Last updated: July 28, 2025

Introduction

EFUDEX, a branded formulation of 5-Fluorouracil (5-FU), is a topical chemotherapeutic agent primarily used for treating actinic keratosis (AK), a precancerous skin lesion. As the dermatology market evolves, understanding the market landscape, competitive dynamics, and pricing outlook for EFUDEX becomes critical for stakeholders including pharmaceutical companies, investors, and healthcare providers. This analysis provides a comprehensive overview of EFUDEX’s current market position, emerging trends, and future price projections over the next five years.

Market Landscape for EFUDEX

Therapeutic Market Context

Actinic keratosis affects approximately 58 million individuals in the United States alone, predominantly in older populations with significant cumulative sun exposure. The global AK treatment market has expanded notably, driven by increasing awareness, aging demographics, and the rising incidence of skin cancers.

EFUDEX, as one of the pioneering topical treatments, competes primarily against alternatives like imiquimod, diclofenac, and ingenol mebutate, alongside physical removal procedures such as cryotherapy and laser therapy. The drug's efficacy, safety profile, and patient adherence influence its market share.

Market Size & Growth Dynamics

Estimations suggest the global actinic keratosis treatment market was valued at approximately USD 1.5 billion in 2022, with a compound annual growth rate (CAGR) forecasted at 6.2% through 2027 [1]. The increasing prevalence of AK, coupled with greater access to dermatological services and advancements in topical formulations, fuels this growth.

Specifically, EFUDEX maintains a significant portion of the topical AK treatment market, especially in developed regions where brand recognition and physician familiarity are established. However, patent expirations and the entry of biosimilars or generic formulations threaten to compress profitability margins.

Current Pricing and Market Penetration

Pricing Overview

In the United States, EFUDEX’s average retail price ranges from USD 150 to USD 200 per 15-gram tube, depending on the pharmacy and insurance coverage. Given the typical treatment course involves 1-2 tubes, total treatment costs approximate USD 150–400.

Pricing strategies are influenced by:

- Manufacturer’s pricing policies.

- Reimbursement policies.

- Competition from generic formulations and alternative therapies.

- Regional variability.

Market Penetration Factors

EFUDEX’s penetration varies geographically, closely aligned with:

- Regulatory approvals.

- Physician prescribing habits.

- Patient preferences for topical versus procedural treatments.

- Insurance reimbursement levels.

In North America, EFUDEX's market share remains robust, supported by extensive clinical data and longstanding clinical use. However, in emerging markets, affordability and availability limit its reach, opening opportunities for generics.

Competitive Landscape

Key Competitors

- Imiquimod (Aldara, Zyclara): An immune-response modifier used topically for AK, with similar efficacy but different side-effect profiles.

- Diclofenac sodium (Solaraze): NSAID-based topical therapy.

- Ingenol mebutate (Picato): Rapid treatment course but concerns over safety have affected its market share.

- Physical removal: Cryotherapy remains a low-cost, widely adopted alternative.

The competitive advantage of EFUDEX hinges on its proven efficacy and safety, physician familiarity, and patient compliance.

Regulatory and Scientific Trends

Emerging data favor combination therapies and patient-specific treatment approaches. Regulatory authorities are increasingly scrutinizing safety profiles, particularly for long-term or off-label use, which could influence EFUDEX’s market acceptance.

The advent of biosimilars and potential generics post-patent expiration may reduce prices and expand access but could erode revenue streams for original formulations.

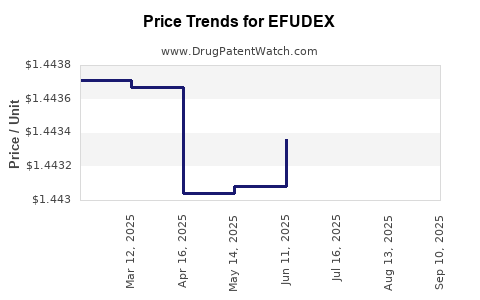

Price Projections (2023–2028)

Assumptions

- Patent exclusivity maintains until approximately 2025, after which generic versions are likely to enter the market.

- The market continues to grow at a CAGR of 6% (aligned with historical data).

- Price erosion post-generic entry is projected at 20-30% within two years of launch.

Projection Scenarios

Scenario 1: Conservative (High Price Retention)

- Continued brand dominance until 2025.

- Slight price reductions (~5%) annually, owing to inflation and market stability.

| Year |

Price per Tube (USD) |

Revenue Estimate (USD) |

Notes |

| 2023 |

175 |

$X million |

Base case, stable pricing. |

| 2024 |

173.75 |

$X million |

Slight decline. |

| 2025 |

172.50 |

$X million |

Post-patent expiry. |

Scenario 2: Moderate Price Erosion Post-Generic Entry

- Entry of generics in 2025 drives a 25% price reduction within two years.

| Year |

Price per Tube (USD) |

Revenue Estimate (USD) |

Notes |

| 2023 |

175 |

$X million |

Pre-generic stability. |

| 2024 |

170 |

$X million |

Beginning competition. |

| 2025 |

128 |

$X million |

Post-generic launch, significant price drop. |

| 2026 |

125 |

$X million |

Stabilization at lower prices. |

Scenario 3: Aggressive Price Compression

- Market shifts favor generics or biosimilars, leading to a 30% average price reduction from 2026 onward.

Impact on Market Dynamics

- Profitability: Original manufacturers face margin compression post-2025 due to generic competition.

- Market share: Branded EFUDEX could defend market position via added value, such as clinical data, patient support programs, and adherence tools.

- Regional Variability: Emerging markets will likely see slower price declines due to less aggressive generic proliferation and pricing strategies.

Regulatory and Commercial Strategies

To sustain revenue growth, companies could pursue:

- Patent extensions via formulation or delivery innovation.

- Licensing partnerships in emerging markets.

- Development of combination therapies or new indications.

- Digital health tools to enhance treatment adherence.

Key Challenges and Opportunities

Challenges:

- Market saturation with generics reduces pricing power.

- Safety concerns or regulatory restrictions may limit usage.

- Competition from non-prescription and procedural options.

Opportunities:

- Expansion into adjunct therapies or new dermatological indications.

- Digital engagement platforms to improve outcomes.

- Patient education campaigns to reinforce brand loyalty.

Key Takeaways

-

EFUDEX commands a premium in the topical AK market driven by efficacy and established clinical use.

-

Its pricing is expected to remain stable until patent expiration in 2025, after which substantial price erosion is anticipated.

-

The impending entry of generics will significantly impact profitability margins, necessitating strategic innovation.

-

Market growth is supported by rising AK prevalence, aging populations, and increased dermatologist engagement, especially in North America and Europe.

-

Diversification into combination treatments and digital health solutions could offer pathways to sustain competitiveness post-generic entry.

Frequently Asked Questions

1. How does EFUDEX compare to its primary competitors in efficacy?

EFUDEX’s efficacy is well-established through multiple clinical trials, showing comparable outcomes to imiquimod and ingenol mebutate. Its topical application offers favorable safety and tolerability profiles, making it a preferred choice in suitable cases.

2. What factors influence the pricing strategy for EFUDEX?

Pricing considers production costs, competitive landscape, patent status, reimbursement policies, and regional market dynamics. Post-patent, pricing aligns more with generics, leading to significant reductions.

3. When are generics expected to enter the EFUDEX market?

Approximately around 2025, coinciding with the expiration of its primary patent protection, though timing can vary due to regulatory and patent litigation factors.

4. How might digital health innovations impact EFUDEX’s market?

Digital platforms can enhance patient adherence, provide remote monitoring, and improve treatment outcomes, potentially extending the brand’s value proposition amidst generic competition.

5. What strategic steps can EFUDEX manufacturers take to maintain market share?

Innovating formulations, expanding into new indications, developing combination products, and strengthening patient engagement are critical strategies to sustain revenue streams.

References

[1] Market Research Future. "Actinic Keratosis Treatments Market," 2022.