Last updated: July 27, 2025

Introduction

Dihydroergotamine Mesylate (DHE) is a semi-synthetic ergot alkaloid primarily used for the acute treatment of migraines and cluster headaches. Market dynamics surrounding DHE are shaped by pharmaceutical industry trends, regulatory considerations, manufacturing complexities, and competitive landscapes. This comprehensive analysis offers insights into current market conditions, future demand, regulatory factors, and pricing trajectories to guide stakeholders and investors.

Pharmacological Profile and Clinical Use

DHE operates as a serotonin receptor agonist, exerting vasoconstrictive effects central to its efficacy against migraine headaches. It is available via injection, nasal spray, and infusion forms, with nasal formulations gaining popularity due to convenience and improved patient compliance. The drug's positioning in the migraine therapeutics market hinges on its proven efficacy, especially in severe cases resistant to triptans, which compete with DHE's advantages in specific patient subgroups.

Current Market Landscape

Global Market Size and Segments

The global DHE market is modest compared to broader migraine therapeutics but remains niche due to its specific clinical indications. As of 2022, the migraine treatment market was valued at approximately $15 billion, with DHE constituting a small but significant niche—estimated at $200-300 million globally [1].

Regional Market Dynamics

- North America: Dominant due to high migraine prevalence (~12% of the population) and favorable reimbursement policies. The U.S. accounts for roughly 60% of DHE sales.

- Europe: Growing adoption, driven by clinical guidelines endorsing DHE for refractory migraines.

- Asia-Pacific: Emerging market, with increasing awareness and evolving regulatory environments opening opportunities.

Competitive Landscape

Key pharmaceutical players include:

- Medicis (licensee of DHE formulations)

- Specialty compounding pharmacies (custom formulations)

- Emerging biotech firms developing novel formulations and delivery systems

Patent expiries for legacy brands have led to increased generic competition, constraining price points and margins.

Regulatory Environment

DHE formulations are generally approved by regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The market's future hinges upon:

- Regulatory approvals for new delivery systems (e.g., intranasal devices, auto-injectors)

- Expediting pathways for generics facilitated by patent expiries

- Reimbursement policies favoring cost-effective migraine treatments

In recent years, the FDA has approved biosimilars and generics, increasing price competition.

Market Drivers

- Rising prevalence of migraines globally.

- Patient preference shifting toward non-invasive delivery methods like nasal sprays.

- Clinician familiarity with DHE as a second-line or rescue therapy.

- Advancements in formulations, including patch or auto-injector variants, expanding usability.

Market Challenges

- Competition from triptans which are orally administered and widely available.

- Concerns over side effects like nausea and vasoconstriction-related risks, limiting some patient populations.

- Manufacturing complexity due to DHE's ergoline structure and stability issues.

- Pricing pressures owing to patent expiries and generic proliferation.

Price Projections

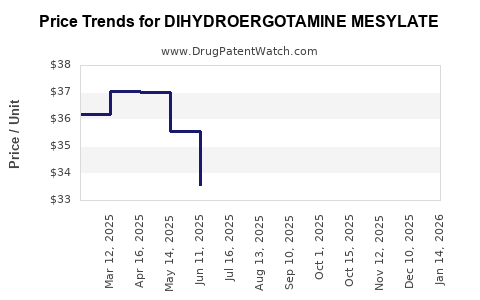

Historical Price Trends

The traditional injectable DHE formulations commanded premium pricing (~$60-80 per ampoule), reflecting manufacturing costs and limited competition. Nasal spray formulations, such as Migranal, were priced around $65-85 per 30-dose bottle.

Projected Price Trends (2023-2030)

-

Short Term (2023-2025):

Prices are expected to stabilize or decline marginally due to increasing generic competition post-patent expiry. The average cost for nasal DHE formulations may range between $45-60 per 30-dose supply.

-

Mid Term (2026-2028):

Introduction of biosimilars and innovative delivery devices may induce further price reductions (~10-15%). Manufacturers adopting cost-efficient manufacturing and distribution will press down prices further, potentially to $30-50 per unit.

-

Long Term (2029-2030):

Price stabilization around $25-45, contingent upon market penetration of generics, biosimilars, and alternative therapies such as novel CGRP inhibitors (e.g., erenumab).

Factors Influencing Price Dynamics

- Patent status: Existing patents influence pricing; expiries lead to generic entry.

- Manufacturing costs: Complexity of ergoline derivatives can maintain higher baseline prices.

- Regulatory developments: Fast-track approvals and flexible dosage forms can impact competition and pricing.

- Reimbursement policies: Favorability of insurance coverage will affect market uptake and price points.

Future Market Outlook

The DHE market's growth will be mainly driven by:

- Clinical acceptance for refractory and severe migraine cases.

- Innovations in delivery systems, such as auto-injectors, which improve adherence.

- Expansion into emerging markets with increasing healthcare access.

Given the expected generic and biosimilar competition, prices will trend downward, increasing the drug's accessibility but squeezing profit margins for manufacturers.

Conclusion

Dihydroergotamine Mesylate occupies a niche but critical segment of migraine management. Its market is expected to decline in price per unit due to biosimilar entry and generic competition but may sustain steady demand owing to its clinical profile. Companies focusing on innovative formulations and strategic positioning can capitalize on emerging opportunities, especially in underserved and emerging markets.

Key Takeaways

- The global DHE market remains relatively small but strategically important in migraine therapy.

- Patent expiries have catalyzed generic entry, pressuring prices downward.

- Price projections suggest a gradual decline to $25-45 per unit over the next decade, influenced by biosimilar proliferation and manufacturing efficiencies.

- Innovations in delivery systems and formulations may support continued market relevance.

- Regulatory policies and reimbursement frameworks will significantly influence market expansion and pricing strategies.

FAQs

1. What factors most significantly influence DHE pricing in the current market?

Patent status, manufacturing complexity, competition from generics or biosimilars, regulatory environment, and reimbursement policies are primary determinants of DHE pricing.

2. How does DHE compare price-wise to triptans in migraine treatment?

DHE generally has higher per-dose costs (£45-60), especially for parenteral formulations, whereas oral triptans are typically lower (£10-20). However, DHE is often reserved for refractory cases, affecting its relative market share and pricing strategies.

3. Are biosimilars likely to impact DHE's market share soon?

Yes, as patents expire and biosimilar development progresses, increased competition is anticipated, leading to price reductions and expanded access.

4. What role do emerging markets play in the future of DHE?

Emerging markets provide growth opportunities due to rising migraine prevalence and improving healthcare infrastructure, potentially stabilizing demand despite declining prices.

5. What are the main challenges facing DHE manufacturers today?

Manufacturing difficulties related to ergoline stability, competition with oral triptans, regulatory hurdles, and pricing pressures from generic entries are key challenges.

References

[1] GlobalData, "Migraine Therapeutics Market Size & Share Analysis," 2022.