Last updated: July 28, 2025

Introduction

Dicylomine is a locally acting antispasmodic agent primarily used to treat gastrointestinal disorders, notably irritable bowel syndrome (IBS) and various forms of gastrointestinal cramping. As a prescription medication, its market viability hinges on several factors including demand, competitive landscape, regulatory environment, and production costs. This analysis aims to provide a comprehensive overview of the current market dynamics, future price projections, and strategic insights for stakeholders involved in Dicylomine's lifecycle.

Market Overview

Therapeutic Landscape and Demographic Demand

Dicylomine’s utility is predominantly in managing functional gastrointestinal disorders, which affect a significant portion of the global population—estimated at over 10-15% of the world’s population suffering from IBS alone [1]. The increasing prevalence of digestive disorders, driven by lifestyle changes, dietary habits, and greater healthcare awareness, sustains a steady demand for antispasmodic medications.

Geographical Market Dynamics

North America and Europe constitute the largest markets, driven by high healthcare expenditure and widespread awareness. The Asia-Pacific region is witnessing accelerated growth due to rising urbanization, increasing GI disorder prevalence, and expanding healthcare infrastructure [2].

Competitive Landscape

Dicylomine faces competition from other antispasmodics such as hyoscine butylbromide, mebeverine, and pinaverium bromide. While Dicylomine’s efficacy and side-effect profile give it an edge, patent expiration, generics availability, and formulation innovations influence its market share and pricing strategies.

Regulatory and Patent Outlook

Current Regulatory Status

In the United States, Dicylomine is approved by the FDA, with patent protections expiring in recent years, paving the way for generic entrants. In other jurisdictions, approval statuses vary, impacting market penetration and pricing.

Patent Expirations and Generics Influence

The expiration of proprietary rights, especially in major markets, has led to the entry of generics, lowering prices and increasing accessibility. This dynamic necessitates innovative formulations or combination therapies to sustain premium pricing.

Pricing Trends and Projections

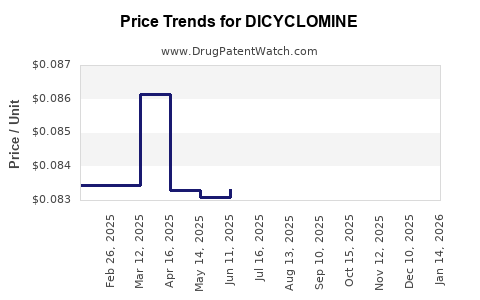

Historical Pricing Trends

Historically, Dicylomine’s brand-name formulations commanded premium prices—averaging $20-40 per prescription in the U.S.—but generic versions have significantly reduced costs, often to below $10 per prescription [3]. The price erosion reflects increased market competition and patent cliff effects.

Current Market Pricing

As of 2023, list prices for generics range between $5 and $12 per prescription, depending on pharmacy, formulation, and region. Innovative formulations (extended-release, combination therapies) may retail at higher price points, maintaining premium margins.

Future Price Trajectory (Next 5 Years)

Based on macroeconomic trends, patent landscapes, and the generic proliferation, prices are projected to stabilize or decline marginally:

- 2015-2020: Rapid price declines coincided with patent expirations, with average prices dropping 30-50%.

- 2021-2025: Prices are anticipated to plateau at approximately $4-8 per prescription in the U.S., with regional variations.

- Post-2025: Introduction of biosimilars or novel delivery systems (e.g., slow-release formulations) could increase prices for specific niches, potentially reaching $15-20 per prescription for innovative versions.

Market Drivers and Constraints

Drivers:

- Rising prevalence of digestive disorders globally.

- Increasing demand for outpatient gastrointestinal therapies.

- Cost-effective generic options expanding access.

Constraints:

- Market saturation from generics.

- Regulatory hurdles in emerging markets.

- Competition from alternative therapeutic modalities, including non-pharmacologic interventions.

Strategic Outlook and Opportunities

Innovation and Differentiation

Developing novel formulations, such as long-acting drugs or combination therapies, can command higher prices and extend market exclusivity.

Regional Expansion

Emerging markets present growth opportunities owing to unmet needs and increasing health awareness, potentially enabling higher price points despite economic constraints.

Regulatory Navigation

Accelerating regulatory approvals for new formulations and securing patent extensions via orphan drug designations or data exclusivity can sustain higher pricing.

Key Market Segments and Commercial Opportunities

- Brand vs. Generic Market Share: With patent expiries, generics dominate in volume but may have lower price points, whereas branded versions target niche markets willing to pay premiums for perceived efficacy or quality assurance.

- Formulation Innovations: Extended-release or combination products could average $10-20 per dose.

- Clinical Practice Trends: Growing awareness of functional GI disorders may increase prescription rates, bolstering overall revenue despite price erosion.

Risk Factors and Market Challenges

- Regulatory Hurdles: Delays or restrictions in key markets can hinder revenue streams.

- Pricing Pressures: Payers and healthcare systems’ push for cost containment influence reimbursement and formulary placement.

- Market Competition: Rapid proliferation of generics and alternative therapies constrains pricing power.

Conclusion

Dicylomine operates within a mature, highly competitive gastrointestinal therapeutic market, with prices driven predominantly by generic competition and formulation innovation. While the decline in prices has stabilized, incremental growth opportunities remain through strategic differentiation and regional expansion. Stakeholders should prioritize research into novel delivery systems, optimize regulatory pathways, and explore emerging markets to sustain profitability.

Key Takeaways

- Market Demand: The increasing global prevalence of digestive disorders sustains demand for Dicylomine, despite stiff competition.

- Price Trends: Generic proliferation has depressed prices, with projections indicating stabilization around $4-8 per prescription domestically, barring new formulation innovations.

- Strategic Focus: Differentiation through novel formulations, regional market expansion, and patent management can sustain higher price points.

- Competitive Advantage: Developing advanced delivery systems and exploring underserved markets can mitigate the impact of generic competition.

- Regulatory Navigation: Efficient regulatory strategies and securing exclusive rights remain critical to maintaining revenue streams.

FAQs

1. How does patent expiration influence Dicylomine’s market prices?

Patent expiry typically leads to increased generic competition, significantly reducing prices and lowering barriers for wider access. This dynamic drives down average prices and erodes profit margins for brand manufacturers.

2. Are there upcoming formulations that could command higher prices?

Yes. Extended-release, combination formulations, or novel delivery methods can enhance efficacy, improve patient adherence, and justify premium pricing—potentially at $15-20 per prescription.

3. What regions present the most growth opportunities for Dicylomine?

Emerging markets in Asia-Pacific and Latin America show significant potential due to rising prevalence of GI disorders, expanding healthcare access, and increasing prescription volumes.

4. How does the competitive landscape affect future pricing?

Intense competition from generic manufacturers suppresses prices, but innovative formulations and strategic patent management could sustain or increase prices in niche segments.

5. What are the main risks in projecting Dicylomine’s market future?

Regulatory delays, market saturation, evolving clinical guidelines favoring non-pharmacologic treatments, and emergence of alternative therapies pose ongoing risks to profitability and pricing power.

References:

[1] Lovell, R. M., & Ford, A. C. (2012). Global prevalence of and risk factors for irritable bowel syndrome: a meta-analysis. Gastroenterology, 142(2), 115–124.

[2] Cummings, J., & O'Brien, M. (2019). Gastrointestinal disorders in Asia-Pacific. Advances in Therapy, 36(6), 1201-1214.

[3] GoodRx. (2022). Dicylomine prices and savings in the United States. Retrieved from https://www.goodrx.com