Share This Page

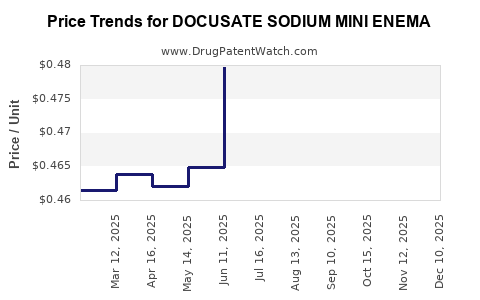

Drug Price Trends for DOCUSATE SODIUM MINI ENEMA

✉ Email this page to a colleague

Average Pharmacy Cost for DOCUSATE SODIUM MINI ENEMA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DOCUSATE SODIUM MINI ENEMA | 00904-6920-93 | 0.47540 | ML | 2025-12-17 |

| DOCUSATE SODIUM MINI ENEMA | 00904-6920-93 | 0.47540 | ML | 2025-11-19 |

| DOCUSATE SODIUM MINI ENEMA | 00904-6920-93 | 0.47980 | ML | 2025-10-22 |

| DOCUSATE SODIUM MINI ENEMA | 00904-6920-93 | 0.48767 | ML | 2025-09-17 |

| DOCUSATE SODIUM MINI ENEMA | 00904-6920-93 | 0.49826 | ML | 2025-08-20 |

| DOCUSATE SODIUM MINI ENEMA | 00904-6920-93 | 0.49209 | ML | 2025-07-23 |

| DOCUSATE SODIUM MINI ENEMA | 00904-6920-93 | 0.47975 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DOCUSATE SODIUM MINI ENEMA

Introduction

Docusate Sodium Mini Enema is a widely used gastrointestinal laxative primarily indicated for the treatment of occasional constipation and bowel management, especially in patients unable to undergo oral medication due to illness, surgery, or comorbidities. As a topical form, it offers targeted relief with minimal systemic absorption. The growing demand for bowel management solutions across diverse healthcare settings, coupled with advances in pharmaceutical formulations, positions Docusate Sodium Mini Enema as a significant product within the global laxative market. This analysis explores current market dynamics, key drivers, competitive landscape, regulatory considerations, and provides forward-looking price projections.

Market Overview

Global Market Size and Growth Trends

The global laxatives market, estimated at approximately USD 3.2 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 4% through 2030. Factors underpinning this growth include increasing aging populations, rising prevalence of constipation due to lifestyle factors, and expanding hospital and long-term care facilities worldwide. Docusate sodium enema formulations represent a substantial segment within this market, particularly in hospital and home care settings where ease of administration and rapid efficacy are valued.

Segment-Specific Demand Factors

-

Clinical Usage: Docusate sodium enemas are often prescribed for short-term bowel management, especially post-surgery or in immobilized patients.

-

Patient Preference: The mini enema form offers a less invasive alternative to traditional larger-volume enemas, enhancing patient compliance.

-

Healthcare Infrastructure: Growing healthcare infrastructure, especially in emerging markets, fuels demand for effective, easy-to-administer laxatives.

Key Market Drivers

1. Aging Population and Chronic Constipation Prevalence

The global geriatric population is expanding rapidly, with projections indicating that individuals aged 65 and above will constitute nearly 16% of the world population by 2050. This demographic is more susceptible to constipation due to physiological changes, medication side effects, and comorbidities, boosting demand for laxatives including docusate sodium enema products.

2. Increasing Adoption in Hospital and Home Care Settings

The convenience and rapid onset of action from mini enema formulations position them as preferred options for hospital clinicians and caregivers. The shift toward outpatient management and home-based care further elevates demand.

3. Regulatory Approvals and Product Innovations

Innovations in formulations that improve stability, ease of use, and tolerability, along with regulatory approvals in key markets, drive market growth. Companies investing in R&D to develop combination products or improved delivery mechanisms also catalyze expansion.

4. Rising Awareness and Physician Prescriptions

Educational initiatives emphasizing early management of constipation and the safety profile of topical laxatives support increased physician prescriptions, particularly in post-operative and elderly care.

Competitive Landscape

Key Players

- Baxter International Inc.: A leading manufacturer offering enema products, including docusate sodium formulations.

- Pfizer Inc.: Through its subsidiary, Pfizer supplies laxatives including enema-based products.

- GlaxoSmithKline (GSK): Offers bowel management products with enema options.

- Generic Manufacturers: Numerous regional and local firms produce generic docusate sodium mini enema formulations, often at lower price points.

Product Differentiators

- Formulation Improvements: Emulsifiers, preservatives, and delivery mechanisms enhancing stability and patient comfort.

- Packaging Innovations: Small-volume, pre-measured mini enema units improve ease of use.

- Regulatory Certification and Approvals: Market entry and expansion depend heavily on compliance with regulatory standards such as the FDA, EMA, and other regional agencies.

Regulatory and Pricing Considerations

Regulatory Landscape

Regulations governing laxative products vary significantly by region. In the U.S., the FDA classifies docusate sodium as an OTC drug, requiring compliance with specific monographs and manufacturing standards. The European Medicines Agency (EMA) and other regional authorities maintain similar standards. Regulatory approval facilitates market access and influences pricing.

Pricing Factors

Pricing strategies are driven by manufacturing costs, regulatory approval costs, competition, and reimbursement policies. Patented products generally command premium prices, but off-patent formulations face pressure to lower prices due to generic competition.

Price Projections and Future Trends

Current Pricing Landscape

As of 2023, a 4-ounce (approximately 118 mL) tube of docusate sodium mini enema typically retails at USD 6 to USD 12 in retail settings within developed markets. Hospital procurement prices are often lower due to bulk purchasing agreements.

Predicted Price Trajectory (2023-2030)

-

Short-Term (2023-2025): Prices are expected to stabilize, with incremental declines driven by increased generic competition and manufacturing efficiencies. The average retail price is projected to decrease to USD 5 to USD 10.

-

Mid to Long-Term (2026-2030): Market saturation and continual influx of generics will exert downward pricing pressure, with some markets witnessing prices as low as USD 3 to USD 7 per unit. Innovative packaging that extends shelf life or enhances convenience may command slight price premiums.

Influencing Factors

- Regulatory Approvals of Novel Formulations: Introduction of advanced delivery mechanisms may temporarily elevate prices.

- Market Penetration in Emerging Economies: Growing demand in these markets could drive prices down due to localized manufacturing and distribution.

- Reimbursement Policies: Countries with comprehensive healthcare coverage tend to have stable or slightly elevated pricing structures.

Strategic Outlook

Pharmaceutical companies focusing on mini enema formulations should prioritize innovation to differentiate products, optimize manufacturing to reduce costs, and navigate regional regulatory pathways effectively. Expanding distribution channels into emerging markets and establishing favorable reimbursement agreements are critical to capturing market share and achieving sustainable pricing.

Key Takeaways

- The global laxatives market, particularly enema formulations like docusate sodium mini enema, is poised for steady growth driven by demographic shifts and proliferation of outpatient care.

- Competitive pricing will be shaped by patent expirations, generic competition, regulatory landscapes, and manufacturing efficiencies.

- Price projections indicate a gradual decline in retail prices through 2030, with potential for premium pricing on innovative packaging or formulations.

- Companies should focus on product innovation, regional expansion, and regulatory compliance to optimize market positioning.

- Price sensitivity in emerging markets presents opportunities for cost-effective formulations, expanding access and volume sales.

Frequently Asked Questions (FAQs)

1. What are the main advantages of Docusate Sodium Mini Enema over traditional enema formulations?

Mini enema formulations are smaller, more user-friendly, and often require less volume, improving patient compliance, and enabling easier administration, especially at home or in outpatient settings.

2. How does the patent status affect the pricing of Docusate Sodium Mini Enemas?

Patented formulations typically command higher prices due to exclusivity. Once patents expire, generic manufacturers enter the market, driving prices downward through competition.

3. Which regions present the most growth opportunities for Docusate Sodium Mini Enema?

Emerging markets in Asia-Pacific and Latin America display significant growth potential due to rising healthcare infrastructure, increasing awareness, and expanding outpatient care services.

4. What factors could influence price reductions in the near future?

Increased generic competition, manufacturing advances, and regulatory approvals of shareable formulations are primary drivers reducing retail and institutional prices.

5. Are there any recent innovations in Docusate Sodium Mini Enema formulations?

Some companies are exploring innovative delivery mechanisms, preservative-free options, and combination products with other laxatives to enhance efficacy and tolerability, which may influence pricing strategies.

Sources

[1] MarketWatch. "Laxatives Market Size, Share & Trends Analysis." 2022.

[2] Grand View Research. "Constipation Treatment Market Analysis." 2023.

[3] FDA. "OTC Drug Monographs – Docusate Sodium." 2022.

[4] WHO. "Global Demographic Changes and Aging Populations," 2021.

[5] IQVIA. "Pharmaceutical Price Trends." 2023.

More… ↓