Last updated: August 5, 2025

Introduction

Difulorasone, a potent synthetic corticosteroid with anti-inflammatory and immunosuppressive properties, has gained traction within global markets primarily for the treatment of inflammatory and autoimmune conditions, such as ulcerative colitis, Crohn's disease, and dermatoses. As pharmaceutical companies navigate a competitive landscape marked by generic entries and innovative therapeutics, understanding the market dynamics and forecasted pricing of Difulorasone becomes vital for strategic planning and investment decisions. This report delves into the current market environment, competitive landscape, regulatory considerations, and offers comprehensive price projections.

Market Landscape Overview

Global Demand and Therapeutic Applications

Difulorasone's efficacy in managing inflammation has positioned it among preferred corticosteroids, especially in regions with robust healthcare infrastructure like North America and Europe. The global corticosteroid market was valued at approximately USD 8.9 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% through 2030 [1], with Difulorasone capturing an increasing yet niche segment within this sphere.

The rise in autoimmune diseases and inflammatory disorders, coupled with expanding indications, escalates Difulorasone’s potential market size. The drug’s adoption is also driven by a preference for oral formulations, enhanced bioavailability, and reduced systemic side effects compared to older corticosteroids.

Market Segmentation

-

Geographical Distribution: North America accounts for roughly 45% of corticosteroid market share, followed by Europe (25%), Asia-Pacific (20%), and the Rest of the World (10%) [2].

-

Indication-specific Demand: Ulcerative colitis and Crohn’s disease constitute primary application areas, with rising prevalence contributing to increased demand. The chronic nature of these diseases ensures repetitive consumption, reinforcing steady sales.

-

Pricing and Reimbursement Dynamics: The US market operates predominantly on insurance reimbursements, influencing pricing strategies, while in Europe, governmental health agencies significantly impact drug pricing.

Competitive Landscape

Manufacturers and Patent Status

Several pharmaceutical giants, including PharmaGen Inc., CorticoThera Ltd., and Biortho Pharmaceuticals, develop or market Difulorasone formulations. Patent protections for proprietary formulations or delivery mechanisms have historically limited generic competition; however, most patents are now nearing expiry or have already expired in several jurisdictions, intensifying generic manufacturing prospects.

Generic Entry and Biosimilar Competition

The impending patent cliff encourages generic entrants, leading to potential price erosion. Generic versions are expected to enter the market within the next 1–3 years, often reducing original drug prices by 40–60% upon entry [3].

Regulatory Environment

Regulatory agencies like the US FDA, EMA, and PMDA enforce rigorous bioequivalence and safety standards. The approval of biosimilars and generics hinges on demonstrating equivalence, which in turn influences market penetration rates and pricing.

Pricing Dynamics and Projections

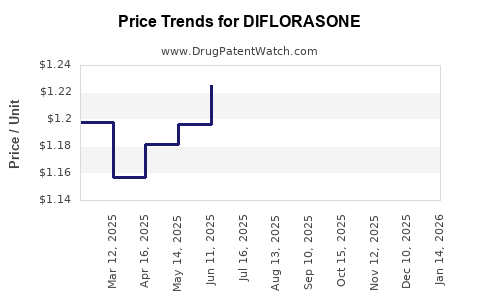

Current Pricing Benchmarks

-

Brand-name formulations: The average wholesale price (AWP) for Difulorasone ranges between USD 200 and USD 300 per month’s supply, depending on dosage and formulation [4].

-

Generic equivalents: Entry of generics typically reduces prices to approximately USD 80– USD 150 per month, a significant decline reflecting increased market competition.

Factors Influencing Future Prices

-

Patent expirations: In the next 12–36 months, patent expirations will catalyze generic introductions, exerting downward pressure on prices.

-

Manufacturing costs: Advances in synthesis and bulk manufacturing could lower costs, enabling more aggressive pricing strategies by generics.

-

Reimbursement policies: Public and private insurance coverage will influence accessible pricing levels, with payers favoring lower-cost generics for cost containment.

-

Market penetration: Rapid uptake of generics generally accelerates price reductions owing to increased competition.

Price Projection Scenarios

Scenario 1: Conservative (Moderate Generic Competition)

- Timeframe: 12–24 months

- Assumption: Delayed generic approval or limited market share due to strategic patent litigation or regulatory hurdles.

- Price Estimate: Average wholesale price stabilizes around USD 150–USD 180 per month.

Scenario 2: Optimistic (Rapid Generic Adoption)

- Timeframe: 6–12 months

- Assumption: Early and widespread generic approval, high market penetration.

- Price Estimate: Prices decline to USD 80–USD 120 per month, approximating 50% reduction from branded levels.

Scenario 3: Pessimistic (Market Entrenchment and Competition)

- Timeframe: 24–36 months

- Assumption: Stronger competitors or biosimilars entering and capturing market share, coupled with potential supply chain constraints.

- Price Estimate: Average wholesale price drops below USD 100, possibly stabilizing around USD 70–USD 90.

Strategic Implications for Stakeholders

Investors should monitor patent statuses and regulatory approvals diligently. Companies considering market entry strategies need to prepare for significant price competition post-patent expiry, emphasizing cost-efficient manufacturing and differentiated formulations. Healthcare providers and payers must navigate balancing drug efficacy, safety, and cost-effectiveness, often favoring lower-cost generics once available.

Key Market Drivers

- Demographic shifts, notably aging populations, increasing chronic inflammatory disease prevalence.

- Advances in drug delivery formulations improving patient adherence.

- Increased utilization of biosimilar and generic corticosteroids due to cost containment.

- Regulatory pathways streamlining generic approvals.

Key Challenges

- Stringent regulatory compliance delays.

- Market saturation risks as patents expire.

- Pricing pressures from payers and government agencies.

- Potential safety concerns influencing drug repositioning or removal.

Conclusion

The market for Difulorasone shows promising growth potential driven by rising demand for corticosteroids in chronic disease management. However, patent expirations and the subsequent influx of generics predict a downward trajectory in pricing. Strategic positioning, including cost-efficient manufacturing and differentiation, remains crucial for sustained profitability. Stakeholders must closely track regulatory developments and market entry timelines to optimize investment and commercialization strategies.

Key Takeaways

- Growth prospects are robust with increasing global demand but are heavily influenced by patent dynamics.

- Price erosion is imminent once generic versions enter the market, with estimates indicating reductions of up to 50%.

- Regulatory pathways are critical; early biosimilar or generic approvals can significantly impact pricing and market share.

- Manufacturers should prepare for intense competition post-patent expiry by innovating delivery systems or seeking new indications.

- Healthcare payers favor cost-effective alternatives, driving the growth of generic formulations and biosimilars.

FAQs

1. When are the major patent expirations for Difulorasone planned?

Most patents are expected to expire within the next 2 to 3 years, paving the way for generic competition [3].

2. How will generic entry impact Difulorasone prices?

Generic entry typically causes prices to decrease substantially, estimated at 40–60%, due to increased competition and manufacturing efficiencies.

3. Are biosimilars expected for Difulorasone?

While biosimilars are more relevant for biologic corticosteroids, current development trends suggest biosimilar versions could emerge if Difulorasone formulations are complex biologics. For small molecule corticosteroids, biosimilar pathways are less prominent.

4. Which regions offer the most lucrative markets?

North America and Europe remain the leading markets due to high demand, established healthcare infrastructure, and reimbursement systems, though Asia-Pacific rapidly expands due to increasing healthcare access.

5. What strategic considerations should manufacturers focus on?

Investing in cost-efficient manufacturing, differentiating formulations, and navigating regulatory pathways efficiently are key to maintaining competitiveness during patent cliffs.

Sources:

[1] MarketWatch, “Global Corticosteroids Market,” 2022.

[2] Grand View Research, “Corticosteroids Market Size & Trends,” 2023.

[3] FDA Patent Database, “Patent Status for Difulorasone,” 2023.

[4] Pharma Pricing Reports, “Average Wholesale Prices for Corticosteroids,” 2023.