Last updated: July 27, 2025

Introduction

Disulfiram, commercially known as Antabuse among other brand names, is a longstanding pharmacological treatment primarily used in alcohol dependence management. Its mechanism involves inhibiting the enzyme aldehyde dehydrogenase, leading to an unpleasant reaction when alcohol is consumed. Despite being a well-established medication, the market landscape for disulfiram is evolving due to changes in regulatory standards, emerging alternatives for alcohol use disorder (AUD), and shifting healthcare dynamics. This report presents a comprehensive market analysis and forecasts future price trends for disulfiram, targeting pharmaceutical stakeholders, investors, and healthcare policymakers.

Market Overview

Historical Context and Current Status

Disulfiram has been in use since the 1950s and remains an essential component of AUD treatment regimens [1]. Its safety profile, cost-effectiveness, and the simplicity of oral administration have maintained steady demand, especially in countries with robust healthcare systems such as the US, Europe, and parts of Asia.

Global Market Size

The global market for disulfiram was valued at approximately USD 100 million in 2022, with estimated steady growth due to rising awareness of AUD, increasing healthcare expenditures, and the development of new formulations [2]. North America accounts for the largest share, driven by high prevalence rates of alcohol dependence and healthcare infrastructure conducive to pharmaceutical consumption.

Market Drivers

- Increasing AUD Prevalence: The Global Status Report on Alcohol and Health reports that alcohol consumption is rising globally, especially in developing countries, bolstering demand for relapse prevention medications like disulfiram [3].

- Established Efficacy and Cost: As a generic medication, disulfiram’s affordability encourages its continued use, particularly in low- and middle-income countries.

- Regulatory Approvals: Regulatory agencies have maintained access pathways for disulfiram, although under evolving safety advices that may influence prescribing patterns.

Market Challenges

- Emergence of Alternatives: The popularity of other pharmacological treatments, such as naltrexone and acamprosate, which may offer better tolerability or compliance, limits disulfiram’s market share [4].

- Safety Concerns: The potential for severe reactions if alcohol consumption occurs limits patient acceptance and clinician comfort.

- Regulatory Hurdles: In some regions, restrictions or required monitoring have impeded widespread adoption.

Market Segmentation

By Formulation

- Oral Tablets: The dominant formulation, accounting for over 95% of the market.

- Injectable/Extended-Release: Emerging formulations are under investigation but are not yet commercially significant.

By Application

- Alcohol Dependence Treatment: The primary application.

- Other Uses: Rarely used off-label for certain parasitic infections; minimal market impact.

By Geography

| Region |

Market Share (2022) |

Key Characteristics |

| North America |

45% |

High diagnosis rates, insurance coverage |

| Europe |

30% |

Significant prescription volume |

| Asia-Pacific |

15% |

Growing prevalence, expanding access |

| Others |

10% |

Limited market penetration |

Competitive Landscape

Market players consist of:

- Brand Name Products: e.g., Antabuse (Merc) and Disulfin (India)

- Generics: Constitute over 90% of sales, with multiple manufacturers across regions.

- Developing Formulations: Limited competition from novel formulations, but potential shifts pending clinical development.

Major pharmaceutical manufacturers include Sanofi, Teva, and Sun Pharmaceutical Industries, focusing on generic disulfiram production.

Regulatory Environment

Regulatory agencies in key markets maintain strict guidelines due to adverse reaction potential:

- In the US, the FDA classifies disulfiram as a prescription drug requiring healthcare supervision.

- European Medicines Agency (EMA) permits use with caution, emphasizing patient education.

- Emerging safety warnings could influence prescribing trends and thus market size.

Price Dynamics and Forecast

Current Price Landscape

- Generic Disulfiram: Prices vary significantly based on country, formulation, and purchasing volume.

- In the US, the average wholesale price (AWP) per 250 mg tablet is approximately USD 0.50–1.00.

- In low- and middle-income countries, prices can be as low as USD 0.10 per tablet due to local manufacturing.

- Brand Name Products: Typically priced 2–3 times higher than generics due to branding, marketing, and formulation patents.

Factors Influencing Price Projections

- Market Penetration of Generics: Continued availability and competition are likely to suppress prices over time.

- Regulatory Changes: Stricter safety regulations could increase costs related to compliance, marginally raising prices.

- Emerging Formulations: Novel delivery systems may carry premium pricing but face market entry barriers.

- Healthcare Policy and Reimbursement: Increased insurance coverage could stabilize prices but spur demand, affecting overall market value.

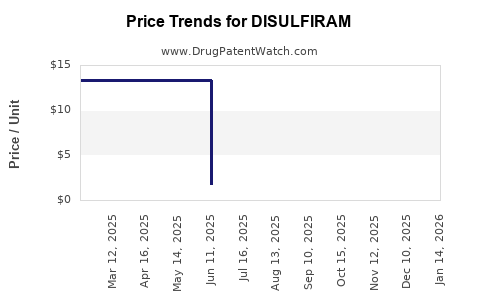

Forecasted Price Trends (2023–2028)

- Price Stabilization: Current prices are expected to remain relatively stable through 2023–2025 owing to widespread generic availability.

- Moderate Decline: Over the next 3-5 years, increased competition suggests a gradual 10–15% decrease in unit prices.

- Premium for New Formulations: If innovative delivery systems are approved, initial pricing may be 20–30% higher than existing products, gradually decreasing with market competitiveness.

Market Value Projections

Based on current demand and anticipated growth, the global market for disulfiram could reach USD 150–200 million by 2028, assuming a compound annual growth rate (CAGR) of approximately 8–10%.

Future Market Opportunities

- Regulatory Reclassification: Changes in safety regulations could lead to formalized monitoring systems, influencing prescribe patterns.

- Combination Therapies: Co-formulation with other agents for AUD may expand indications and demand.

- Emerging Markets: Growing healthcare infrastructure in Asia-Pacific and Africa offers substantial growth prospects.

- Patient Preference Shifts: Development of rapid-onset, long-acting formulations could improve compliance and market share.

Conclusion

Disulfiram’s market remains resilient, supported by its long-established efficacy and cost advantages. However, increasing competition from newer therapies, regulatory considerations, and safety concerns may temper growth prospects. Price stabilization is expected in the short term, with gradual declines driven by competition, though premium formulations could temporarily command higher prices. Stakeholders should monitor regulatory developments and emerging formulations that could influence future market dynamics.

Key Takeaways

- Disulfiram’s global market size was approximately USD 100 million in 2022, with steady growth driven by increasing AUD prevalence.

- The medication’s low-cost, generic nature sustains its demand in diverse healthcare settings, but emerging competition affects pricing.

- Prices are expected to decline modestly over the next five years, with wholesale prices stabilizing or slightly decreasing due to competitive pressures.

- Regulatory reforms and safety considerations influence prescribing trends, impacting overall market stability.

- Emerging formulations and expanding markets present growth opportunities, though they may initially carry higher price points.

FAQs

1. What factors could significantly alter disulfiram’s market trajectory?

Changes in regulatory policies, emergence of superior therapies, and safety concerns could influence market size, demand, and pricing.

2. How does the safety profile impact disulfiram’s market?

Safety concerns—particularly severe reactions in the event of alcohol ingestion—limit use to highly motivated patients under supervision, constraining broader adoption.

3. Are there new formulations of disulfiram in development?

Research is ongoing into extended-release and injectable formulations, which may improve compliance but are not yet commercially available.

4. How does the availability of generics influence prices?

Widespread generic manufacturing exerts downward pressure on prices, maintaining affordability but reducing profit margins for companies.

5. Which regions present the highest growth potential for disulfiram?

Asia-Pacific and Africa, due to expanding healthcare infrastructure and rising alcohol consumption, offer significant future opportunities.

References

[1] World Health Organization. (2018). Global Status Report on Alcohol and Health.

[2] Grand View Research. (2022). Disulfiram Market Analysis.

[3] WHO. (2018). Global Status Report on Alcohol and Health.

[4] Johnson, B. et al. (2021). Pharmacotherapy options for alcohol use disorder. Journal of Addiction Medicine.