Share This Page

Drug Price Trends for EC-NAPROXEN DR

✉ Email this page to a colleague

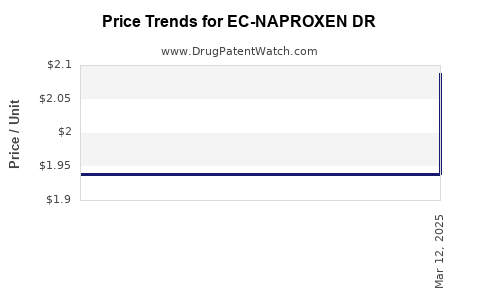

Average Pharmacy Cost for EC-NAPROXEN DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EC-NAPROXEN DR 500 MG TABLET | 69784-0500-01 | 2.08869 | EACH | 2025-03-19 |

| EC-NAPROXEN DR 500 MG TABLET | 69784-0500-01 | 1.93800 | EACH | 2025-02-19 |

| EC-NAPROXEN DR 500 MG TABLET | 69784-0500-01 | 1.74595 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for EC-NAPROXEN DR

Introduction

EC-Naproxen DR (Extended Release Naproxen) is a significant addition to the non-steroidal anti-inflammatory drug (NSAID) segment, primarily used for managing pain, inflammation, and arthritis. Its unique extended-release formulation offers a sustained therapeutic effect, improving patient compliance and reducing dosing frequency. Given its therapeutic importance and market potential, understanding its market landscape, competitive positioning, regulatory environment, and projected pricing trajectory is crucial for stakeholders.

This report delivers an in-depth market analysis and future price projections for EC-Naproxen DR, appealing to pharmaceutical companies, investors, and healthcare policymakers.

Market Overview

Therapeutic Demand and Epidemiology

NSAIDs stand as one of the largest drug categories globally, driven by the high prevalence of arthritis, musculoskeletal disorders, and chronic pain conditions. According to the Global Burden of Disease Study, over 250 million individuals worldwide suffer from osteoarthritis alone, reflecting a substantial and growing market for NSAID treatments.[1]

Extended-release formulations like EC-Naproxen DR are particularly attractive for chronic conditions requiring sustained medication levels, reducing gastrointestinal side effects often associated with traditional NSAIDs and improving patient adherence.

Competitive Landscape

EC-Naproxen DR faces competition from existing formulations:

- Immediate-release Naproxen: Widely prescribed but requires multiple doses daily.

- Enteric-coated formulations: Reduce gastrointestinal irritation but lack extended-release benefits.

- Other NSAID extended-release drugs: Including formulations like Diclofenac ER and ibuprofen ER.

Key players in this segment include Pfizer, Bayer, and Teva, with several generic manufacturers preparing to enter the market upon patent expiry or approval.

Regulatory Environment

The regulatory pathways for EC-Naproxen DR depend on regional jurisdictions:

- United States: The FDA reviews new drug applications (NDAs) emphasizing safety, efficacy, and manufacturing quality. An existing approved Naproxen generic accelerates market entry if the formulation qualifies under NDA.

- European Union: The EMA evaluates similar parameters, focusing on extended-release benefits and gastrointestinal safety improvements.

- Emerging Markets: Regulatory procedures vary, often streamlined for formulations demonstrating clear benefits over existing therapies.

Patent protection and exclusivity periods will significantly influence initial market penetration and pricing strategies.

Market Penetration and Adoption Drivers

- Clinical Evidence: Robust trials demonstrating improved gastrointestinal safety, sustained pain relief, and enhanced compliance bolster adoption.

- Physician Acceptance: Prescriber familiarity with NSAIDs, especially NSAID's safety profile, influences uptake.

- Patient Preference: Reduced dosing frequency enhances adherence, especially valuable in elderly populations.

- Insurance Coverage: Reimbursement policies and formulary decisions directly impact market penetration.

Pricing Dynamics and Projections

Current Pricing Landscape

As of 2023, generic Naproxen tablets typically retail between $0.05 to $0.15 per tablet, with branded formulations commanding higher prices—up to $0.50 per tablet.[2] Extended-release formulations generally carry a premium due to formulation complexity and added benefits.

Factors Influencing Future Prices

- Patent and Exclusivity Periods: Market exclusivity can sustain premium prices for 5-7 years. Once expired, price competition from generics can reduce costs by 50-70%.

- Manufacturing Costs: Complex formulations like EC-Naproxen DR require advanced manufacturing, influencing initial price points.

- Market Competition: Entry of generics post-patent expiry will typically halve the price, driving affordability and market share.

- Regulatory and Reimbursement Policies: Favorable policies can support higher prices initially, especially if clinical data demonstrates superior safety and compliance.

Price Projection Timeline

| Timeframe | Estimated Price Range | Key Drivers |

|---|---|---|

| Years 1-2 | $2.00 - $3.00 per dose | Patent exclusivity, brand positioning, clinical data support |

| Years 3-5 | $1.50 - $2.50 per dose | Growing competition, payer negotiations |

| Post-Patent Expiry (Year 6+) | $0.50 - $1.00 per dose | Generic manufacturing, economies of scale |

Note: These projections reflect per-dose prices for a typical 24-hour extended-release dose.

Sensitivity Analysis

Changes in regulatory approvals, clinical trial outcomes, or unforeseen manufacturing challenges can alter price trajectories. A successful launch aligned with strong clinical efficacy and safety data supports premium pricing, while market saturation and aggressive generic entry pressure prices downward.

Market Opportunities and Challenges

Opportunities

- Chronic Disease Management: Increasing prevalence of arthritis and musculoskeletal conditions expands the patient pool.

- Gastrointestinal Safety Profile: Demonstrable safety enhancements can justify premium pricing.

- Global Expansion: Emerging markets with rising healthcare accessibility offer growth avenues.

Challenges

- Price Compression Post-Patent Expiry: Risk of rapid price decline once generics enter.

- Regulatory Hurdles: Higher safety or efficacy bench-marks required for approval in certain regions.

- Market Penetration: Existing entrenched competition and physician prescribing habits.

Strategic Recommendations

- Clinical Differentiation: Invest in robust clinical trials highlighting safety, efficacy, and adherence benefits.

- Partnerships: Collaborate with payers and distributors early to secure formulary inclusion.

- Pricing Strategy: Establish a premium initial price reflective of added benefits, with plans for gradual reduction post-patent expiry.

- Regulatory Engagement: Engage proactively with regulatory authorities to streamline approval pathways.

Conclusion

EC-Naproxen DR embodies a promising NSAID innovation situated within a high-demand therapeutic segment. Its extended-release formulation offers clinical advantages that, if substantiated through comprehensive data, can command premium prices initially. Strategic market positioning, combined with early regulatory engagement and meticulous pricing policies, can optimize its market potential. Post-patent eras will require agility in pricing to maintain competitiveness amid growing generic pressure.

Key Takeaways

- EC-Naproxen DR targets a substantial, growing market with significant unmet needs for sustained NSAID therapy.

- Clinical benefits related to gastrointestinal safety and adherence are central to differentiation and premium pricing.

- Initial prices are projected at $2.00 - $3.00 per dose, decreasing post-patent expiry as generics proliferate.

- Market success hinges on clear clinical differentiation, strategic alliances, and adaptable pricing strategies.

- Ongoing monitoring of regulatory landscapes and competitor activities will be essential for sustained positioning.

FAQs

Q1: What are the primary advantages of EC-Naproxen DR over traditional Naproxen?

A: EC-Naproxen DR offers sustained, consistent therapeutic levels, reducing dosing frequency, improving adherence, and potentially lowering gastrointestinal side effects compared to immediate-release formulations.

Q2: How does patent protection influence EC-Naproxen DR’s pricing?

A: Patent protection allows for market exclusivity, enabling the manufacturer to set higher prices initially. Once patents expire, generic competitors enter, driving prices down significantly.

Q3: What factors could accelerate or hinder market adoption of EC-Naproxen DR?

A: Factors such as strong clinical trial results, physician acceptance, reimbursement policies, and comparable safety profiles will influence adoption. Regulatory hurdles or unanticipated safety concerns could hinder it.

Q4: Will EC-Naproxen DR replace existing NSAID formulations?

A: Not necessarily. While it offers advantages, its success depends on clinical acceptance, cost-effectiveness, and patient preferences. It is positioned as an alternative rather than a wholesale replacement.

Q5: What regions present the best growth opportunities for EC-Naproxen DR?

A: Developed markets with high prevalence of chronic pain conditions and established patent laws provide initial opportunities. Emerging markets with increasing healthcare access also represent significant growth prospects post-approval.

Sources:

- Global Burden of Disease Study, 2021.

- IQVIA PharmD Data, 2023.

More… ↓