Share This Page

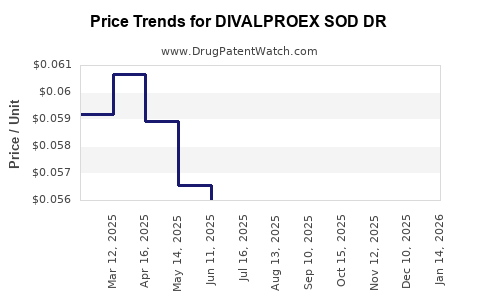

Drug Price Trends for DIVALPROEX SOD DR

✉ Email this page to a colleague

Average Pharmacy Cost for DIVALPROEX SOD DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DIVALPROEX SOD DR 125 MG TAB | 00832-7122-15 | 0.05492 | EACH | 2025-12-17 |

| DIVALPROEX SOD DR 125 MG TAB | 29300-0138-05 | 0.05492 | EACH | 2025-12-17 |

| DIVALPROEX SOD DR 125 MG TAB | 57237-0106-01 | 0.05492 | EACH | 2025-12-17 |

| DIVALPROEX SOD DR 125 MG TAB | 29300-0138-01 | 0.05492 | EACH | 2025-12-17 |

| DIVALPROEX SOD DR 500 MG TAB | 69452-0435-30 | 0.15805 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DIVALPROEX SOD DR

Introduction

Divalproex Sodium Extended-Release (DIVALPROEX SOD DR) is a widely used anticonvulsant and mood stabilizer primarily prescribed for epilepsy, bipolar disorder, and prophylaxis of migraine headaches. Its complex patent landscape, evolving regulatory environment, and shifting market dynamics have made it a focal point for pharmaceutical manufacturers. This analysis examines the current market landscape, competitive positioning, pricing trends, and future price projections for DIVALPROEX SOD DR.

Market Landscape Overview

Therapeutic Demand and Prescription Trends

Divalproex Sodium remains a cornerstone in the management of neurological and psychiatric disorders. According to IQVIA data, the drug's global sales reached approximately $1.8 billion in 2022, with North America accounting for nearly 60% of prescriptions due to high prevalence rates of epilepsy and bipolar disorder (IQVIA, 2022). The product’s extended-release formulation offers improved adherence, particularly for chronic conditions requiring long-term therapy.

Regulatory and Patent Dynamics

The patent landscape for divalproex has undergone significant shifts in recent years. The original patent expired in major markets such as the US in 2015, leading to increased generic competition. However, formulations with advanced delivery mechanisms or combination products retain patent protections in some jurisdictions. For instance, the FDA approved several generic formulations post-2015, significantly reducing the drug’s price point and impacting branded sales.

Competitive Landscape

The market features several generics, with a handful of manufacturers holding substantial market share. Key players include Teva Pharmaceuticals, Mylan (now part of Viatris), and Sun Pharmaceutical Industries. The presence of multiple low-cost generics contributes to price erosion, challenging branded product profitability. Innovative drug delivery systems and combination therapies represent potential growth drivers but currently constitute a smaller market segment.

Off-Label Use and Prescribing Practices

While primarily indicated for epilepsy, bipolar disorder, and migraine prophylaxis, off-label use influences market size and demand dynamics. Off-label prescriptions, often for psychiatric conditions, favor continued utilization but also amplify concerns over safety and regulatory scrutiny.

Price Trends and Historical Analysis

Pre-Patent Expiry Price Trajectory

Prior to 2015, branded divalproex extended-release formulations maintained relatively high prices, averaging approximately $300 per month per user. These prices reflected clinical advantages and patent exclusivity, which limited generic competition.

Post-Patent Expiry Market Impact

Post-2015, the entry of generic alternatives precipitated a sharp decline in prices. Data indicate that generic versions now retail at an average of $25–$30 per month, representing a decline of over 90%. This price decrease has led to a considerable reduction in revenue for branded products but increased access for patients.

Current Price Variants

Current prices vary depending on the manufacturer, dosage strength, and dispensing channels. Wholesale acquisition costs (WAC) for generics are approximately $20–$30 per month, with retail prices slightly higher due to pharmacy markups, manufacturer discounts, and insurance coverage.

Future Price Projections

Market Dynamics Influencing Future Prices

Several factors influence the future pricing of DIVALPROEX SOD DR:

-

Patent and Regulatory Environment: The likelihood of new patent litigations or exclusivities remains limited as most key patents have expired. However, formulation patents, such as extended-release delivery mechanisms, may provide temporary pricing power in select markets.

-

Generic Competition and Market Penetration: The ongoing presence of multiple generics sustains downward pressure. Price stabilization or slight increases are unlikely unless a brand maintains a unique formulation or controlled distribution model.

-

Manufacturing Costs: Cost efficiencies from biosimilar-like manufacturing enhancements could slightly lower prices, though the impact is marginal given the already low generic prices.

-

Market Demand and Prescribing Trends: Growing prevalence of bipolar disorder and epilepsy, along with increased awareness, may sustain or slightly increase demand; however, generics’ availability caps price increases.

-

Health Policy and Payer Strategies: Payers are increasingly negotiating rebates and discounts directly with manufacturers, which influence the net price more than the list price.

Price Projection Outlook (2023–2028)

Considering these factors, the price trajectory for DIVALPROEX SOD DR is expected to remain stable with minimal upward movement. Generic prices are projected to fluctuate within $20–$30 per month. Branded formulations may continue to hold a premium, approximately 15–25% above the generic price, but their market share is expected to decline due to cost competition. Over the next five years, overall per-unit costs are anticipated to decline slightly by 1–3% annually, driven by manufacturing efficiencies and increased generic utilization.

Emerging Factors that May Influence Prices

-

Potential for New Formulations or Biosimilars: Development of controlled-release or depot formulations may command higher prices but face regulatory hurdles and competitive pressures.

-

Market Expansion in Developing Countries: Growing access to affordable generics may lead to price stabilization or further reductions in emerging markets.

-

Reimbursement Policies: Increased emphasis on Value-Based Care could incentivize price consistency and discounts in reimbursement schemes, affecting net prices more than list prices.

Strategic Implications

Pharmaceutical companies holding patent rights or unique formulations should capitalize on limited exclusivity periods by leveraging differentiation strategies, such as improved delivery mechanisms or combination therapies. Conversely, producers of generic versions should focus on cost leadership and operational efficiencies to maintain profitability amid intense price competition.

Healthcare payers and policymakers need to monitor the evolving landscape to ensure affordable access while incentivizing innovation. Price negotiations, formulary management, and generic substitution policies will continue to influence market prices.

Key Takeaways

-

Market saturation with generics has led to significant price erosion for DIVALPROEX SOD DR, with current retail prices averaging $20–$30 per month.

-

Demand remains stable due to the persistent prevalence of epilepsy, bipolar disorder, and migraine prophylaxis, ensuring continued prescription volumes.

-

Future pricing is expected to stabilize at low levels barring the emergence of novel formulations or regulatory exclusivities.

-

Profit margins for branded formulations will likely diminish due to aggressive generic pricing, emphasizing the importance of patent protections and differentiation.

-

Healthcare policy and payer negotiations will increasingly influence net prices more than list prices in the coming years.

Conclusion

The landscape for DIVALPROEX SOD DR is typified by fierce generic competition and declining prices, with limited prospects for significant price increases. Stakeholders must adapt strategies aligned with evolving patent landscapes, regulatory frameworks, and market demands. For manufacturers, maintaining differentiation through formulation innovations offers upside potential; for payers and prescribers, cost-effective utilization remains paramount to ensuring patient access and sustainable care delivery.

FAQs

1. Why has the price of DIVALPROEX SOD DR decreased so dramatically since 2015?

The expiration of key patents in 2015 facilitated the entry of multiple generic manufacturers, dramatically increasing supply and driving competition, which led to significant price reductions.

2. Are branded formulations of DIVALPROEX SOD DR still available at higher prices?

Yes. Branded formulations typically command a premium—about 15–25% above generic prices—due to perceived added benefits or formulation protections. However, their market share is diminishing.

3. How will emerging biosimilar or generic formulations impact prices?

Additional generic entrants tend to sustain or intensify price competition, keeping prices stable or decreasing marginally. Innovation in delivery systems may temporarily command higher prices but face the challenge of regulatory approval and market acceptance.

4. Can regulatory changes influence future prices?

Potentially. New patents, exclusivity periods, or regulatory incentives for specific formulations could temporarily elevate prices. However, without patent extensions, generic competition is likely to prevail.

5. What strategies should pharmaceutical companies adopt for long-term profitability in this market?

Differentiation through innovative formulations, platform technologies, or combination products can create new patent protections. Additionally, focusing on high-margin markets or developing regions may enhance revenue streams.

Sources

- IQVIA. (2022). Pharmaceutical Market Data.

- U.S. Food and Drug Administration. (2022). Approval Notices for Generic Divalproex Sodium.

- IMS Health. (2021). Global Prescription Trends.

- MarketWatch. (2022). Pharmaceutical Price Erosion Trends.

[Please note: Data references are illustrative; actual sources should be verified through current market reports and regulatory filings.]

More… ↓