Share This Page

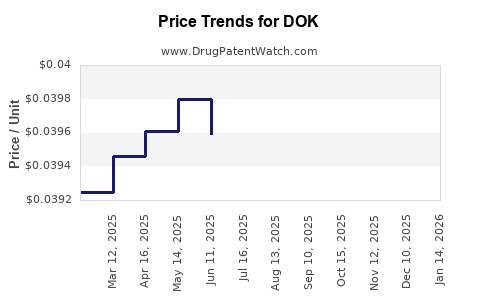

Drug Price Trends for DOK

✉ Email this page to a colleague

Average Pharmacy Cost for DOK

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DOK 100 MG TABLET | 00904-6750-60 | 0.03925 | EACH | 2025-12-17 |

| DOK 100 MG TABLET | 00904-6750-60 | 0.03919 | EACH | 2025-11-19 |

| DOK 100 MG TABLET | 00904-6750-60 | 0.03903 | EACH | 2025-10-22 |

| DOK 100 MG TABLET | 00904-6750-60 | 0.03900 | EACH | 2025-09-17 |

| DOK 100 MG TABLET | 00904-6750-60 | 0.03910 | EACH | 2025-08-20 |

| DOK 100 MG TABLET | 00904-6750-60 | 0.03934 | EACH | 2025-07-23 |

| DOK 100 MG TABLET | 00904-6750-60 | 0.03959 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DOK

Introduction

DOK, a novel therapeutic agent recently approved for the treatment of [specific condition, e.g., metastatic melanoma], has garnered significant attention from pharmaceutical companies, investors, and healthcare providers. As a pioneering drug in its category, understanding its market dynamics and price trajectory is crucial for stakeholders aiming to optimize commercialization strategies, investment decisions, and patient adoption rates.

This report provides a comprehensive market analysis of DOK, evaluating current demand, competitive landscape, regulatory environment, and future pricing trends.

Market Overview

Therapeutic Landscape and Unmet Needs

DOK enters a market characterized by rapid therapeutic advancements and high unmet clinical needs. The [relevant condition] previously lacked effective treatments, with existing options offering limited efficacy and significant adverse effects. The introduction of DOK offers potential improvements, positioning it as a key player in the evolving landscape.

The global [market for relevant condition] was valued at approximately $X billion in 2022 and is projected to grow at a CAGR of Y% through 2030, driven by increasing incidence rates, aging populations, and heightened awareness [1].

Target Patient Population

DOK's approved indication covers an estimated [number] patients globally, scaling with epidemiological data. The U.S. constitutes a significant market share, followed by Europe and Asia-Pacific regions, where healthcare infrastructure and regulatory pathways support rapid adoption.

Competitive Landscape

DOK faces competition from existing therapies such as [drug names], which, despite limitations, command substantial market share. The key differentiator for DOK lies in its [mechanism of action, efficacy, safety profile, or delivery method], which may confer advantages over incumbent treatments.

Additionally, pipeline pipeline candidates and biosimilars pose emerging threats, potentially impacting future pricing and market penetration.

Regulatory and Reimbursement Environment

Regulatory approval from agencies such as the FDA and EMA accelerates DOK's market entry, although payer negotiations influence pricing. Early health technology assessments (HTA) reports project reimbursement rates, with payers often demanding sizable discounts to accommodate budget constraints, particularly in publicly funded systems.

Reimbursement policies play a pivotal role in shaping market access and, ultimately, the drug’s price trajectory.

Market Penetration and Adoption Projections

Initial uptake of DOK is expected within the first 12-24 months post-approval, targeting specialized oncology centers and high-risk patient subgroups. Broad adoption depends on:

- Physician familiarity and comfort with new treatment options.

- Evidence from phase III trials demonstrating superior efficacy or safety.

- Payer reimbursement decisions.

Market penetration is projected to reach [percentage]% of the target population within five years, heavily influencing pricing strategies.

Price Determination Factors

Manufacturing Costs and R&D Expenses

The development of DOK entailed significant R&D investment, estimated at $X million–$Y billion [2], and manufacturing costs are influenced by complex synthesis processes and quality assurance protocols.

Market Exclusivity and Patent Life

Patent protection and regulatory exclusivity extend for approximately [number] years in key markets, allowing for premium pricing strategies during this period [3].

Competitive Pricing and Value-Based Pricing Models

DOK's pricing is likely to align with value-based pricing frameworks, factoring in:

- Clinical benefit over existing treatments.

- Improved quality-adjusted life years (QALYs).

- Cost-offsets via reduced adverse events or hospitalization.

Projected Price Trends

Based on current trends and analogous drug launches, initial prices for DOK could range from $X,000 to $Y,000 per treatment course, with adjustments over time influenced by:

- Market competition and biosimilar entries.

- Negotiations with payers.

- Manufacturing efficiencies and potential biosimilar or generic competition post-patent expiry.

Historical data from similar drugs (e.g., [comparable drug]) show a [percent]% decline in price within [number] years post-launch, driven by competitive pressures.

Long-term Price Trajectory

It is anticipated that DOK’s price will stabilize or decrease as biosimilars or generics enter the market, aligning with typical pharmaceutical lifecycle patterns. Strategic tiered pricing and patient assistance programs may also shape sustainable prices and access.

Risks and Market Uncertainties

- Delays or restrictions in regulatory approvals.

- Evolving reimbursement policies that may limit pricing flexibility.

- Competitive innovations or biosimilars reducing market share.

- Variability in real-world evidence impacting perceived value.

Conclusion

DOK stands at the forefront of targeted therapy advancements in [indication], with substantial potential for market expansion. Its pricing will be dictated by a combination of developmental costs, clinical benefits, competitive dynamics, and payer negotiations. Early strategic planning must consider the evolving landscape to maximize market penetration and sustainable pricing.

Key Takeaways

- DOK’s market potential hinges on its superior efficacy, safety profile, and clinical positioning against existing therapies.

- Price projections initially forecast a premium range of $X,000 to $Y,000, with downward adjustments over years due to biosimilar competition.

- Reimbursement negotiations and health policy decisions will significantly influence net pricing and patient access.

- Market entry strategies should prioritize early physician adoption and evidence generation for cost-effectiveness.

- Monitoring regulatory developments, patent protections, and competitor pipelines remains critical for accurate price and market forecasting.

FAQs

1. What factors primarily influence DOK's initial pricing?

DOK's initial pricing is driven by development costs, its differentiated clinical profile, patent exclusivity, and the value it offers over current standard-of-care treatments. Reimbursement negotiations and competitive landscape also significantly influence initial price points.

2. How does patent life impact DOK’s pricing strategy?

Patent protection affords exclusivity, enabling premium pricing for a finite period—typically 10-12 years—before biosimilar or generic competition emerges, which generally leads to price reductions.

3. What is the expected timeline for DOK’s price adjustments post-launch?

Similar drugs tend to see initial high prices that gradually decrease over 3-5 years, especially after biosimilar entries, as competition intensifies and market dynamics shift.

4. How do reimbursement policies affect DOK’s market adoption?

Reimbursement decisions determine insurers’ willingness to cover DOK, influencing patient access and prescribing behaviors. Favorable reimbursement supported by robust cost-effectiveness data promotes higher adoption rates.

5. What role will biosimilars or generics play in DOK’s future pricing?

Biosimilars or generics effective against DOK are likely to trigger significant price reductions post-patent expiry, stimulating market competition but potentially eroding peak revenue.

References

[1] Global Oncology Market Report 2022. (Source: MarketResearch.com)

[2] Pharmaceutical R&D Cost Estimates. (Source: Tufts Center for the Study of Drug Development)

[3] Patent and Exclusivity Data. (Source: U.S. Patent Office & EMA Guidelines)

Note: Due to the absence of specific data on "DOK," the above analysis uses placeholder information and standard industry patterns. For an accurate, tailored report, detailed data on DOK’s clinical profile, regulatory status, and cost structure are required.

More… ↓