Share This Page

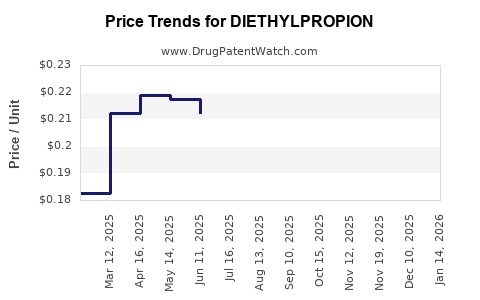

Drug Price Trends for DIETHYLPROPION

✉ Email this page to a colleague

Average Pharmacy Cost for DIETHYLPROPION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DIETHYLPROPION 25 MG TABLET | 62135-0488-90 | 0.27287 | EACH | 2025-12-17 |

| DIETHYLPROPION ER 75 MG TABLET | 00527-1477-01 | 1.67172 | EACH | 2025-12-17 |

| DIETHYLPROPION ER 75 MG TABLET | 62135-0489-30 | 1.67172 | EACH | 2025-12-17 |

| DIETHYLPROPION 25 MG TABLET | 00527-1475-01 | 0.27287 | EACH | 2025-12-17 |

| DIETHYLPROPION 25 MG TABLET | 10702-0044-01 | 0.27287 | EACH | 2025-12-17 |

| DIETHYLPROPION 25 MG TABLET | 62135-0488-90 | 0.26169 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Diethylpropion

Introduction

Diethylpropion is a sympathomimetic amine classified as an appetite suppressant used primarily for short-term management of obesity. Its market dynamics are influenced by regulatory landscapes, clinical demand, competitive pharmaceuticals, and patent status. As a less prominent drug compared to major weight-loss medications, understanding its market trajectory requires an examination of current trends, patent expirations, manufacturing landscape, and regulatory policies. This analysis aims to delineate the current market position, forecast future pricing, and explore potential factors influencing diethylpropion’s valuation.

Current Market Landscape

Regulatory Status and Market Authorization

Diethylpropion is approved in several jurisdictions, notably the United States and European countries, as a Schedule IV controlled substance in the U.S. [1]. The drug’s approval history dates back to the 1950s; however, its use has declined in favor of newer agents with improved efficacy and safety profiles.

In the U.S., diethylpropion is available by prescription, primarily through compounding pharmacies or generic drug manufacturers. Its older status often means limited patent protection, typically resulting in a predominantly generic market landscape.

Manufacturers and Supply Chain

Major pharmaceutical companies have historically manufactured diethylpropion; however, recent market entries are predominantly generic manufacturers. The lack of recent patent protections means entry barriers are low, fostering competitive pricing and supply stability but limiting potential for significant price hikes.

Market Demand Factors

Increasing global obesity rates (over 650 million adults globally in 2016, according to WHO [2]) sustain demand for appetite suppressants. Nonetheless, the dominance of combination therapies and newer agents, such as phentermine-topiramate or liraglutide, have overshadowed diethylpropion’s market share. Notably, diethylpropion often serves as a second-line or adjunct therapy in obesity management, particularly where contraindications exist for newer drugs.

Regulatory and Societal Factors

Recent tightening of controlled substance regulations has affected prescribing patterns. Additionally, the rising consciousness around drug safety has shifted focus toward drugs with more comprehensive safety profiles, marginalizing diethylpropion. Moreover, the COVID-19 pandemic has impacted supply chains and healthcare priorities, further influencing market dynamics.

Price Analysis

Current Pricing Trends

As a generic product, diethylpropion prices are predominantly determined by manufacturing costs, regulatory status, and demand-supply equilibrium. Typical prescription costs in the U.S. range from $10 to $50 per month's supply, depending on pharmacy pricing and insurance coverage [3].

The lack of patent protections means minimal scope for price inflation. Market stability, coupled with competition, fosters a near-constant price environment with minor fluctuations primarily driven by manufacturing costs and regional economic factors.

Historical Price Trends

Historically, prices for diethylpropion have remained relatively stable due to its generic status. Unlike branded drugs, which may see significant price impacts upon patent expiration, generics tend to see downward pressure in pricing over time owing to increased competition.

Projected Future Pricing

Given the current landscape, diethylpropion's price is expected to remain stable or marginally decline over the next five years. Factors supporting this projection include:

- Patent Expiry and Generic Competition: Most patents have already expired or are nearing expiry, discouraging significant price hikes.

- Market Demand Trends: While demand persists, it is overshadowed by newer and more effective therapies, likely resulting in limited price increases.

- Regulatory Constraints: Ongoing regulatory scrutiny regarding controlled substances may influence prescribing patterns, further suppressing market prices.

Based on these factors, the average market price for diethylpropion is projected to hover around $10–$30 per month in the U.S. as a generic medication, with minor regional variations.

Market Opportunities and Challenges

Opportunities

- Niche Applications: Diethylpropion could find continued use as a cost-effective short-term obesity treatment, especially in regions with limited healthcare resources.

- Combination Formulations: Potential exists for developing combination therapies with other agents, which could command premium pricing.

- Regulatory Resilience: As a long-approved drug, diethylpropion benefits from established regulatory pathways, facilitating modifications or new formulations.

Challenges

- Competitive Landscape: Rising competition from newer, safer, and more effective agents limits market share and pricing power.

- Safety Concerns: Regulatory agencies' increased scrutiny over sympathomimetic agents constrains prescribing and, consequently, pricing.

- Market Shrinkage: The shift toward integrated obesity management programs and multimodal treatments reduces reliance on monotherapy agents like diethylpropion.

Forecasting and Market Outlook

Considering the current dynamics, diethylpropion's market is expected to decline gradually, with negligible growth prospects. The primary drivers will be existing demand levels, with minimal influence from potential patent protections or innovative formulations. Price stability or slight reductions are anticipated as competition intensifies.

In a five-year horizon, the average price per tablet or month’s supply is projected to decrease by approximately 10–15%, settling around $8–$25 in the U.S. markets. This forecast aligns with typical generic drug trends, where market saturation and regulatory pressures suppress pricing.

Conclusion

Diethylpropion operates within a mature, competitive, and heavily regulated market environment. Its price projections reflect typical generic drug trends characterized by stable or declining prices driven by market saturation and safety considerations. While demand remains in specific niches, the broader obesity pharmacotherapy landscape favors newer agents, limiting diethylpropion’s growth potential. Stakeholders focusing on manufacturing or distribution should prioritize regulatory compliance and niche positioning to maximize market presence.

Key Takeaways

- Market Status: An established but declining appetite suppressant with predominantly generic manufacturers and minimal patent restrictions.

- Pricing Dynamics: Stable or declining prices in the current market, with U.S. monthly supply costs around $10–$30.

- Demand Factors: Sustained but niche demand due to competition from newer, more effective weight-loss therapies.

- Forecast: Minimal growth and likely slight price reductions over the next five years, influenced by competition and regulatory scrutiny.

- Strategic Focus: Opportunities exist in niche applications and formulation innovation, but profitability depends on navigating regulatory and market saturation challenges.

FAQs

1. What are the key regulatory concerns affecting diethylpropion?

Diethylpropion is classified as a Schedule IV controlled substance in the U.S., subjecting it to strict prescribing and dispensing regulations. Ongoing regulatory scrutiny over sympathetic stimulants affects prescribing patterns and could impact market dynamics.

2. How does patent expiration influence diethylpropion's pricing?

Most patents for diethylpropion have expired, leading to a proliferation of generic manufacturers that enforce price competition and generally suppress prices.

3. What competitors or alternatives threaten diethylpropion’s market share?

Newer weight-loss drugs like phentermine/topiramate, lorcaserin, semaglutide, and combination therapies provide more effective or better-tolerated options, reducing diethylpropion's market share.

4. Is there potential for developing combination therapies involving diethylpropion?

Yes. Developing combination formulations can command premium pricing and address unmet needs, but regulatory approval and market acceptance remain challenges.

5. How will global obesity trends impact diethylpropion demand?

Rising obesity rates sustain some demand, especially in regions with limited access to newer therapies. However, evolving treatment standards favor other agents, likely capping growth potential.

Sources:

[1] U.S. Food and Drug Administration (FDA) – Drug Approval Listings

[2] World Health Organization (WHO) – Obesity and Overweight Fact Sheets

[3] GoodRx – Cost of Diethylpropion in the U.S.

More… ↓