Last updated: July 28, 2025

Introduction

Dorzolamide Hydrochloride (HCl) is a topical carbonic anhydrase inhibitor primarily used for lowering intraocular pressure (IOP) in conditions such as glaucoma and ocular hypertension. As a generic pharmaceutical, Dorzolamide HCl has experienced a complex market landscape influenced by patent expirations, competitive dynamics, regulatory shifts, and evolving treatment preferences. This analysis provides an in-depth review of the current market status and offers price projections for Dorzolamide HCl over the forecast period.

Current Market Landscape

1. Market Overview

Dorzolamide HCl is a well-established medication with longstanding FDA approval, originally marketed by Novartis (sold under Trusopt). The intense competition from generics in recent years has significantly altered the commercial landscape. The global eye health market, specifically for glaucoma management, is projected to reach USD 12 billion by 2027, with prostaglandin analogs dominating the treatment paradigm. However, dorzolamide remains relevant as an adjunct or alternative in specific cases or combination therapies.

2. Key Players and Market Share

-

Brand Leaders and Generics: Since patent expiry, multiple pharmaceutical companies have entered the generic dorzolamide market, including Teva, Sandoz, Mylan, and others. These manufacturers leverage cost competitiveness and wide distribution networks.

-

Market Penetration: Generics hold over 90% of the market share due to the high cost-effectiveness and insurance coverage. The residual market is primarily composed of branded formulations, often used for specific indications or patient preferences.

-

Pricing Dynamics: Generic pricing initially collapsed after patent expiry, with prices decreasing by approximately 70-80% within the first two years. Current prices are driven by competition, regulatory policies, and supply chain factors.

3. Regulatory and Patent Landscape

The original patent for dorzolamide expired in the early 2010s, paving the way for generic manufacturers. Patent litigations and settlements may influence market entry and pricing strategies; however, most entry barriers are now minimal. Regulatory compliance for quality and bioequivalence standards remains crucial.

Market Drivers and Challenges

Drivers:

- Rising prevalence of glaucoma and ocular hypertension, especially in aging populations.

- Cost savings from generic drug adoption.

- Increasing global healthcare access, especially in emerging markets.

- Continuous innovations in drug delivery systems (combination therapies, sustained-release formulations).

Challenges:

- Competition from fixed-dose combination drugs (e.g., dorzolamide/timolol) reducing standalone dorzolamide sales.

- Market saturation in mature regions like North America and Europe.

- Stringent regulatory requirements affecting supply chain and manufacturing.

- Volatility in raw material costs, particularly for the active pharmaceutical ingredient (API).

Market Opportunities

- Expansion in Emerging Markets: Increasing ophthalmological disease burden boosts demand in Asia-Pacific, Latin America, and Africa.

- Combination Products: Growth potential exists in fixed-dose combinations that include dorzolamide, which often command higher prices.

- Innovative Delivery Systems: Development of sustained-release formulations may capture premium segment share.

Price Projections for Dorzolamide HCl

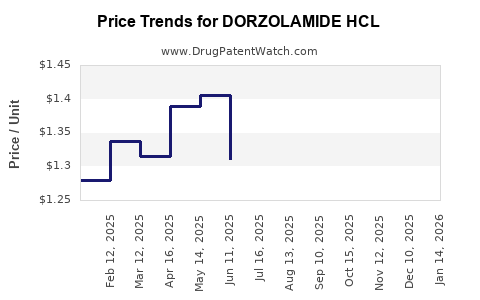

1. Historical Pricing Trends

The average wholesale acquisition cost (AWAC) for a 20 mg/mL bottle of dorzolamide (per 30-day supply) fell from approximately USD 70–80 pre-patent expiry to USD 15–20 by 2022 in mature markets, primarily driven by generic competition. In emerging markets, prices are typically lower, averaging USD 5–10.

2. Short-Term (Next 1–2 Years)

Prices are expected to stabilize narrowly within current levels, considering:

- Limited new generic entrants due to manufacturing scale.

- Continued price erosion driven by existing competition.

- Slight declines of 3–5%, driven by inflation in raw materials and logistics costs.

Estimated Range: USD 14–USD 18 per 30-day supply.

3. Medium to Long-Term (3–5 Years)

As patent challenges diminish further and generics saturate markets, prices are projected to decline gradually. However, regulatory pressures or the introduction of value-added formulations could influence this trend.

- Scenario 1 (Stable Competition): Prices remain stable with minor fluctuations, averaging USD 12–USD 15.

- Scenario 2 (Increased Competition): Additional generic market entrants push prices down by an aggregate 10–20%, potentially reducing the price to USD 10–USD 12.

Forecast Range: USD 10–USD 15 in mature markets; potentially lower in less regulated regions.

4. Factors Influencing Future Pricing

- Regulatory Policy Changes: Enhanced price controls or national formularies may suppress prices.

- Supply Chain Dynamics: Raw material costs (e.g., for the API) can cause short-term volatility.

- Market Penetration: Increased adoption due to new indications or combinations may offset pricing pressures.

Implications for Stakeholders

Pharmaceutical Companies: The commoditization of dorzolamide HCl requires strategic focus on differentiation via combination therapies or innovative delivery systems. Cost reduction in manufacturing and market expansion in emerging regions remain vital.

Investors: The diminishing pricing trajectory emphasizes the importance of diversification and innovation in ophthalmology portfolios. Longer-term ROI is tied to pipeline development and market diversification.

Healthcare Providers: Cost-effective generic options improve access but may limit revenue potential for innovators. Being cognizant of regulatory shifts can anticipate price changes impacting procurement.

Key Takeaways

- Dorzolamide HCl's market has shifted from patented exclusivity to intense generic competition.

- Current prices in mature markets typically range between USD 14–USD 18 per 30-day supply.

- Future price declines are anticipated, stabilizing around USD 10–USD 12 in the next 3–5 years, barring regulatory or market entry changes.

- Market growth is primarily driven by increasing glaucoma prevalence and expansion into emerging markets.

- Strategic focus on combination drugs and innovative formulations will enable manufacturers to buffer against price erosion.

FAQs

1. What is the primary use of dorzolamide hydrochloride?

Dorzolamide HCl is used to lower intraocular pressure in patients with glaucoma or ocular hypertension, often as adjunct therapy alongside other IOP-lowering agents.

2. How has patent expiry impacted dorzolamide's pricing?

Patent expiry led to proliferation of generic manufacturers, resulting in significant price reductions—approximately 70–80%—within two years, increasing affordability and market penetration.

3. What are the key factors influencing future prices of dorzolamide?

Major factors include generic competition, regulatory policies, raw material costs, market penetration in emerging economies, and developments in drug delivery technology.

4. Which regions are expected to see the most growth for dorzolamide?

Emerging markets such as Asia-Pacific, Latin America, and Africa are poised for growth due to rising disease prevalence and increasing healthcare access.

5. Is dorzolamide becoming obsolete given newer treatments?

While some newer therapies like prostaglandin analogs dominate the market, dorzolamide remains relevant for specific patient populations and combination therapy options, preserving a niche in glaucoma management.

References

- [1] IQVIA. Global Ophthalmic Market Insights, 2022.

- [2] FDA. Dorzolamide Hydrochloride (Trusopt) Approval Details, 1995.

- [3] Market Research Future. Ophthalmic Drugs Market Forecast, 2022.

- [4] EvaluatePharma. Global Generic Market Trends, 2022.

- [5] IMARC Group. Ophthalmology Drugs Market Report, 2023.

Note: Data points and projections are based on current market intelligence and are subject to change due to regulatory, economic, or competitive developments.