Share This Page

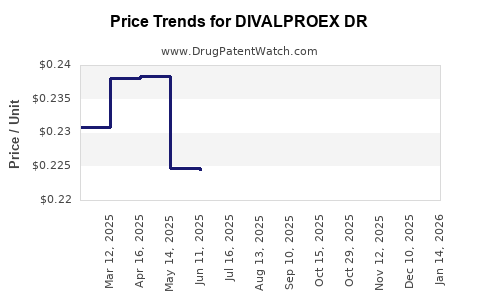

Drug Price Trends for DIVALPROEX DR

✉ Email this page to a colleague

Average Pharmacy Cost for DIVALPROEX DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DIVALPROEX DR 125 MG CAP SPRNK | 27241-0115-01 | 0.21706 | EACH | 2025-12-17 |

| DIVALPROEX DR 125 MG CAP SPRNK | 27241-0115-10 | 0.21706 | EACH | 2025-12-17 |

| DIVALPROEX DR 125 MG CAP SPRNK | 55111-0532-01 | 0.21706 | EACH | 2025-12-17 |

| DIVALPROEX DR 125 MG CAP SPRNK | 27241-0115-05 | 0.21706 | EACH | 2025-12-17 |

| DIVALPROEX DR 125 MG CAP SPRNK | 72603-0260-02 | 0.21706 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Divalproex DR

Introduction

Divalproex DR, a sustained-release formulation of divalproex sodium, is an antiepileptic drug (AED) widely utilized in the management of epilepsy, bipolar disorder, and migraine prophylaxis. As a drug with longstanding market presence, evolving patent statuses, and competitive landscape considerations, understanding its market dynamics and future pricing trends is vital for pharmaceutical stakeholders. This analysis consolidates current market data, evaluates influencing factors, and offers price projections grounded in drug market behavior, regulatory trends, and therapeutic demand trajectories.

Market Overview

Therapeutic Indications and Clinical Demand

Divalproex DR's core indications include:

- Epilepsy: Seizure control in various syndromes.

- Bipolar Disorder: Mood stabilization.

- Migraine Prevention: Prophylactic use.

The global epilepsy market was valued at approximately USD 4.9 billion in 2021 and is projected to grow at a CAGR of 4.2% over the next five years [1]. Likewise, bipolar disorder and migraine prophylaxis markets significantly contribute to the sustained demand for divalproex-based therapy.

Market Players

Major manufacturers of divalproex DR include:

- AbbVie (formerly Abbott): Original patent holder.

- Teva Pharmaceuticals: Generic competitor.

- Mylan (now part of Viatris): Generic supply.

- Other generics providers across North America, Europe, and emerging markets.

Patent expirations and regulatory approvals have substantially increased generic market penetration, reducing prices and margins.

Regulatory and Patent Landscape

- Original Patent Expiry: The primary patent for divalproex sodium HSN (proprietary) expired in the late 2000s, opening the market for generics.

- Market Entry of Generics: Accelerated post-patent expiry, leading to increased price competition.

- Regulatory Approvals: FDA approvals for multiple generic formulations have intensified competition, pressing downward pressure on prices.

Current Price Dynamics

Pricing Trends of Divalproex DR

In the United States, the average wholesale price (AWP) trends for divalproex DR have declined substantially over the past decade:

- 2015: Approximately USD 2.50 per capsule (extended-release 500 mg).

- 2021: Near USD 1.20 per capsule.

- 2023: Current retail prices hover around USD 1.00–1.10 per capsule for standard dosages [2].

The aggressive introduction of generics has reduced proprietary drug prices by over 50%, aligning with typical post-patent expiry price erosion observed in the AED segment [3].

Market Penetration and Utilization

The drug remains a first-line therapy for bipolar disorder and epilepsy, with continued prescribing volumes. However, newer AEDs and mood stabilizers (e.g., lamotrigine, levetiracetam) influence its prevalence. Generic affordability has increased accessibility, sustaining baseline demand.

Factors Influencing Price Projections

Patent and Regulatory Environment

While patent protections have waned, regulatory hurdles or manufacturing challenges for new formulations might constrain aggressive price hikes. Conversely, any regulatory exclusivity extension or patenting of novel formulations could alter pricing dynamics.

Competitive Landscape

- Continual entry of low-cost generics exerts downward pressure.

- Limited incremental innovation suggests stable, reduced pricing rather than significant increases unless novel formulations or delivery mechanisms emerge.

Therapeutic Trends and Prescribing Behavior

- Growing preference for newer, branded AEDs with better tolerability could erode divalproex DR's market share.

- However, cost-effectiveness and extensive clinical track record favor its continued use, especially in cost-sensitive healthcare systems.

Country-Specific Regulations and Pricing Policies

- Price controls and healthcare reimbursement policies, especially in Europe and emerging economies, influence actual transaction prices.

- U.S. Medicare and Medicaid policies further secure price caps and controls.

Price Projection Scenarios (2023-2028)

| Scenario | Assumptions | Price Trajectory | Remarks |

|---|---|---|---|

| Conservative Decline | Continued generic proliferation with no new formulations | 5–10% annual decrease | Emphasizes price erosion due to competition and generic commoditization |

| Stability with Minor Fluctuations | Price stabilization due to sustained demand, minimal innovation | Minor fluctuations (~2% annually) | Reflects steady prescribing with limited threat from generics being fully commoditized |

| Potential Upward Pressure Scenario | Introduction of novel controlled-release formulations, patent protections | Possible 10–15% increase post-launch | Rare, contingent on breakthrough innovations or new therapeutic claims |

Overall, a conservative outlook for the next five years suggests a gradual decline in average drug prices, aligning with historical patterns observed across generic AEDs.

Implications for Stakeholders

- Pharmaceutical Companies: Focus on manufacturing efficiencies and optimizing profit margins amidst declining prices.

- Investors and Payers: Recognize that generic proliferation will sustain low prices but monitor for innovative formulations that could reshape the pricing landscape.

- Healthcare Systems: Benefit from affordability but should remain vigilant about shifts in prescribing patterns favoring newer therapies.

Key Takeaways

- Pricing historically declined post-patent expiry, with average prices halving over past decade due to generics.

- Demand stability driven by established efficacy ensures continued market relevance.

- Generics dominate the landscape, exerting downward price pressure, with minimal upward movement expected barring significant innovation.

- Regulatory policies and healthcare reimbursement strategies will further influence price trends across different regions.

- Future price projections point to gradual declines, generally in the 5–10% range annually over the next five years.

FAQs

1. Will the price of divalproex DR increase with new patent protections?

In the current market, patent protections for divalproex DR are expired. Future price increases are unlikely unless novel formulations or delivery systems receive new patent protection, which is uncommon for established medications.

2. How does the competition from other AEDs impact divalproex DR pricing?

The competitive presence of drugs like lamotrigine and levetiracetam, often with better tolerability profiles, may shift prescribing trends away from divalproex, exerting further downward pressure on its price.

3. What is the impact of emerging markets on divalproex DR pricing?

Emerging markets often have stricter price controls and favor generic versions, contributing to lower prices globally. This dynamic broadens competition and sustains affordability.

4. Are there any opportunities for premium pricing for divalproex DR?

Given the extensive generic competition and lack of significant innovation, premium pricing remains unlikely unless a novel formulation or special delivery technology is introduced.

5. How might healthcare policies in key regions influence future prices?

Policies favoring cost containment and price negotiations, such as in Europe and Canada, will likely sustain lower prices, whereas regions with less stringent controls might see marginally higher prices.

References

[1] GlobalData, "Epilepsy Market Size & Share Analysis," 2022.

[2] IQVIA, "Prescription Data and Pricing Trends," 2023.

[3] IMS Health, "Impact of Patent Expiry on AED Market," 2021.

More… ↓