Share This Page

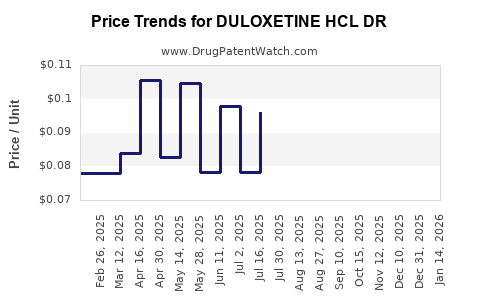

Drug Price Trends for DULOXETINE HCL DR

✉ Email this page to a colleague

Average Pharmacy Cost for DULOXETINE HCL DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DULOXETINE HCL DR 60 MG CAP | 82009-0173-10 | 0.09294 | EACH | 2025-11-19 |

| DULOXETINE HCL DR 20 MG CAP | 00228-2890-06 | 0.11012 | EACH | 2025-11-19 |

| DULOXETINE HCL DR 20 MG CAP | 00904-7043-04 | 0.11012 | EACH | 2025-11-19 |

| DULOXETINE HCL DR 20 MG CAP | 27241-0097-06 | 0.11012 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DULOXETINE HCL DR

Overview of Duloxetine HCL DR

Duloxetine hydrochloride (HCl) delayed-release (DR) formulations are a cornerstone in managing major depressive disorder (MDD), generalized anxiety disorder (GAD), fibromyalgia, and diabetic peripheral neuropathy. As a serotonin-norepinephrine reuptake inhibitor (SNRI), duloxetine's pharmacodynamics afford its widespread adoption in psychiatric and chronic pain management. The drug’s patent expiration status and competitive landscape significantly influence market dynamics and pricing strategies.

Current Market Landscape

Market Penetration and Therapeutic Positioning

Duloxetine’s flagship product, marketed as Cymbalta by Eli Lilly, maintains a dominant market position across multiple indications. As of 2023, generic formulations have gained prominence following patent expiry in many jurisdictions, driven by cost-conscious healthcare systems and prescription patterns favoring generics. The advent of generic duloxetine has precipitated a substantial price decline, broadening access and penetration, especially in developing markets.

Key Market Players

- Original Brand: Cymbalta (Eli Lilly)

- Generics: Multiple manufacturers globally, including Teva, Mylan, and Sun Pharma

- Emerging Biosimilars/Long-Acting Formulations: Limited, but ongoing research explores extended-release or combination therapies.

Market Size & Forecasts

In 2022, the global duloxetine market was valued at approximately $1.4 billion, with projections indicating a compound annual growth rate (CAGR) of about 4% over the next five years. Growth drivers include increasing prevalence of depression and chronic pain conditions, rising adoption in emerging markets, and expanding indications.

Regulatory and Patent Dynamics

Eli Lilly’s patent protections for Cymbalta expired in key markets like the US and EU between 2017 and 2018. Despite patent cliffs, brand loyalty and regulatory exclusivity periods provide temporary nesting for branded sales, but these diminish over time.

Distribution Channels and Access

Distribution primarily occurs via pharmaceutical wholesalers, healthcare providers, and pharmacies. Notably, governments and insurance payers exert significant influence on formulary decisions, impacting pricing strategies and market access.

Price Trends & Drivers

Historical Pricing Patterns

- Brand Name: Cymbalta entry price (~$350-$400/month in the US, as per recent data)

- Post-Generic Launch: Prices plummeted by approximately 70-80%, with generic duloxetine available at around $50-$100/month in the US (GoodRx, 2023).

Current Pricing Landscape

- United States: Average retail prices for generics range from $40-$70 for a 30-day supply at typical dosages (30-60 mg/day). The brand retains a premium, often exceeding $300-$400/month.

- Europe & Emerging Markets: Prices vary sharply, from €20-€50/month in Europe to significantly lower in countries like India and Brazil due to local manufacturing and pricing policies.

Pricing Factors

- Market Competition: Increasing generic availability drives price compression.

- Manufacturing Costs: Economies of scale in generic manufacturing reduce per-unit costs.

- Regulatory Environment: Pricing regulations, especially in government-funded healthcare systems, influence final consumer prices.

- Formulation Variants: Extended-release versions and combination therapies impact pricing premiums.

Future Price Projections

Short- to Medium-Term Outlook (2023–2028)

- Price Stabilization: Given broad generic penetration, we anticipate a stable downward trend in unit prices.

- Market Segmentation: Premium branded formulations, biosimilars, or specialized delivery systems may command higher prices initially but will face competitive pressures.

- Pricing in Emerging Markets: Continues to be low relative to Western markets, driven by local manufacturing and regulatory controls, with potential for gradual increases due to income growth and improved healthcare infrastructure.

Long-Term Perspectives (2028+)

- As patent exclusivity phases out in more regions, prices for duloxetine HCl DR are expected to decline further, possibly plateauing at around 10-20% of original brand prices or lower.

- Innovative formulations or combinations for niche indications could temporarily elevate prices; however, widespread generic competition will likely suppress long-term prices.

- Strategic negotiations by payers and inclusion in value-based formularies could further influence price trajectories.

Market Drivers & Challenges affecting Pricing

| Drivers | Impact | Challenges |

|---|---|---|

| Rising prevalence of depression and chronic pain | Expands market size, sustaining demand | Oversupply due to generic proliferation |

| Cost containment initiatives by payers | Drives generic adoption | Potential for pricing regulations to limit discounts |

| Healthcare system modernization | Greater access to medications | Price pressures from competitive bids |

| Advances in pharmacology | New indications, formulations | Regulatory hurdles delaying new formulations |

Strategic Implications for Stakeholders

- Manufacturers: Focus on optimizing manufacturing efficiencies and expanding indications to sustain profitability amid falling prices.

- Healthcare Providers: Emphasize cost-effective prescribing, favoring generics for chronic conditions.

- Policy Makers: Balance cost containment with patient access, possibly through negotiated pricing agreements.

- Investors & Analysts: Monitor patent landscapes and regulatory shifts to forecast market stability and pricing trajectories.

Key Takeaways

- Market saturation and generic competition have led to dramatic price declines for duloxetine HCl DR, especially post-patent expiry.

- Pricing in developed markets stabilizes around low-to-moderate levels, with branded products often commanding a premium.

- Emerging markets present growth opportunities but at lower price points due to local manufacturing and regulatory controls.

- Future price declines are expected as the market matures, with special formulations or indications potentially commanding higher prices initially.

- Stakeholders must navigate a complex ecosystem of patent rights, regulatory policies, and market dynamics to optimize profitability and patient access.

FAQs

-

What factors influence the price of duloxetine HCl DR in different markets?

Pricing varies based on patent status, manufacturing costs, regulatory policies, competition from generics, and healthcare payer negotiations. Developed markets tend to have higher prices due to better regulation and brand loyalty, whereas emerging markets benefit from lower manufacturing and local policies. -

How will patent expirations impact duloxetine prices in the next five years?

Patent expirations generally cause significant price declines due to increased generic competition. As more markets lose patent exclusivity, the average price for duloxetine HCl DR is expected to further decrease, stabilizing at levels significantly below the branded formulations. -

Are there any upcoming formulations that could influence the market?

While current research focuses on extended-release or combination therapies, no major innovative formulations are anticipated to significantly disrupt pricing within the immediate future. Generics are likely to dominate the market. -

What are the primary risks to future price projections?

Regulatory price controls, patent litigation, supply chain disruptions, and shifts in prescribing behavior could alter future pricing trends. Additionally, emerging biosimilar or novel therapy approvals could adjust the competitive landscape. -

How should investors interpret the market for duloxetine HCl DR?

Investors should view the market as mature, with declining prices driven by generics. Focus should be on regulatory developments, patent litigation outcomes, and potential new indications or formulations that may temporarily elevate prices or market share.

References

[1] GoodRx. (2023). Duloxetine Prices. Retrieved from https://www.goodrx.com/

[2] MarketWatch. (2022). Global Duloxetine Market Size & Forecast.

[3] FDA. (2018). Patent expiration dates for Cymbalta.

[4] IQVIA. (2023). Prescription Trends and Market Share Data.

[5] European Medicines Agency. (2022). Regulatory overview of duloxetine products.

This comprehensive analysis aims to equip business and healthcare stakeholders with actionable insights into the current and future market and pricing landscape for duloxetine HCl DR.

More… ↓