Last updated: July 27, 2025

Introduction

Dorzolamide-Timolol is a combination ophthalmic pharmaceutical primarily indicated for the reduction of elevated intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension. While established as an effective therapeutic option, understanding its market dynamics and price trajectory is critical for stakeholders including pharmaceutical companies, healthcare providers, and investors. This analysis explores current market landscape, competitive positioning, regulatory status, pricing trends, and future projections for Dorzolamide-Timolol.

Market Overview and Therapeutic Context

Medical Indication and Clinical Landscape

Dorzolamide-Timolol combines a carbonic anhydrase inhibitor (Dorzolamide) with a beta-blocker (Timolol), synergistically lowering IOP more effectively than monotherapies. Marketed under brand names such as Cosopt (by Merck) and generic formulations, it addresses a critical need among millions of glaucoma patients worldwide (WHO, 2020).

The global glaucoma market was valued at approximately USD 4.2 billion in 2021, with projections reaching USD 6.5 billion by 2030, driven by rising prevalence, aging populations, and increased awareness of early diagnosis—factors that underpin the demand for combination therapies like Dorzolamide-Timolol (Grand View Research, 2022).

Competitive Environment

Dorzolamide-Timolol faces competition from other fixed-dose combinations (FDCs), such as Brinzolamide-Apraclonidine and Brimonidine-Timolol, as well as high-prescribing monotherapies. Notably, some formulations are available as branded drugs and in generic forms, influencing market share and pricing strategies.

Major players include Merck, Santen Pharmaceutical, Alcon (Novartis), and generic manufacturers. Patent expiry for branded formulations has intensified competition, leading to price erosion and increased accessibility.

Regulatory and Patent Status

Patent Landscape

The original patent for Cosopt expired in various jurisdictions between 2015-2020, opening doors for generics. Consequently, generic versions proliferated, exerting downward pressure on prices. Merck’s patent extensions and litigation efforts temporarily delayed generics in certain markets, but the overall trend favors generics.

Regulatory Approvals

Regulatory agencies, including the FDA and EMA, approved Dorzolamide-Timolol for ophthalmic use based on its efficacy and safety profile. Regulatory pathways for generics are well-established, facilitating rapid market entry and price competition.

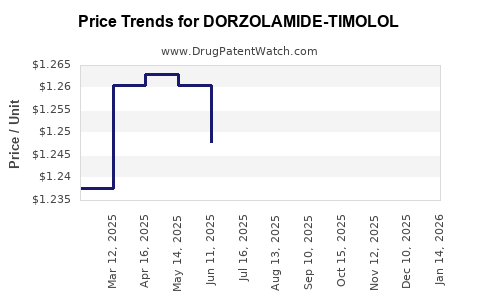

Pricing Trends and Factors Influencing Price Dynamics

Price Trends in Developed Markets

In North America and Europe, the branded Cosopt traditionally retailed at USD 50-70 per bottle. Following patent expiration and the entry of generics, prices declined substantially, with generic formulations now priced between USD 10-20 per bottle in the U.S.

Unbranded and Generic Pricing

Generic versions account for over 75% of prescriptions in many regions and are typically priced 60-80% lower than branded counterparts. The presence of multiple generic suppliers fosters a highly competitive environment that continues to suppress prices.

Market Access and Reimbursement Policies

Reimbursement schemes in the U.S., Europe, and emerging markets influence pricing. Countries with government-subsidized healthcare systems leverage price negotiations and reference pricing, further affecting margins and retail prices.

Impact of Distribution Channels

Pharmacies, hospitals, and online vendors also impact pricing. Online pharmacies often offer significant discounts, increasing access but exerting downward pressure on retail prices.

Future Price Projections

Factors Supporting Price Stability and Reduction

- Patent expiries will lead to a dominant generic market, compelling further price cuts.

- Increased competition from new formulations or delivery systems, such as sustained-release eye drops or alternative combination drugs.

- Regulatory pressures aimed at reducing healthcare costs.

Potential Price Trends (Next 5-10 Years)

- USD 5-10 per bottle in mature generic markets, reflecting continued commoditization.

- Premium pricing may persist temporarily in markets with limited generic entry or smaller patient populations.

- Price stabilization is expected in high-income countries, with variations depending on regulatory and reimbursement policies.

Emerging Markets Outlook

In developing countries, prices remain relatively higher due to limited generic penetration, import tariffs, and infrastructure challenges. However, increased local manufacturing and regulatory harmonization could reduce prices to USD 3-7 per bottle over the next decade.

Market Drivers and Challenges

Drivers

- Growing prevalence of glaucoma, especially among aging populations.

- Increasing awareness and early diagnosis.

- Favorable reimbursement policies for combination therapies.

Challenges

- Price erosion due to generic competition.

- Patent litigations delaying generic entry.

- Limited differentiation among available formulations, intensifying price competition.

- Patient adherence issues, affecting demand and market growth.

Strategic Implications

Pharmaceutical companies should focus on:

- Innovation to develop sustained-release formulations or novel delivery systems that command premium pricing.

- Market penetration through cost-effective generics, especially in emerging markets.

- Regulatory navigation to extend patent life or expedite approvals.

- Partnerships with distribution channels to optimize market access and pricing.

Conclusion

Dorzolamide-Timolol occupies a significant position within the glaucoma treatment landscape. Its market is characterized by robust demand in tandem with intense price competition post-patent expiry. The trajectory points toward further price reductions in developed markets, driven by generic proliferation, while emerging markets may see more stable, higher-end prices due to nascent competition. Stakeholders should prioritize innovation and strategic market positioning to optimize profitability amid evolving regulatory and competitive forces.

Key Takeaways

- The global glaucoma market is expanding, fueling sustained demand for Dorzolamide-Timolol, especially generic formulations.

- Patent expirations have catalyzed significant price erosion, making generics the primary growth driver.

- Future pricing will likely gravitate toward USD 5-10 per bottle in developed markets, with higher prices persisting in regions with limited generic options.

- Market dynamics are shaped by regulatory policies, reimbursement schemes, and competitive innovations.

- To maximize value, stakeholders should consider research into novel delivery mechanisms and strategic market expansion into emerging regions.

FAQs

1. How does the patent status impact the pricing of Dorzolamide-Timolol?

Patent expiry opens the market to generic manufacturers, significantly lowering the drug’s price due to increased competition. Patent litigations and extensions can temporarily sustain higher prices but generally lead to price reductions once patent protections lapse.

2. What is the average market price of Dorzolamide-Timolol in the U.S.?

Branded formulations traditionally ranged from USD 50-70 per bottle. Currently, generic versions are available at approximately USD 10-20, reflecting substantial price declines post-patent expiry.

3. Are there upcoming innovations that could influence the market?

Yes. Research is ongoing into sustained-release ocular implants and alternative drug delivery systems, which could command higher prices and improve patient adherence.

4. How do regulatory policies in emerging markets affect the price of Dorzolamide-Timolol?

Regulatory policies that streamline approval processes and promote local generic manufacturing typically lead to lower prices—potentially USD 3-7 per bottle—although affordability varies by country.

5. What strategies should pharmaceutical companies adopt to remain competitive?

Investing in innovation, optimizing supply chains, pursuing strategic partnerships, and entering emerging markets are crucial to maintaining profitability amid price erosion.

References

[1] World Health Organization. (2020). Global Data on Visual Impairment.

[2] Grand View Research. (2022). Glaucoma Market Size, Share & Trends Analysis.

[3] U.S. Food and Drug Administration. (2021). Regulatory approval for ophthalmic drugs.

[4] MarketWatch. (2022). Ophthalmic Drugs Price Trends.