Share This Page

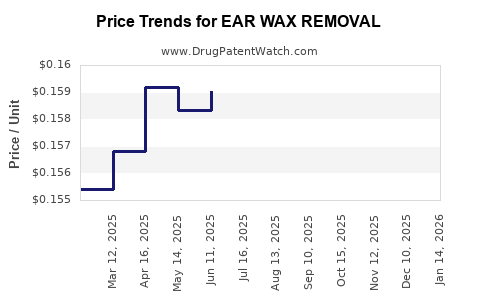

Drug Price Trends for EAR WAX REMOVAL

✉ Email this page to a colleague

Average Pharmacy Cost for EAR WAX REMOVAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| EAR WAX REMOVAL 6.5% DROP | 46122-0557-05 | 0.15705 | ML | 2025-12-17 |

| EAR WAX REMOVAL 6.5% DROP | 11527-0143-51 | 0.15705 | ML | 2025-12-17 |

| EAR WAX REMOVAL 6.5% KIT | 46122-0556-05 | 0.15705 | ML | 2025-12-17 |

| EAR WAX REMOVAL 6.5% DROP | 00904-7478-35 | 0.15705 | ML | 2025-12-17 |

| EAR WAX REMOVAL 6.5% KIT | 70000-0490-02 | 0.15705 | ML | 2025-12-17 |

| EAR WAX REMOVAL 6.5% DROP | 70000-0490-01 | 0.15705 | ML | 2025-12-17 |

| EAR WAX REMOVAL 6.5% DROP | 70000-0490-01 | 0.16037 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ear Wax Removal Medications

Introduction

The global ear wax removal market is witnessing steady growth driven by rising awareness of auditory health, aging populations, and increasing incidences of ear-related conditions. A critical segment within this landscape comprises over-the-counter (OTC) ear wax removal products, including drops, sprays, and irrigation kits. This analysis evaluates current market trends, key players, regulatory considerations, technological advancements, and provides price projections for ear wax removal drugs over the next five years.

Market Overview

Current Market Landscape

The ear wax removal market encompasses both prescription and OTC products, with OTC solutions accounting for approximately 65-70% of sales globally ([1]). These products primarily contain carbamide peroxide, glycerin, saline, or other cerumenolytic agents to facilitate safe earwax removal. North America and Europe dominate the market, driven by high awareness and regulatory approvals, while emerging economies exhibit substantial growth potential owing to increased healthcare access ([2]).

Key Players

Major companies include Johnson & Johnson, Novartis, and GlaxoSmithKline, with a diverse portfolio of cerumenolytic products. Generic manufacturers also hold a significant share given the low-cost nature of many OTC formulations. The market is competitive, with innovation focusing on improved safety, efficacy, and user convenience.

Regulatory Landscape

Regulatory requirements vary by region. In the U.S., the FDA classifies certain ear drops as OTC drugs, requiring adherence to safety and labeling standards. European authorities, such as the EMA, impose similar regulations. This regulatory environment influences product pricing and availability.

Market Drivers

- Aging Population: Increased prevalence of age-related earwax buildup necessitates easy-to-use removal products.

- Auditory Health Awareness: Rising awareness about ear hygiene and hearing health boosts product demand.

- Product Innovation: Development of innovative delivery systems (e.g., ergonomic bottles, multi-use kits) enhances user experience.

- COVID-19 Pandemic Impact: Heightened hygiene awareness and increased self-care practices have accelerated OTC ear care product sales.

Market Challenges

- Safety Concerns: Reports of ear damage from improper use hinder product adoption. Ensuring safety through formulation and education remains crucial.

- Regulatory Hurdles: Stringent approval processes can delay product entry or updates, impacting market dynamics.

- Competition from Alternatives: Devices like irrigators and professional cleaning services pose competition to OTC products.

Technological and Product Trends

- Enhanced Formulations: Combining cerumenolytics with soothing agents (e.g., aloe vera, lidocaine) to reduce discomfort.

- Smart Delivery Systems: Incorporation of technology for precise dosing and user feedback.

- Eco-Friendly Packaging: Focus on sustainable materials to appeal to environmentally conscious consumers.

Pricing Dynamics and Projections

Historical Price Trends

Existing OTC ear wax removal products range from $5 to $15 per bottle or kit, with premium formulations reaching higher prices due to added features or brand reputation ([3]). Prescription options, if prescribed, are generally priced higher, but OTC remains the dominant sales channel.

Price Drivers

- Ingredients and Formulation Complexity: Higher efficacy formulations command premium pricing.

- Brand vs. Generic: Brand-name products often retail at 20-30% higher prices than generics.

- Regulatory Costs: Compliance expenses impact product pricing, especially for new entrants.

- Distribution Channels: Online sales and pharmacy retail influence pricing strategies, with online platforms often offering discounts.

Future Price Projections (2023-2028)

Based on market trends, inflation rates, and technological advancements, ear wax removal product prices are expected to increase modestly, averaging a CAGR of approximately 3-5%. Some key projections include:

-

OTC Drops/Kits:

- 2023: $6.00 - $14.00 per unit

- 2028: $7.50 - $18.00 per unit

-

Premium formulations (e.g., with soothing agents or advanced delivery systems):

- 2023: $12.00 - $20.00 per unit

- 2028: $15.00 - $25.00 per unit

-

Prescription Ear Cleansing Agents: Typically priced between $20 and $50 per course but may see slight increments based on formulation innovations.

Price Sensitivity and Consumer Trends

Price sensitivity remains moderate. Consumers are willing to pay a premium for products perceived as safer or more effective, especially among older demographics and hearing aid users. Brands leveraging trust and proven efficacy are positioned to maintain higher price points.

Market Opportunities and Strategic Insights

- Innovation and Differentiation: Developing products with improved safety profiles and added benefits can justify premium pricing and capture market share.

- Regional Expansion: Targeting emerging markets by offering cost-effective yet reliable products can unlock significant growth.

- Regulatory Navigation: Streamlining approval processes and maintaining compliance will enable rapid market entry and sustained pricing strategies.

- Digital Engagement: Utilizing e-commerce and telehealth platforms to boost accessibility and consumer education can foster brand loyalty and command better prices.

Key Takeaways

- The ear wax removal market is poised for steady growth, driven by demographic shifts, rising awareness, and ongoing product innovation.

- OTC formulations dominate sales, with prices expected to rise modestly at a 3-5% CAGR through 2028.

- Premium products with enhanced features can command higher margins, while affordability remains critical for emerging markets.

- Strategic focus on safety, efficacy, and consumer education will be vital for maintaining competitiveness.

- Companies should invest in regulatory compliance and innovative delivery systems to differentiate offerings and justify premium pricing.

FAQs

1. What are the primary active ingredients in ear wax removal products?

Carbamide peroxide is the most common, facilitating cerumen softening. Other agents include glycerin, saline, and mineral oils.

2. How does regulation impact pricing for ear wax removal medications?

Regulatory compliance increases development and approval costs, which can be reflected in retail prices. Stringent standards may delay product launches but also enhance consumer trust.

3. Are premium ear wax removal products significantly more effective?

Premium formulations often contain additional soothing or pain-relieving agents, which can improve user comfort but may not necessarily provide superior cerumen removal efficacy compared to standard products.

4. What market segments exhibit the highest growth potential?

Elderly populations, individuals with hearing aids, and regions with low current penetration but rising healthcare awareness hold significant growth opportunities.

5. Will the COVID-19 pandemic influence the ear wax removal market long-term?

Yes, increased focus on self-care and hygiene has sustained higher demand for OTC ear care products, a trend likely to persist post-pandemic.

References

[1] MarketWatch, "Global Ear Wax Removal Market Size, Share & Trends," 2022.

[2] Allied Market Research, "Ear care products market analysis," 2022.

[3] Walmart and Amazon product listings, 2022 pricing data.

More… ↓