Share This Page

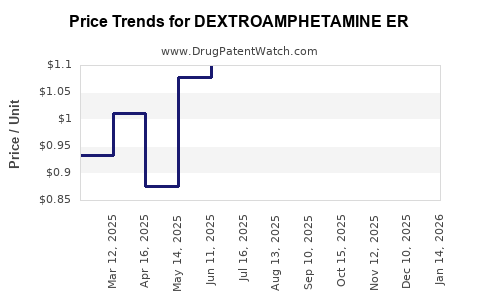

Drug Price Trends for DEXTROAMPHETAMINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for DEXTROAMPHETAMINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DEXTROAMPHETAMINE ER 15 MG CAP | 45963-0305-09 | 1.73828 | EACH | 2025-12-17 |

| DEXTROAMPHETAMINE ER 5 MG CAP | 00406-8960-01 | 1.01148 | EACH | 2025-12-17 |

| DEXTROAMPHETAMINE ER 15 MG CAP | 00406-8962-01 | 1.73828 | EACH | 2025-12-17 |

| DEXTROAMPHETAMINE ER 5 MG CAP | 45963-0303-09 | 1.01148 | EACH | 2025-12-17 |

| DEXTROAMPHETAMINE ER 10 MG CAP | 00406-8961-01 | 1.06260 | EACH | 2025-12-17 |

| DEXTROAMPHETAMINE ER 10 MG CAP | 45963-0304-09 | 1.06260 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Dextroamphetamin ER (Extended-Release)

Introduction

Dextroamphetamin ER, a long-acting stimulant primarily used for Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy, commands a significant market share within the psychostimulant therapeutics sector. As regulatory landscapes and healthcare dynamics evolve, understanding its market trajectory and price movements becomes crucial for pharmaceutical stakeholders, healthcare providers, and investors. This analysis synthesizes current market conditions, competitive landscape, regulatory influences, and pricing trends to forecast future price directions.

Market Overview

Therapeutic Demand and Market Size

Dextroamphetamin ER has experienced steady demand, driven by increasing ADHD diagnoses globally. The World Health Organization estimates that ADHD affects approximately 5-7% of children and 2-5% of adults worldwide [1]. The global ADHD therapeutics market was valued at around USD 14 billion in 2022, expanding at a compound annual growth rate (CAGR) of approximately 6% from 2020 through 2025 [2].

The Extended-Release (ER) formulations constitute a substantial proportion of this market, favored for improved adherence, consistent symptom control, and reduced abuse potential relative to immediate-release versions. Major players include brands such as Vyvanse (lisdexamfetamine), Adderall XR, and generic dextroamphetamine ER products, which collectively drive competitive dynamics.

Key Market Drivers

- Increasing Diagnosis Rates: Enhanced awareness and diagnostic protocols boost prescriptions.

- Pricing and Reimbursement Policies: Favorable reimbursement schemes support market penetration.

- Generic Entrants: Patent expirations enable generics, amplifying accessibility and slightly tempering price inflation.

- Regulatory Constraints: Stricter manufacturing, distribution, and prescribing guidelines impact market supply and pricing.

Competitive Landscape

The dextroamphetamin ER segment is characterized by a combination of branded and generic formulations. The key differentiators include:

- Formulation Efficacy: Extended-release ensures 8-12 hours of symptom control.

- Pricing Strategies: Branded medications often command premiums, though generics have significantly reduced consumer costs.

- Market Penetration: Generics have captured over 60% of prescriptions in several markets, notably the U.S., diminishing overall market prices [3].

Major pharmaceutical firms, including Shire/Takeda (Vyvanse) and Teva, are principal competitors. The entrance of new players and biosimilars enhances saturation, exerting downward pressure on prices.

Regulatory Dynamics and Patent Landscape

Patent expirations for key formulations, such as the original dextroamphetamine ER, have allowed generics to flourish, exerting competitive pressure on prices. However, branded formulations often retain exclusivity through method-of-use patents and formulation patents, which can delay generic entry in some regions.

Regulatory agencies, including the FDA, periodically implement stricter manufacturing and prescribing standards, potentially impacting supply chains and pricing stability.

Pricing Trends and Projections

Historical Price Movements

Historically, dextroamphetamin ER prices experienced a slight decline post-generic entry, aligning with the broader trend of generic commoditization in the psychostimulant market. For instance:

- Brand-name products: In 2018, the average wholesale price (AWP) for branded dextroamphetamin ER was approximately USD 250 per month supply [4].

- Generics: Prices ranged between USD 15-50 per month supply, representing a 80-85% markdown relative to brands.

Forecasted Price Dynamics (2023–2030)

Given the current trends, the following projections are plausible:

- Stabilization of Generic Prices: With market saturation, generic prices are unlikely to decline further significantly; instead, they may stabilize or slightly increase due to inflationary pressures and supply chain adjustments.

- Brand Premiums: Branded formulations like Vyvanse maintain premium pricing; however, their market share remains limited due to aggressive generic competition.

- Impact of New Formulations: Development of abuse-deterrent or long-acting formulations may command higher prices temporarily but will face market competition.

Forecast:

- Generics: Expected to hover between USD 20–60 per month supply from 2023 to 2030, with potential minor fluctuations based on regional market policies.

- Branded Dextroamphetamin ER: Anticipated to sustain higher prices, approximately USD 250–300 per month supply, though facing gradual erosion in market share.

Market Risks and Opportunities

Risks:

- Regulatory Restrictions: Stricter controls could limit supply or raise compliance costs.

- Patent Litigation: Challenges to patents could introduce additional generics, impacting prices.

- Market Saturation: Ubiquity of generics could suppress price growth and profitability.

Opportunities:

- Innovation in Formulation: Extended-release or abuse-deterrent technologies can fetch premium prices.

- Emerging Markets: Expanding healthcare infrastructure in Asia-Pacific and Latin America opens new demand channels.

- Alternative Delivery Systems: Novel drug delivery mechanisms could provide competitive advantages and price premiums.

Conclusion

Dextroamphetamin ER remains a vital segment within psychostimulant therapy, with a mature but evolving market landscape. Long-term price projections indicate a stabilization at lower levels for generic formulations, with branded products maintaining premium pricing due to brand recognition and formulation advantages. Strategic market positioning and continued innovation are critical for stakeholders seeking to optimize profitability amid increasing competition.

Key Takeaways

- The global ADHD therapeutic market supports steady demand for dextroamphetamin ER, with growth driven largely by rising diagnosis rates and expanding treatment access.

- Patent expirations have led to significant price compression, particularly among generic formulations, which are expected to stabilize further.

- Branded formulations will retain premium pricing margins but face erosion of market share; innovation and formulation advances offer potential for higher margins.

- Regulatory developments and patent landscapes critically influence supply dynamics and pricing; staying abreast of legal and policy changes is essential.

- Emerging markets and novel drug delivery technologies represent strategic growth avenues, potentially enabling price premiums and increased market share.

FAQs

1. How has patent expiration affected dextroamphetamin ER prices?

Patent expirations have enabled generic manufacturers to enter the market, leading to sharp price declines for generic formulations. Branded versions retain higher prices but face intense competition, resulting in overall market price stabilization.

2. What is the projected price range for generic dextroamphetamin ER in the next decade?

Prices are forecasted to stabilize between USD 20 and USD 60 per month supply, with variations depending on regional factors, manufacturing costs, and regulatory changes.

3. Are branded versions of dextroamphetamin ER likely to sustain higher premiums?

While branded formulations like Vyvanse command higher prices—USD 250–300 monthly—they are increasingly challenged by generics, which dominate prescription volumes and suppress premium pricing opportunities.

4. How do regulatory changes impact the dextroamphetamin ER market?

Stricter manufacturing standards and prescribing guidelines could limit supply or increase costs, exerting upward pressure on prices temporarily. Conversely, regulatory hurdles may also delay generic entry, sustaining higher prices longer.

5. What future growth opportunities exist for dextroamphetamin ER?

Emerging markets, technological innovations in drug delivery, and new formulations with abuse-deterrent properties offer avenues for growth and higher pricing potential amid competitive pressures.

Sources:

[1] WHO. “ADHD Fact Sheet,” 2021.

[2] MarketsandMarkets. “ADHD Therapeutics Market Analysis,” 2022.

[3] IQVIA. “U.S. Prescription Drug Data,” 2022.

[4] GoodRx. “Average Wholesale Prices for ADHD Medications,” 2018.

More… ↓