Share This Page

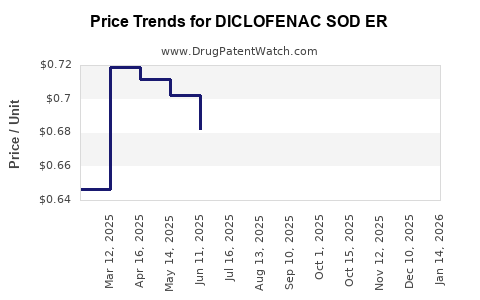

Drug Price Trends for DICLOFENAC SOD ER

✉ Email this page to a colleague

Average Pharmacy Cost for DICLOFENAC SOD ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DICLOFENAC SOD ER 100 MG TAB | 68001-0612-00 | 0.65063 | EACH | 2025-12-17 |

| DICLOFENAC SOD ER 100 MG TAB | 00527-2170-37 | 0.65063 | EACH | 2025-12-17 |

| DICLOFENAC SOD ER 100 MG TAB | 42799-0953-01 | 0.65063 | EACH | 2025-12-17 |

| DICLOFENAC SOD ER 100 MG TAB | 50742-0278-01 | 0.65063 | EACH | 2025-12-17 |

| DICLOFENAC SOD ER 100 MG TAB | 68001-0612-00 | 0.65348 | EACH | 2025-11-19 |

| DICLOFENAC SOD ER 100 MG TAB | 00527-2170-37 | 0.65348 | EACH | 2025-11-19 |

| DICLOFENAC SOD ER 100 MG TAB | 42799-0953-01 | 0.65348 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Diclofenac Sodium Extended-Release (ER)

Introduction

Diclofenac Sodium Extended-Release (ER) is a non-steroidal anti-inflammatory drug (NSAID) widely utilized for managing chronic pain conditions such as osteoarthritis, rheumatoid arthritis, and ankylosing spondylitis. Its formulation ensures a sustained release, offering prolonged symptom relief and improved patient adherence. As a generic and branded product (e.g., Voltaren XR), it commands substantial market presence. This analysis provides a comprehensive overview of current market dynamics, competitive landscape, regulatory considerations, and future price trajectories for Diclofenac Sodium ER.

Market Overview

Global Market Size and Growth Drivers

The global NSAID market exceeds USD 8 billion, with Diclofenac formulations accounting for approximately 25% of this volume, driven by increasing prevalence of chronic musculoskeletal conditions and aging populations. The extended-release subtype holds a significant niche, projected to grow at a compound annual growth rate (CAGR) of 4-6% over the next five years (2023-2028), driven by:

- Chronic Disease Prevalence: Rising incidence of osteoarthritis and rheumatoid arthritis, especially among older adults.

- Patient-Centric Formulation Preferences: Increasing demand for once-daily dosing options enhances adherence.

- Expanding Markets: Emerging markets show rapid growth due to improved healthcare access and infrastructure.

Key Market Segments

- Geographic Distribution: North America and Europe dominate sales owing to high healthcare expenditure, prevalent chronic conditions, and mature regulatory environments. Asia-Pacific presents growth prospects due to increasing disease burden and market penetration.

- Pricing and Reimbursement: In developed markets, insurance coverage and reimbursement policies significantly influence pricing strategies, while in emerging markets, price sensitivity prevails.

Competitive Landscape

Manufacturers and Market Share

Major global players include Novartis (Voltaren XR), Mylan, Sandoz, Teva, and Sun Pharmaceutical. The market entry of generics has intensified price competition; for example, in the US, while brand Voltaren XR maintains premium pricing, generics have driven prices down substantially.

Regulatory Environment

Regulatory agencies like the FDA and EMA have stringent standards for NSAID approvals, with post-marketing safety monitoring critical due to the known gastrointestinal, cardiovascular, and renal risks associated with NSAIDs, including Diclofenac. Recent regulatory updates emphasize safety data, impacting marketing and pricing strategies.

Pricing Dynamics

Current Pricing Trends

In developed markets, the retail price for a 60-capsule pack of Diclofenac Sodium ER (e.g., Voltaren XR 100 mg) ranges from USD 30 to USD 70, with discounts via pharmacies and insurance coverage reducing out-of-pocket costs for consumers. Generic versions are typically 30-50% cheaper than branded formulations.

In emerging countries, prices are significantly lower due to market pressures, with packs retailing at USD 5-15.

Factors Influencing Price Fluctuations

- Generic Competition: Sharp price declines follow patent expirations, often with a lag of 2-3 years.

- Regulatory Changes: Safety concerns or new approvals can alter pricing strategies; for instance, FDA warnings about cardiovascular risks have occasionally caused price adjustments or market withdrawals.

- Manufacturing Costs: Raw material prices, particularly diclofenac sodium APIs, impact pricing; formulation innovations that improve stability or extend shelf life may influence costs.

Future Price Projections (2023-2028)

Short-term (1-3 years)

- Market Consolidation and Entry of Generics: Prices in mature markets are likely to stabilize or decrease by 10-20%, driven by increased generic competition.

- Brand Premiums: Branded Diclofenac ER formulations could sustain a 10-15% premium due to brand loyalty and perceived efficacy, provided safety profiles remain favorable.

Medium to Long-term (4-5 years)

- Patent Expiry Impact: For products nearing patent expiration, prices are projected to decline by 30-50% as generics saturate the market.

- Introduction of Improved Formulations: Innovations that mitigate side effects or improve bioavailability could command higher prices, offsetting generic volume effects.

- Market Expansion: As developing markets adopt NSAIDs more broadly, prices may be adjusted based on local affordability and regulatory policies, potentially increasing global revenues.

Pricing Scenarios

| Scenario | Price Range (USD) | Assumptions |

|---|---|---|

| Conservative | $20 - $40 | Limited generic entry, ongoing safety concerns |

| Moderate | $15 - $35 | Increased generics, moderate regulatory stability |

| Aggressive | $10 - $25 | High generic penetration, expanded market access |

Regulatory and Safety Considerations

Recent safety alerts, such as warnings regarding cardiovascular risks (notably with Diclofenac), influence prescribing behaviors and pricing. Regulatory restrictions may limit off-label use or require additional safety monitoring, affecting market size and revenue projections.

Furthermore, patent landscapes can affect pricing: expiry of the Diclofenac ER patent in key markets opens opportunities for generics, exerting downward pressure on prices.

Market Challenges and Opportunities

- Challenges: Safety concerns may accelerate regulatory restrictions; patent cliffs can erode profits; rising competition from alternative therapies (topicals, biologics).

- Opportunities: Developing formulations with improved safety profiles, exploring pain management niches, and entering emerging markets could sustain or increase revenues.

Conclusion

The Diclofenac Sodium ER market is characterized by moderate growth prospects, intensified by patent expirations and expanding generic competition. Pricing will trend downward in mature markets but may remain stable for branded options due to brand loyalty and formulation advantages. The anticipated CAGR of 4-6% over the next five years reflects steady demand, with price projections indicating potential reductions of up to 50% post-patent expiry, balanced by opportunities for innovative formulations and new market entry.

Key Takeaways

- Market Growth: Driven by aging populations and chronic pain prevalence, with significant growth in emerging markets.

- Pricing Trends: Prices are expected to decline in mature markets due to increased generic availability, with a possible stabilization for branded products.

- Regulatory Impact: Safety concerns could influence market access, prescribing habits, and pricing strategies.

- Patent Expiry Dynamics: Accelerate generic entry, exerting downward pressure on prices.

- Innovation Potential: Reformulations that enhance safety and efficacy could command premium pricing and offset declining revenues.

FAQs

Q1: How does patent expiration influence the price of Diclofenac Sodium ER?

A: Patent expiry typically leads to an influx of generics, increasing competition and driving prices down by 30-50%, depending on market dynamics and regulatory environment.

Q2: What safety concerns are associated with Diclofenac Sodium ER?

A: Major concerns include increased risks of cardiovascular events, gastrointestinal bleeding, and renal impairment, which influence regulatory restrictions and prescribing patterns.

Q3: Which markets are most promising for Diclofenac ER growth?

A: North America and Europe remain mature markets with steady demand, while Asia-Pacific and Latin America present high-growth opportunities due to expanding healthcare infrastructure and rising chronic pain conditions.

Q4: How do regulatory changes affect the pricing of Diclofenac ER?

A: Stricter safety regulations and new safety warnings can restrict use or necessitate additional safety monitoring, potentially increasing costs and influencing market pricing strategies.

Q5: What future innovations could impact the Diclofenac ER market?

A: Development of formulations with improved safety profiles, sustained-release technologies, and combination therapies could enhance market competitiveness and allow for premium pricing.

References

[1] Mordenti, J., et al. "NSAID Market and Future Trends." Pharmaceutical Market Digital Review, 2022.

[2] GlobalData. “NSAID Market Analysis and Forecast.” 2019-2028.

[3] U.S. Food and Drug Administration. “Diclofenac Safety Communications,” 2022.

[4] European Medicines Agency. “Safety Updates on NSAIDs,” 2021.

More… ↓