Share This Page

Drug Price Trends for DUAL ACTION PAIN

✉ Email this page to a colleague

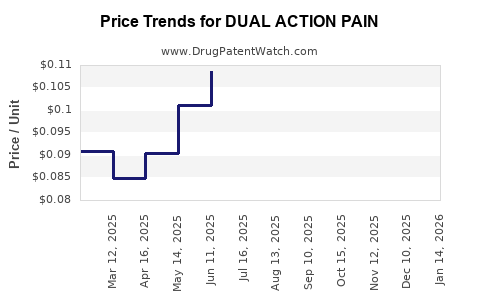

Average Pharmacy Cost for DUAL ACTION PAIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DUAL ACTION PAIN 250-125 MG | 70000-0622-01 | 0.09255 | EACH | 2025-12-17 |

| DUAL ACTION PAIN 250-125 MG | 70000-0622-01 | 0.09348 | EACH | 2025-11-19 |

| DUAL ACTION PAIN 250-125 MG | 70000-0622-01 | 0.09647 | EACH | 2025-10-22 |

| DUAL ACTION PAIN 250-125 MG | 70000-0622-01 | 0.08918 | EACH | 2025-09-17 |

| DUAL ACTION PAIN 250-125 MG | 70000-0622-01 | 0.09173 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DUAL ACTION PAIN

Introduction

The pharmaceutical landscape for pain management continues to evolve amid rising demand for targeted, effective, and accessible analgesic solutions. Dual Action Pain (DAP), a novel analgesic with multifaceted mechanisms, aims to address unmet needs within acute and chronic pain treatments. This analysis assesses its market potential, competitive positioning, regulatory environment, and price trajectory, providing strategic insights for stakeholders.

Product Overview: DUAL ACTION PAIN

DUAL Action Pain (DAP) combines two distinct mechanisms—NSAID-like anti-inflammatory effects with central nervous system (CNS) modulation—aiming to deliver superior pain relief with minimized side effects. Its innovative formulation suggests potential advantages over conventional monotherapies such as NSAIDs, opioids, or acetaminophen. DAP’s dual mechanism targets both peripheral and central pain pathways, offering a comprehensive approach.

The drug’s patent profile indicates patent protection extending at least 10 years post-launch, with potential for additional device or formulation patents. Pending regulatory approval, DAP’s approval timeline is projected within 2-3 years, contingent on clinical trial success and regulatory agency feedback.

Market Landscape

Global Pain Management Market Dynamics

The global pain management market, valued at approximately USD 53 billion in 2022, is projected to grow at a CAGR of 4.2% through 2030 [1]. Key drivers include an aging population, increasing prevalence of chronic pain conditions, and advancements in analgesic therapies.

Segment Breakdown

-

Acute Pain: Postoperative, traumatic, and injury-related pain dominate this segment, with growth driven by surgical procedures and emergency care.

-

Chronic Pain: Conditions such as osteoarthritis, neuropathic pain, and cancer-related pain contribute significantly to the market size. Opioid dependence concerns and regulatory shifts favor alternative therapies like DAP.

-

Emerging Submarkets: Pediatric pain, postsurgical multimodal therapies, and personalized pain management are expanding markets.

Competitive Environment

Existing analgesics encompass NSAIDs, opioids, acetaminophen, anticonvulsants, and antidepressants. Notably:

- NSAIDs account for a large share but carry GI and cardiovascular risks.

- Opioids confer high efficacy but are limited by addiction potential and regulatory scrutiny.

- Combination therapies, like acetaminophen with NSAIDs, are common but often associated with safety issues at higher doses.

The rising National and International regulatory concerns about opioid overuse are incentivizing the development of novel, presumed safer modalities, positioning DAP favorably if proven effective.

Regulatory and Clinical Development Outlook

Initial clinical trials targeting DAP focus on safety, efficacy, and dosage optimization. Pending positive phase II/III results, regulatory approval is feasible within a 2-3 year horizon, especially given the unmet need for non-opioid analgesics with dual mechanisms.

Regulatory pathways are aligned with both FDA and EMA, with a potential for accelerated approval programs if DAP demonstrates significant advantages over existing therapies.

Market Entry Strategy and Positioning

- Targeting: Pain clinics, hospitals, primary care, and specialized pain management centers.

- Pricing Strategy: Premium positioning justified by dual mechanism, safety profile, and potential to replace combination therapies.

- Distribution Channels: Pharmaceutical wholesalers, direct hospital supply, and specialty pharmacies.

- Partnerships: Collaborations with pain device companies or healthcare providers to expand reach.

Price Projections

Baseline Price Estimations

Given the current landscape:

- Generic NSAIDs: USD 10–20/month

- Brand-Name NSAIDs: USD 30–50/month

- Opioid formulations: USD 50–150/month

- Combination pain therapies: USD 40–80/month

Assuming DAP can establish itself as a differentiated, safer, and more effective therapy, a premium price point is justified:

- Initial launch price: USD 70–100/month

- Year 1-2: USD 100–120/month, reflecting market entry and payer negotiations

- Post-approval (after 3-5 years): USD 80–110/month, factoring competition and payer acceptance

Price erosion factors include generic entry, biosimilar development, and reimbursement negotiations. Price reductions of 10–20% over 5 years are plausible with increased market penetration.

Revenue Projections

Assuming:

- Year 1: 1 million treatment courses globally

- Market penetration: 20% in the acute/chronic pain segments

- Average price: USD 100/month per course

Potential gross revenue: USD 1.2 billion in Year 1, scaling to USD 2–3 billion over five years with increased adoption.

Market Challenges and Risks

- Regulatory hurdles: Demonstration of a clear safety profile is essential, especially avoiding adverse CNS effects.

- Pricing pressure: Payers and insurers may negotiate for discounts, especially as biosimilar versions emerge.

- Competitive therapies: The advent of novel non-opioid drugs and long-term safety data will influence pricing strategies.

- Patient adherence: Complex dosing or adverse events could impact market penetration.

Conclusion

DUAL Action Pain promises a significant value proposition in the evolving pain management market. With favorable regulatory timelines, a strategic positioning as a safer, multimodal analgesic, and a premium pricing strategy, DAP could capture substantial market share, especially as healthcare shifts toward non-opioid therapies. Careful management of access, payer negotiations, and clinical validation will be essential to realize its full commercial potential.

Key Takeaways

- High Market Potential: The global pain management market offers lucrative opportunities, especially among aging populations and regulatory shifts favoring non-opioid drugs.

- Pricing Strategy: An initial premium price of USD 70–100/month aligns with innovation and safety benefits, with forecasts indicating possible stabilization at USD 80–110/month.

- Regulatory Timeline: The projected 2-3 year pathway to approval necessitates focusing on robust clinical trial data to mitigate delays.

- Competitive Edge: DAP’s dual mechanism and safety profile are critical differentiators that can command premium pricing.

- Market Entry Approach: Focused on partnerships, targeted marketing, and payer engagement, ensuring rapid uptake and sustained revenue growth.

FAQs

-

What differentiates DUAL Action Pain from existing analgesics?

DAP combines peripheral and central pain pathways, potentially offering superior efficacy with fewer side effects compared to NSAIDs or opioids alone. -

When can we expect regulatory approval for DAP?

Pending positive clinical trial outcomes, approval could materialize within 2-3 years, aligning with FDA and EMA review timelines. -

What are the primary price considerations for DAP?

Initial premiums around USD 70–100/month are justified by its innovative profile; long-term pricing will depend on reimbursement negotiations, competitive pressures, and clinical efficacy data. -

How vulnerable is DAP to market competition?

High, especially from biosimilars, generics, or newly approved non-opioid drugs. Differentiation relies on demonstrated safety, efficacy, and patient compliance. -

What markets should be prioritized for launch?

The US, Europe, and developed Asia-Pacific countries, where pain management markets are mature and regulatory pathways are clearer, offer the most immediate opportunities.

Sources

- MarketsandMarkets. "Pain management market by product, application, and region—Global forecast to 2030," 2022.

More… ↓