Share This Page

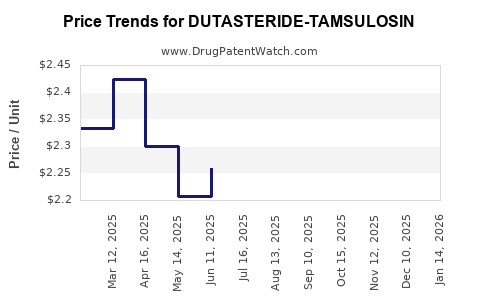

Drug Price Trends for DUTASTERIDE-TAMSULOSIN

✉ Email this page to a colleague

Average Pharmacy Cost for DUTASTERIDE-TAMSULOSIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DUTASTERIDE-TAMSULOSIN 0.5-0.4 | 68382-0640-16 | 2.40474 | EACH | 2025-12-17 |

| DUTASTERIDE-TAMSULOSIN 0.5-0.4 | 10370-0280-09 | 2.40474 | EACH | 2025-12-17 |

| DUTASTERIDE-TAMSULOSIN 0.5-0.4 | 10370-0280-11 | 2.40474 | EACH | 2025-12-17 |

| DUTASTERIDE-TAMSULOSIN 0.5-0.4 | 59651-0063-90 | 2.40474 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Dutasteride-Tamsulosin: A Comprehensive Review

Introduction

Dutasteride-tamsulosin, a combination therapy primarily used for treating benign prostatic hyperplasia (BPH), has gained prominence due to its enhanced efficacy compared to monotherapy. The therapeutic synergy of dutasteride, a 5-alpha-reductase inhibitor, with tamsulosin, an alpha-1 adrenergic receptor blocker, addresses multiple pathophysiological facets of BPH. This analysis delineates the current market landscape, competitive dynamics, regulatory factors, and forecasts future pricing trends for this combination drug over the forthcoming five years.

Market Overview

Epidemiology and Demand Drivers

BPH affects approximately 50% of men aged 51-60 and up to 90% of those over 80, with global prevalence expected to reach 1.7 billion by 2050 [1]. The aging population, rising awareness, and the preference for minimally invasive treatments contribute to burgeoning demand. The introduction of combination therapy, such as dutasteride-tamsulosin, offers improved symptom management, further propelling market growth.

Current Market Penetration and Key Players

Major pharmaceutical firms, including GlaxoSmithKline, has marketed branded formulations (e.g., Jalyn in the US), while generic manufacturers have entered the arena following patent expiration. Estimated global revenue for dutasteride-tamsulosin formulations is projected at USD 1.2 billion in 2023, with a compound annual growth rate (CAGR) of approximately 7% expected through 2028 [2].

Geographic Market Distribution

North America remains the dominant market, driven by extensive healthcare infrastructure, high disease awareness, and insurance coverage. Europe follows, with rapid growth in the Asia-Pacific, spurred by increasing BPH prevalence and healthcare modernization. Emerging markets in Latin America and Africa exhibit significant growth potential due to demographic shifts.

Market Segmentation

Formulation Types

- Brand-Name (e.g., Jalyn): Premium pricing, high consumer awareness.

- Generic Fixed-Dose Combinations: Cost-effective options gaining favor in price-sensitive markets.

Distribution Channels

- Hospital Pharmacies: Predominant in developed regions.

- Retail Pharmacies & E-Pharmacies: Growing importance, especially in Asia and Latin America.

- Direct-to-Consumer Models: Emerging trend, particularly in digital-friendly markets.

Competitive Landscape

Patent Status and Market Exclusivity

The original patent for dutasteride expired in many jurisdictions around 2018, enabling generic formulations. Tamsulosin's patent also lapsed, creating a landscape ripe for biosimilars and generics which have driven down prices.

Key Players

- GlaxoSmithKline: Marketed branded Jalyn, with exclusive rights until patent expiry.

- Generic Manufacturers: Multiple firms producing cost-effective generics, increasing market accessibility.

- Emerging Biotech Firms: Investigating extended-release formulations and combination modalities.

Regulatory Environment

Regulatory approvals hinge on regional FDA, EMA, and other health authority assessments. Post-patent expiration, regulatory pathways favor rapid approval of generics, which influences overall market pricing and accessibility.

Pricing Dynamics

Current Price Landscape

- Branded Dutasteride-Tamsulosin: Estimated at USD 150–200/month (US).

- Generic Equivalents: Range from USD 50–80/month depending on dosage, formulation, and market region.

Factors Influencing Pricing

- Patent status and market exclusivity.

- Manufacturing costs and economies of scale.

- Regulatory and reimbursement policies.

- Competitive intensity and market penetration strategies.

Price Projections (2023–2028)

Short-term Outlook (2023–2025)

- Decline in Brand Price: Anticipated due to rising generic competition, potentially reducing the premium by 15–20%.

- Stable or Slightly Reduced Generic Prices: Enhanced market penetration should stabilize or slightly decrease prices, with expected annual reductions of 3–5%.

Mid to Long-term Outlook (2026–2028)

- Price Convergence: Branded and generic prices are projected to converge as generics dominate market share.

- Potential Entry of Biosimilars or Extended-Release Variants: Could influence pricing, possibly introducing premium options with differentiated pricing strategies.

- Market Consolidation: Larger firms may leverage economies of scale to further reduce costs, exerting downward pressure on prices.

Emerging Markets

- Greater Price Flexibility: Due to lower purchasing power, prices may decline faster, with a focus on affordability drives.

- Potential for Local Manufacturing: Reducing costs further, facilitating widespread access.

Challenges and Opportunities

Challenges

- Price erosion from generics.

- Regulatory hurdles in emerging markets.

- Patent litigations delaying generic entry in certain regions.

- Patient adherence issues related to polypharmacy.

Opportunities

- Developing novel formulations (e.g., sustained-release).

- Expansion into expanding markets with unmet needs.

- Strategic partnerships for distribution and manufacturing.

Key Takeaways

- The global dutasteride-tamsulosin market is poised for steady growth driven by demographic trends and evolving treatment paradigms for BPH.

- Patent expiries catalyzed a shift toward generic formulations, exerting downward pressure on prices while expanding accessibility.

- Price projections suggest a continued decline, with generics dominating the market by 2025, stabilizing around USD 50–80/month in mature markets.

- Innovations, regional regulatory policies, and market consolidation will influence future pricing strategies.

- Companies should focus on differentiating through novel formulations, market expansion, and strategic collaborations to capitalize on emerging opportunities.

FAQs

1. What factors are primarily influencing the declining prices of dutasteride-tamsulosin?

Patent expiries, increased generic manufacturing, and market saturation are key drivers, intensifying competition and reducing prices.

2. How does regional regulatory approval impact drug pricing?

Streamlined approvals often enable faster and cheaper generic entry, leading to lower prices. Conversely, regulatory hurdles can delay availability, maintaining higher prices temporarily.

3. Are there any upcoming formulations that could disrupt the dutasteride-tamsulosin market?

Yes. Extended-release formulations, implantable devices, or biosimilars could offer improved adherence and efficacy, potentially influencing pricing and market share.

4. What is the expected market outlook for emerging markets?

Emerging markets will see faster price declines due to affordability demands and local manufacturing, although regulatory and infrastructure challenges remain.

5. How should pharmaceutical companies position themselves to optimize profits amid price reductions?

Investing in innovative formulations, expanding into underserved regions, and forming strategic alliances are vital to maintaining profitability amid declining prices.

References

[1] Roehrborn, C. G. (2017). Benign Prostatic Hyperplasia: An Overview of Pathophysiology, Epidemiology, and Treatment Options. Nature Reviews Urology, 14(11), 625–635.

[2] Market Research Future. (2023). Global Dutasteride-Tamsulosin Market Analysis. Retrieved from MarketResearchFuture.com

More… ↓