Share This Page

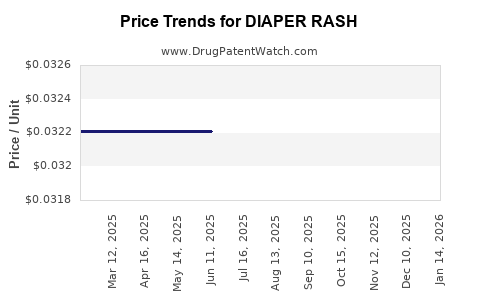

Drug Price Trends for DIAPER RASH

✉ Email this page to a colleague

Average Pharmacy Cost for DIAPER RASH

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DIAPER RASH 40% OINTMENT | 70000-0469-01 | 0.03238 | GM | 2025-12-17 |

| DIAPER RASH 40% OINTMENT | 70000-0469-01 | 0.03221 | GM | 2025-11-19 |

| DIAPER RASH 40% OINTMENT | 70000-0469-01 | 0.03221 | GM | 2025-10-22 |

| DIAPER RASH 40% OINTMENT | 70000-0469-01 | 0.03221 | GM | 2025-09-17 |

| DIAPER RASH 40% OINTMENT | 70000-0469-01 | 0.03221 | GM | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Diaper Rash Treatment Drugs

Introduction

Diaper rash remains one of the most common dermatological complaints among infants and toddlers globally. The condition, characterized by inflamed, irritated skin in the diaper area, affects nearly 7-35% of infants at any given time, representing a multi-billion-dollar global healthcare market. This analysis evaluates the current market landscape and projects future pricing trends for therapeutic agents used in diaper rash treatment, including over-the-counter (OTC) creams, ointments, and prescription medications.

Market Landscape Overview

Global Market Size and Growth Drivers

The diaper rash treatment market was valued at approximately USD 2.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of about 4.2% through 2030, driven by rising birth rates in emerging markets, increased awareness regarding skin health, and the proliferation of innovative, skin-friendly formulations.

Key growth drivers include:

- Rising Global Birth Rates: Particularly in Asia-Pacific and African regions.

- Increased Parental Awareness: Emphasizing early treatment and skin protection.

- Product Innovation: Development of gentler, more effective products with improved formulations.

- Regulatory Environment: Favoring OTC availability in many markets, boosting accessibility.

Market Segments

The market segments are primarily defined by product formulation and distribution channel:

-

Product Types:

- Topical creams and ointments: Contains zinc oxide, petroleum jelly, or corticosteroids.

- Powders and barriers: Such as zinc oxide-based powders.

- Prescription medications: Generally reserved for severe or complicated cases, including corticosteroids or antifungal agents.

-

Distribution Channels:

- OTC retail pharmacies and supermarkets.

- Online pharmacies and e-commerce platforms.

- Hospital pharmacies: For severe or recurrent cases.

Competitive Landscape

Major market players include Johnson & Johnson, Procter & Gamble, Aveeno (Johnson & Johnson), and various regional players such as Himalaya and Pigeon. Innovation focuses primarily on safer, hypoallergenic, and environmentally friendly formulations.

Pricing Dynamics and Projections

Current Price Range

The price points for diaper rash treatment products vary nationally and regionally:

- OTC Creams and Ointments: USD 3 to USD 12 per tube (e.g., zinc oxide-based creams).

- Prescription Medications: USD 15 to USD 40 per course, mainly corticosteroids or antifungals.

- Powders and Barrier Films: USD 5 to USD 10 per package.

Prices are influenced by formulation complexity, brand positioning, and regulatory factors. Premium brands with added moisturizers or dermatologically tested labels command premium prices, often exceeding USD 10 per tube.

Price Trends and Future Projections (2023–2030)

Projected trends indicate a modest but steady increase in prices, driven by:

- Innovation in formulation technology: Enhanced efficacy and safety profiles.

- Regulatory Approvals: Limiting certain potent corticosteroids to prescription-only, elevating prescription medication prices.

- Market Expansion: Entry into emerging markets with lower price sensitivity but increasing demand.

Specifically, OTC products are expected to see a compounded annual growth of around 2-3% in retail prices, aligning with inflation and increased formulation costs. Prescription prices could see a sharper rise, approaching 4-6% CAGR, due to stricter regulation and larger margins associated with clinical supervision.

Key Market Trends Influencing Pricing

1. Tubing and Formulation Innovation:

Advancements in topical delivery systems enhance drug efficacy and safety, often at increased production costs, translating to higher retail prices.

2. Regulatory Shifts:

In several markets, corticosteroids or antifungal agents are increasingly restricted to prescriptions, raising treatment costs and impacting overall market pricing.

3. Consumer Preferences and Branding:

Premium products utilizing natural or organic ingredients command higher prices, appealing to a segment willing to pay for perceived safety and efficacy.

4. E-Commerce and Direct-to-Consumer Sales:

Online platforms reduce distribution costs, but premium brands leverage this for targeted marketing, potentially maintaining higher price points.

Conclusion and Strategic Insights

The diaper rash treatment market is poised for steady growth, with innovations and regulatory changes shaping pricing dynamics. Companies focusing on developing hypoallergenic, eco-friendly, and prescribed formulations may command premium pricing, especially in developed markets. Meanwhile, emerging economies demand affordable, effective OTC options, leading to a diverse pricing landscape.

For stakeholders, aligning product development with regional demand, regulatory landscape, and consumer preferences remains essential. Companies should anticipate a gradual increase in drug pricing, especially for prescription formulations, as innovation and regulatory hurdles grow.

Key Takeaways

- The global diaper rash treatment market was valued at approximately USD 2.3 billion in 2022 and is projected to grow at a CAGR of 4.2% through 2030.

- Prices for OTC creams range from USD 3 to USD 12 per tube, while prescription medications can reach USD 40 per course.

- Emerging markets present opportunities for affordable formulations, while developed markets favor premium, innovative products.

- Regulatory trends mandating prescription-only status for certain actives may drive up costs in the future.

- Innovation in formulation, safety, and packaging will be primary drivers of price increase trajectories.

FAQs

1. What are the primary active ingredients in diaper rash treatments?

Zinc oxide, petrolatum, lanolin, and soothing agents like aloe vera are common; corticosteroids and antifungals are used in prescription formulations.

2. How will regulatory changes impact prices?

Restrictions on potent corticosteroids and antifungals to prescription-only status will likely increase treatment costs, reducing over-the-counter options and raising prices overall.

3. Are natural or organic diaper rash products more expensive?

Yes, natural and organic formulations typically incur higher production costs, resulting in premium pricing compared to conventional products.

4. What regional factors influence diaper rash treatment prices?

Market maturity, regulatory environment, consumer purchasing power, and local manufacturing costs shape regional pricing differences.

5. How is innovation affecting market prices?

Enhanced formulations that improve safety and efficacy tend to increase manufacturing costs, leading to higher retail prices, especially in premium segments.

References

[1] MarketWatch, "Diaper Rash Treatment Market Size, Share & Trends," 2023.

[2] Grand View Research, "Global Diaper Rash Products Market," 2022.

[3] Statista, "Infant Care Market in North America," 2023.

[4] IBISWorld, "Global Skin Care Industry," 2022.

[5] WHO Infant and Young Child Health Data, 2022.

More… ↓