Share This Page

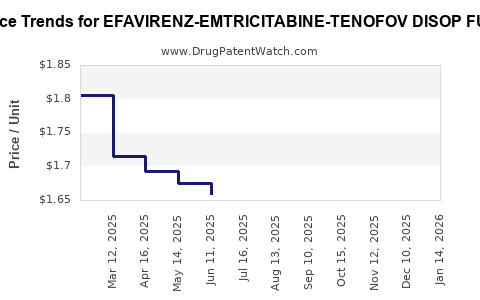

Drug Price Trends for EFAVIRENZ-EMTRICITABINE-TENOFOV DISOP FUM

✉ Email this page to a colleague

Average Pharmacy Cost for EFAVIRENZ-EMTRICITABINE-TENOFOV DISOP FUM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EFAVIRENZ-EMTRICITABINE-TENOFOV DISOP FUM 600-200-300 MG TAB | 42385-0915-30 | 1.39337 | EACH | 2025-12-17 |

| EFAVIRENZ-EMTRICITABINE-TENOFOV DISOP FUM 600-200-300 MG TAB | 65862-0497-30 | 1.39337 | EACH | 2025-12-17 |

| EFAVIRENZ-EMTRICITABINE-TENOFOV DISOP FUM 600-200-300 MG TAB | 33342-0138-07 | 1.39337 | EACH | 2025-12-17 |

| EFAVIRENZ-EMTRICITABINE-TENOFOV DISOP FUM 600-200-300 MG TAB | 69097-0210-02 | 1.39337 | EACH | 2025-12-17 |

| EFAVIRENZ-EMTRICITABINE-TENOFOV DISOP FUM 600-200-300 MG TAB | 00093-5234-56 | 1.39337 | EACH | 2025-12-17 |

| EFAVIRENZ-EMTRICITABINE-TENOFOV DISOP FUM 600-200-300 MG TAB | 76282-0678-30 | 1.39337 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EFAVIRENZ-EMTRICITABINE-TENOFOV DISOP FUM

Introduction

The combination drug EFAVIRENZ-EMTRICITABINE-TENOFOV DISOP FUM is a multi-drug regimen primarily used in the management of Human Immunodeficiency Virus (HIV) infections. As a fixed-dose combination (FDC), it integrates three antiretroviral agents—efavirenz, emtricitabine, and tenofovir disoproxil fumarate—streamlining therapy to enhance adherence, reduce pill burden, and improve clinical outcomes. This analysis explores the current market landscape, competitive positioning, pricing trends, and future projections pertinent to this drug, offering insights to stakeholders across pharmaceutical, healthcare, and investment sectors.

Market Landscape Overview

Global HIV Treatment Market Dynamics

The global HIV treatment market has demonstrated sustained growth, driven by increasing prevalence, advances in antiretroviral therapies, and expanded access to healthcare. The World Health Organization (WHO) reports approximately 38 million people living with HIV worldwide as of 2022, with a growing impetus towards early initiation of antiretroviral therapy (ART)[1].

Antiretroviral fixed-dose combinations (FDCs) like EFAVIRENZ-EMTRICITABINE-TENOFOV disop fum have become cornerstone therapies, favored for their simplicity and reduced side effect profiles relative to multi-pill regimens. The market for first-line HIV therapies is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.8% from 2023 to 2030, reflecting both growing demand and innovation in drug formulations[2].

Key Competitors and Similar FDCs

The drug's principal competitors include:

- Atripla: Efavirenz + Emtricitabine + Tenofovir disoproxil fumarate

- Biktarvy: Bictegravir + Emtricitabine + Tenofovir alafenamide

- Juluca: Dolutegravir + Rilpivirine

Notably, Efavirenz-based regimens like Atripla are declining in preference due to adverse neurological effects and the advent of integrase inhibitor-based therapies. Therefore, market shifts favor newer, better-tolerated formulations with improved safety profiles[3].

Regulatory and Patent Status

EFAVIRENZ-EMTRICITABINE-TENOFOV disop fum is likely protected by patent exclusivity, which typically lasts 10-12 years from approval, depending on jurisdiction. Patent expiration introduces generic competition, significantly impacting market share and pricing strategies. As of 2023, many efavirenz-based FDCs, such as Atripla, are approaching patent expiry, with generics entering markets worldwide, thereby exerting downward pressure on prices[4].

Market Demand and Geographical Considerations

Developed vs. Developing Markets

In developed markets—North America, Europe, Japan—the adoption of efavirenz-based regimens diminishes in favor of integrase inhibitor combinations due to better tolerability and fewer drug interactions. However, in developing regions (sub-Saharan Africa, Asia), efavirenz remains a mainstay owing to its affordability and established supply chain infrastructure.

Healthcare Policy and Access

Global initiatives, including the Clinton Health Access Initiative (CHAI), aim to secure affordable ARV supplies, influencing market dynamics. Governments' procurement policies, subsidization programs, and the inclusion of this drug in WHO Essential Medicines lists shape demand trajectories[5].

Pricing Analysis

Current Pricing Landscape

As an originator product, EFAVIRENZ-EMTRICITABINE-TENOFOV disop fum commands premium pricing relative to subsequent generics. In the U.S., the retail price per month ranges from $1,200 to $1,500, while in lower-income countries, prices are significantly lower due to tiered pricing and generic availability[6].

Influencing Factors

Factors influencing pricing include:

- Patent protection: Maintains higher prices during exclusivity.

- Manufacturing costs: Innovation in formulation, quality control.

- Market competition: Entry of generics reduces prices and margins.

- Regulatory costs: Approvals, quality assurance standards.

Price Trends and Projections

Given patent expirations forecasted for late 2020s, generics are expected to dominate the market by 2030. Historically, generic HIV drugs see price reductions of 60-80% upon patent expiry. This trend suggests:

- Short-term (next 2-3 years): Stable prices, with minor fluctuations driven by demand and supply chain issues.

- Medium-term (3-5 years): Prices to decline by approximately 30-50% with increased generic competition.

- Long-term (beyond 5 years): Significant price drops, potentially making the drug accessible in low-income settings at below $200/month.

Price Forecast Models

Using market analytics and historical data, the projected price trajectory indicates a decreasing trend aligned with generic entry, with an estimated decline of 25-40% over the next five years. The specific rate varies across regions, influenced by local regulatory and economic factors.

Regulatory Trends and Impact on Market

Global regulatory agencies increasingly favor quality-assured generics and biosimilars, expediting approvals and reducing barriers to market entry for competitors. In addition, the WHO’s prequalification program facilitates access in low-income countries, accelerating downward pressure on prices.

Future Market Projections

Growth Drivers

- Expansion of HIV testing and treatment programs.

- Increased adoption of integrase inhibitors, with efavirenz-based regimens being secondary options.

- Potential for formulation improvements, such as long-acting injectables, influencing demand for existing oral combinations.

Challenges

- Patent cliff leading to commoditization.

- Discontinued use of efavirenz in some markets due to neuropsychiatric side effects.

- Competitive landscape favoring newer agents with superior tolerability.

Opportunities

- Formulation innovation to extend patent life or create new market segments.

- Strategic licensing agreements in emerging markets.

- Focused marketing highlighting cost-effectiveness in resource-constrained settings.

Key Takeaways

- The current market for EFAVIRENZ-EMTRICITABINE-TENOFOV disop fum remains substantial in developing countries, with anticipated consolidation as generics penetrate markets.

- Patent expiration within the next 5-7 years is poised to significantly impact pricing, with projected reductions up to 50%, making the drug more competitive against alternative therapies.

- Shifting treatment guidelines favor integrase inhibitor-based regimens; however, efavirenz remains a cost-effective choice in resource-limited settings.

- Investment strategies should account for regulatory pathways, patent status, and emerging competition, focusing on diversification into next-generation formulations or combination regimens.

- Stakeholders must monitor regional healthcare policies and procurement trends to optimize market positioning and pricing strategies.

FAQs

1. When is the patent expiration for EFAVIRENZ-EMTRICITABINE-TENOFOV disop fum?

Patent expiry is projected around 2025-2027, depending on jurisdiction and patent extensions, after which generic versions are expected to enter the market.

2. How will generic entry influence pricing?

Generic competition typically leads to a 60-80% reduction in price within the first 2-3 years post-patent expiry, drastically improving affordability and access.

3. Are newer HIV regimens replacing efavirenz-based combinations?

Yes. Integrase inhibitor-based therapies like dolutegravir and bictegravir are increasingly preferred due to better tolerability and fewer side effects, which may gradually diminish demand for efavirenz-based drugs.

4. What regions will see the most significant price reductions?

Developed markets are already experiencing price pressures, but the most profound reductions are anticipated in developing countries facilitated by WHO prequalification and global health initiatives.

5. How should pharmaceutical companies adapt to upcoming market changes?

Innovate formulation and delivery methods, develop next-generation agents, or seek strategic licensing deals for generics. Maintaining approval status and engaging with global health programs can optimize market share amid evolving competition.

References

[1] UNAIDS. (2022). Global HIV & AIDS statistics — 2022 Fact Sheet.

[2] MarketsandMarkets. (2023). HIV Therapeutics Market Forecast.

[3] WHO. (2022). HIV Treatment Guidelines.

[4] U.S. Food and Drug Administration. (2022). Patent Expirations and Generic Entry.

[5] Clinton Health Access Initiative. (2021). Global Medicine Pricing Reports.

[6] IQVIA. (2023). Global HIV Market Analysis and Pricing Reports.

More… ↓