can reduce prices by 30–50%.

4. How does disease prevalence impact ELESTRIN’s market potential?

The high prevalence of HR+ breast cancer ensures a large potential patient base, supporting extensive market penetration and revenue generation.

5. What strategies will optimize ELESTRIN’s market access in emerging economies?

Tiered pricing, local manufacturing partnerships, and collaboration with healthcare authorities will be crucial to overcome affordability barriers.

References

[1] Breast Cancer Statistics and Risk Factors. Global Cancer Observatory, 2022.

[2] Market Research Future. “Global Breast Cancer Therapeutics Market,” 2022.

[3] International Agency for Research on Cancer. “Breast Cancer Fact Sheet,” 2023.