Share This Page

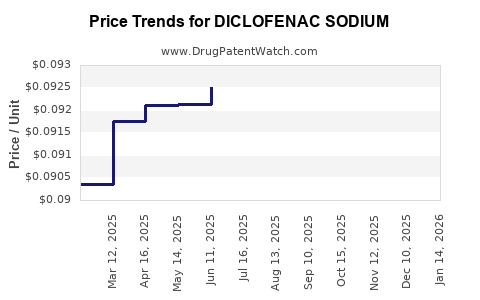

Drug Price Trends for DICLOFENAC SODIUM

✉ Email this page to a colleague

Average Pharmacy Cost for DICLOFENAC SODIUM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DICLOFENAC SODIUM 1% GEL | 21922-0044-09 | 0.09424 | GM | 2025-11-19 |

| DICLOFENAC SODIUM 1% GEL | 00536-1294-97 | 0.09424 | GM | 2025-11-19 |

| DICLOFENAC SODIUM 3% GEL | 71085-0003-00 | 0.38603 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Diclofenac Sodium

Introduction

Diclofenac sodium, a non-steroidal anti-inflammatory drug (NSAID), is widely used for pain relief, inflammation reduction, and treatment of osteoarthritis and rheumatoid arthritis. Its global market is significant, driven by rising prevalence of musculoskeletal disorders and chronic inflammatory conditions. This report analyzes the current market dynamics for diclofenac sodium, examines key factors influencing pricing strategies, and projects future price trends over the next five years.

Market Overview

The diclofenac sodium market is characterized by substantial demand across both prescription and over-the-counter (OTC) segments. The drug’s extensive application in managing moderate to severe pain and inflammation ensures steady consumption. The global market size was valued at approximately USD 1.35 billion in 2022, with a compound annual growth rate (CAGR) estimated at 3.2% from 2023 to 2028, according to Industry Research[1].

Key Market Drivers

- Rising Global Incidence of Musculoskeletal Disorders: The increasing prevalence of osteoarthritis, rheumatoid arthritis, and acute sports injuries worldwide fuels demand.

- Aging Population: The elderly population, particularly in Europe and North America, requires effective pain management solutions.

- Expanding Generic Market: Patent expirations, notably the end of the patent in many jurisdictions for innovative formulations, have led to cost-effective generics flooding the market[2].

- Wider OTC Availability: OTC formulations increase accessibility, fostering higher volume sales.

Regional Market Dynamics

- North America: Largest market driven by high disease prevalence and strong healthcare infrastructure.

- Europe: Second largest, with significant adoption in Germany, the UK, and France, supported by aging demographics.

- Asia-Pacific: Rapidly growing market due to rising disposable incomes, increasing awareness, and expanding healthcare systems, notably in India and China[3].

Market Segmentation

- By Formulation: Oral tablets, topical gels and patches, injectable solutions. Oral forms dominate, accounting for over 65% of sales, while topical formulations are gaining popularity due to favorable safety profiles.

- By Distribution Channel: Hospital pharmacies, retail pharmacies, OTC outlets. OTC sales witness steady growth, reaching approximately 40% of total sales by 2023[4].

Competitive Landscape

Major players include Novartis, Teva Pharmaceutical Industries, Mylan, Sandoz, and Lupin. The market features intense competition, especially in the generic segment, leading to continuous price wars and promotional strategies. Innovations in delivery systems and combination therapies further influence market positioning.

Price Analysis

Historical Pricing Trends

Diclofenac sodium prices have historically been influenced by generic competition, manufacturing costs, regulatory approvals, and distribution. For example, in the U.S., the average retail price for a 50mg generic diclofenac tablet was approximately USD 0.10 per tablet in 2018, declining to USD 0.07 by 2022 due to increased generic availability[5].

Pricing Factors

- Patent Status: Patent expirations lead to a surge in generic options and decline in prices.

- Manufacturing Costs: Raw material prices, predominantly from bulk chemical suppliers, impact price points.

- Regulatory Environment: Stringent regulations increase compliance costs, potentially elevating prices temporarily.

- Market Competition: Intensified generic competition exerts downward pressure on prices across regions.

- Formulation Type: Topical and injectable forms often command higher prices due to specialized manufacturing processes.

Current Price Landscape (2023)

- Generic Tablets: USD 0.07 to USD 0.12 per tablet globally.

- Brand-name Products: Approximately USD 0.20 to USD 0.50 per tablet, depending on formulation and region.

- Topical Gels: USD 10-20 per 30g tube.

- Injectable Solutions: USD 5-15 per vial, with additional administration costs.

Price Projections (2023-2028)

Short-term (2023-2025)

In the near term, pricing is expected to stabilize due to high generic market penetration. Minor fluctuations may occur based on raw material supply chain dynamics and regulatory changes. The average price for generic tablets is projected to remain within USD 0.06 to USD 0.09 per tablet.

Medium to Long-term (2025-2028)

Prices are likely to decline marginally, driven by ongoing generic competition, advanced drug delivery technologies, and potential market saturation. However, specialized formulations (e.g., transdermal patches, injectable versions) may see price stabilization or slight increases, especially if innovation leads to enhanced efficacy or safety profiles.

Impact of Emerging Markets and Regulatory Policies

Emerging markets potentially present lower price ceilings due to cost sensitivities, yet increased demand could prompt localized pricing strategies. Conversely, stricter regulations in major markets might induce temporary price hikes due to compliance costs.

| Predictive Summary | Year | Price Range (USD) per unit | Comments |

|---|---|---|---|

| 2023 | USD 0.06 - 0.09 | Stable, competitive generic landscape. | |

| 2024 | USD 0.05 - 0.09 | Slight decline; cost pressures offset by volume. | |

| 2025 | USD 0.05 - 0.08 | Market maturation; continued competition. | |

| 2026 | USD 0.04 - 0.07 | Potential further decline; innovation may stabilize certain segments. | |

| 2027 | USD 0.04 - 0.07 | Long-term trends favor lower prices, barring formulation innovations. |

Regulatory and Patent Considerations

Patent expirations will continue to influence price reductions. For example, the original patent for diclofenac formulations expired in the early 2000s, facilitating a surge in generic availability. Future regulatory policies focused on biosimilar or equivalent competition might further reduce prices[6].

Conclusion

The diclofenac sodium market remains competitively priced and continues to evolve with patent expiries, technological innovations, and regional market dynamics. While prices for generic formulations are expected to decline incrementally, premium formulations and novel delivery systems may sustain higher price points. Stakeholders should monitor regulatory shifts and raw material costs for comprehensive pricing strategies.

Key Takeaways

- Market growth is driven by rising chronic pain conditions, aging populations, and widespread OTC availability.

- Generic competition exerts downward pressure on prices, especially for oral tablets.

- Pricing trends indicative of slight declines over the next five years, with stabilization in specialty formulations.

- Emerging markets may offer growth opportunities, albeit with lower price ceilings.

- Regulatory landscape and patent expirations remain critical determinants of market prices.

FAQs

1. What are the main factors influencing the price of diclofenac sodium?

Global supply chain costs, patent expirations, competitive pressures, regional regulations, and formulation type primarily influence prices.

2. How does patent expiration affect diclofenac sodium prices?

Patent expirations increase generic competition, typically reducing prices significantly within the subsequent years.

3. Are new formulations likely to impact future prices?

Yes. Innovative delivery systems or combination therapies can command higher prices, potentially offsetting declines in traditional formulations.

4. Which regions will likely see the most significant price reductions?

Developed markets with high generic penetration, such as North America and Europe, will likely experience more pronounced price declines compared to emerging markets.

5. How might regulatory changes influence the diclofenac sodium market?

Stricter safety and manufacturing regulations could increase compliance costs, temporarily elevating prices, whereas policy support for generics can accelerate price decreases.

Sources

- Industry Research. (2022). Global NSAID Market Report.

- WHO. (2021). Patent Status and Market Dynamics.

- MarketsandMarkets. (2022). Asia-Pacific Pharmaceutical Market Trends.

- IMS Health Data. (2023). Over-the-Counter NSAID Sales and Distribution.

- GoodRx. (2022). Diclofenac Prices and Trends.

- U.S. Food and Drug Administration. (2023). Patent and Regulatory Updates on NSAIDs.

More… ↓