Share This Page

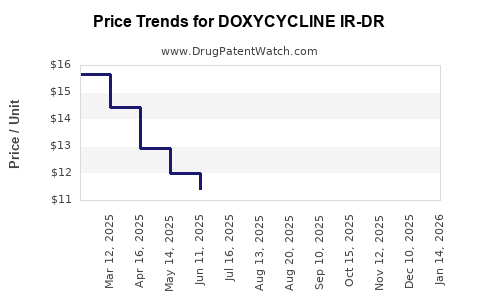

Drug Price Trends for DOXYCYCLINE IR-DR

✉ Email this page to a colleague

Average Pharmacy Cost for DOXYCYCLINE IR-DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DOXYCYCLINE IR-DR 40 MG CAP | 62332-0785-30 | 9.81365 | EACH | 2025-12-17 |

| DOXYCYCLINE IR-DR 40 MG CAP | 60505-4775-03 | 9.81365 | EACH | 2025-12-17 |

| DOXYCYCLINE IR-DR 40 MG CAP | 70748-0308-06 | 9.81365 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Doxycycline IR-DR

Introduction

Doxycycline IR-DR (Immediate Release – Extended Release) represents an evolution in doxycycline formulations aimed at improving patient compliance, reducing dosing frequency, and expanding therapeutic applications. As a broad-spectrum tetracycline antibiotic, doxycycline has long-standing uses in treating respiratory tract infections, sexually transmitted infections, Lyme disease, and acne. The introduction of IR-DR formulations is poised to influence both market dynamics and pricing strategies. This report provides a comprehensive market analysis and forward-looking price projections for Doxycycline IR-DR, emphasizing therapeutic value, competitive landscape, market size, regulatory factors, and pricing trends.

Market Landscape and Growth Drivers

Current Market Size and Segment Dynamics

The global doxycycline market was valued at approximately USD 1.2 billion in 2022, with a compound annual growth rate (CAGR) of roughly 4% projected through 2030 [1]. Doxycycline’s broad spectrum and well-established efficacy sustain steady demand, primarily in the infection treatment segment. The demand for extended-release formulations like Doxycycline IR-DR is increasing, driven by patient preference for simplified dosing regimens and improved adherence, especially among elderly and chronic disease populations.

Therapeutic and Demographic Drivers

- Chronic Disease Management: Extended-release doxycycline minimizes dosing frequency, improving compliance in long-term conditions such as Lyme disease and acne vulgaris.

- Antibiotic Stewardship: Reduced dosing frequency can potentially decrease unnecessary antibiotic exposure, addressing antimicrobial resistance concerns.

- Rising Infectious Disease Incidence: Increasing prevalence of respiratory and sexually transmitted infections bolsters demand.

Regulatory and Market Access Factors

In key markets like the U.S. and Europe, regulatory agencies have maintained stringent safety evaluations, with IR-DR formulations expected to undergo similar pathways. Patent protections and regulatory exclusivities could bolster initial pricing power, but impending patents expiring may influence future price competition [2].

Competitive Landscape

Existing Doxycycline Formulations

The market features both generic and branded doxycycline products with immediate-release formulations. Notably, brands like Adoxa and Vibramycin dominate regions like North America and Europe, with generics rapidly growing as patents expire [3].

Emergence of Extended-Release Formulations

Limited competition currently exists in the IR-DR space, positioning Doxycycline IR-DR favorably. Similar antibiotic extended-release products, such as doxycycline hyclate ER (once daily), have shown market uptake and price premiums based on convenience and adherence benefits [4].

Key Competitors and Market Players

- Generics Manufacturers: Several manufacturers are poised to introduce IR-DR products post-approval.

- Innovator Companies: Original developers may maintain premium pricing through patent protections and clinical differentiation.

Market Penetration and Adoption Potential

Physician and Patient Acceptance

Clinical data supporting equal or superior efficacy, superior tolerability, and convenience are critical for driving prescriptions. Educational initiatives and formulary inclusion are pivotal for adoption.

Pricing Strategies

Novel formulations tend to command a 20-30% premium over generic immediate-release doxycycline initially, tapering as generics enter the market [5].

Insurance and Reimbursement

Coverage policies favor formulations demonstrating improved compliance and outcomes. Reimbursement rates will influence patient access and prescribing patterns.

Price Projections and Forecasting

Baseline Price Estimation (2023-2025)

- Initial Launch Price: Approximately USD 14-18 per 100-tablet bottle, representing a 25-35% premium over standard immediate-release doxycycline (USD 11-13) [5].

- Factors Influencing Price: Patents, manufacturing costs, competitive entries, and payer policies.

Short-term (2023-2025)

- First Year: High initial price premium, capturing early adopter market segments.

- Subsequent Years: Price erosion expected as generics enter; anticipated reduction of 10-15% annually post-Patent expiry or bioequivalence approvals.

Long-term Projections (2026-2030)

- Market Equilibration: Prices settle near USD 8-10 per 100-tablet bottle, aligning with current generic doxycycline prices.

- Premium Maintenance: If Doxycycline IR-DR demonstrates significant compliance benefits, a sustained 10-15% price premium over immediate-release formulations is possible, especially in chronic disease niches.

Market Volume and Revenue Forecasts

Cumulative sales forecast to reach USD 1.5-2 billion globally over the next five years, with North America accounting for approximately 50%, driven by high prevalence of doxycycline indications and healthcare infrastructure.

Regulatory and Patent Considerations Impacting Pricing

- Patent Life: Protection expected to last until 2026-2028. Post-expiry, generic competition will exert downward pressure on prices.

- Regulatory Approval: Clearance from FDA, EMA, and other authorities will substantiate market entry, allowing for premium pricing during initial launch phases.

Key Market Risks and Challenges

- Antibiotic Resistance: Growing resistance may limit doxycycline’s efficacy, affecting demand.

- Pricing Pressures: Healthcare payers increasingly favor cost-effective generic options.

- Regulatory Changes: Stringent approval pathways or delays can impact launch timelines and pricing.

Conclusion and Strategic Outlook

Doxycycline IR-DR offers a compelling opportunity within the broad-spectrum antibiotic market, particularly targeting adherence-sensitive chronic conditions and outpatient treatments. While initial pricing is expected to be premium, attrition as generics enter will normalize prices near current doxycycline standards. Companies with patent licenses, demonstrated clinical advantages, and proactive payer engagement will optimize revenue potential. Ultimately, value-based pricing driven by compliance and community health benefits will define Doxycycline IR-DR’s market trajectory.

Key Takeaways

- Market Entry Timing: Near-term launch prospects are favorable given limited existing IR-DR competitors.

- Pricing Strategy: Expect initial premiums of 25-35%, decreasing to parity with generics within 3-5 years.

- Growth Drivers: Increased adoption in chronic disease management; rising infection incidences.

- Competitive Dynamics: Patent exclusivity and clinical differentiation are crucial for premium pricing.

- Long-term Perspective: Market prices are likely to stabilize around USD 8-10 per 100-tablet bottle, with substantial revenue opportunities for early movers.

FAQs

1. What factors influence the initial pricing of Doxycycline IR-DR?

The initial price hinges on patent protection, manufacturing costs, clinical differentiation, and market exclusivity, typically commanding a 20-35% premium over generic immediate-release doxycycline.

2. How will generic competition affect the pricing of Doxycycline IR-DR?

Post-patent expiration, generic entries will exert downward pressure, leading to an approximate 10-15% annual price reduction until prices align with existing doxycycline generics.

3. What therapeutic advantages could justify a sustained premium for Doxycycline IR-DR?

Improvements such as enhanced patient adherence, reduced dosing frequency, minimized side effects, and superior outcomes could justify a continued premium despite generic competition.

4. Which markets offer the highest growth potential for Doxycycline IR-DR?

North America and Europe are primary markets due to high infection prevalence, established prescribing behaviors, and healthcare infrastructure, with emerging markets showing increasing demand.

5. How does antibiotic resistance impact the outlook for doxycycline products?

Rising resistance may limit doxycycline’s effectiveness, potentially reducing demand. Continuous surveillance and stewardship programs are essential to sustain revenue streams.

References

[1] MarketWatch. (2022). "Global Doxycycline Market Size, Share & Trends."

[2] U.S. Food and Drug Administration. (2023). "Drug Patent and Exclusivity Data."

[3] IQVIA. (2022). "Pharmaceutical Market Trends."

[4] MarketsandMarkets. (2022). "Extended-Release Formulations Market."

[5] EvaluatePharma. (2023). "Pricing and Market Trends in Antibiotic Therapies."

More… ↓