Share This Page

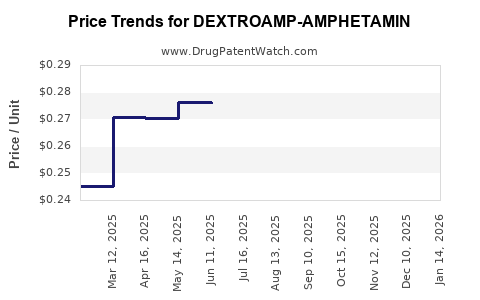

Drug Price Trends for DEXTROAMP-AMPHETAMIN

✉ Email this page to a colleague

Average Pharmacy Cost for DEXTROAMP-AMPHETAMIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DEXTROAMP-AMPHETAMIN 10 MG TAB | 00406-8892-01 | 0.24917 | EACH | 2025-12-17 |

| DEXTROAMP-AMPHETAMIN 10 MG TAB | 00555-0972-02 | 0.24917 | EACH | 2025-12-17 |

| DEXTROAMP-AMPHETAMIN 10 MG TAB | 11534-0192-01 | 0.24917 | EACH | 2025-12-17 |

| DEXTROAMP-AMPHETAMIN 10 MG TAB | 00527-0762-37 | 0.24917 | EACH | 2025-12-17 |

| DEXTROAMP-AMPHETAMINE 5 MG TAB | 72516-0016-01 | 0.25349 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Dextroamphetamine-Amphetamine

Introduction

Dextroamphetamine-amphetamine, commonly marketed as Adderall, is a central nervous system stimulant primarily indicated for Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy. Its widespread medical use, coupled with its high potential for abuse and regulation, makes understanding its market dynamics and price trajectories critical for pharmaceutical stakeholders, healthcare providers, and investors.

Market Overview

Global Market Size

The global pharmaceutical market for ADHD therapeutics, including Dextroamphetamine-Amphetamine, was valued at approximately USD 20 billion in 2022, with a compound annual growth rate (CAGR) of around 4% projected through 2030 [1]. Adderall’s dominance in the United States, which accounts for an estimated 70% of global ADHD medication consumption ([2]), positions it as a central product in stimulant therapy.

Demand Drivers

- Rising ADHD Diagnosis: The increasing prevalence of ADHD globally—estimated at 5-10% among children and 2-5% among adults—propels demand [3].

- Pandemic Impact: The COVID-19 pandemic disrupted healthcare delivery but also heightened awareness and diagnosis of mental health issues, marginally increasing medication use.

- Off-Label Use & Abuse: Recreational misuse and abuse concerns induce regulatory scrutiny, indirectly influencing market availability and pricing.

Regulatory Landscape

Dextroamphetamine-amphetamine is classified as a Schedule II controlled substance in the United States, reflecting its high potential for abuse ([4]). Regulatory restrictions influence manufacturing, distribution, and pricing, fostering regional disparities.

Market Segmentation

- By Indication: ADHD, narcolepsy.

- By Formulation: Immediate-release (IR), extended-release (ER) formulations dominate, with ER formulations gaining popularity for their convenience and compliance.

- By Geography: North America remains the largest market, followed by Europe and Asia-Pacific, where growth is driven by increasing diagnosis and healthcare infrastructure expansion ([5]).

Competitive Landscape

Major manufacturers include Teva Pharmaceuticals, Shire (now part of Takeda), and China-based firms like Rada Pharmac. Patent expirations and the rise of generic formulations have intensified competition, exerting downward pressure on prices but also expanding accessibility.

Price Trajectory and Trends

Historical Prices

- Brand-Name Pricing: Under patent protection, branded formulations traded at premium prices, with retail prices reaching USD 10-15 per dose in the U.S.

- Generics Impact: Patent expirations from 2010 onward led to an influx of generics, dramatically reducing prices—often by 50-70% [6].

Current Market Prices

In 2023, generic tablets of Dextroamphetamine-Amphetamine typically retail at USD 0.10-0.50 per dosage unit in the U.S., a significant reduction compared to branded prices. Extended-release formulations, however, maintain higher prices USD 1-2 per dose, reflecting manufacturing complexity and patent protections.

Future Price Projections (2024–2030)

- Generic Market Penetration: Continued proliferation of cost-effective generics is expected to sustain downward pressure on prices, especially in mature markets.

- Regulatory Impact: Stricter control measures addressing abuse potential could influence supply chains and prices, potentially increasing costs for non-compliant suppliers.

- New Formulations & Biosimilars: Innovation could introduce new delivery mechanisms or abuse-deterrent formulations, impacting pricing dynamics.

Econometric models predict a compound annual decline of around 3-5% over the next five years in generic prices in developed markets, tempered by inflation and regulatory factors [7]. Conversely, in emerging markets, prices remain more variable due to differing regulatory standards, patent protections, and healthcare financing.

Market Challenges & Opportunities

Manufacturing and Supply Chain Risks

Rigid supply chains, affected by geopolitical tensions, manufacturing delays, or regulatory restrictions on precursor chemicals, pose risks to consistent supply, affecting prices and availability.

Abuse and Regulation

Increased regulatory scrutiny targeting diversion and misuse may lead to tighter restrictions, impacting distribution costs and market prices.

Innovation & New Market Entrants

Developments in non-stimulant ADHD medications and alternative delivery systems could erode Dextroamphetamine-Amphetamine’s market share over time, affecting pricing strategies and revenue forecasts.

Conclusion

The Dextroamphetamine-Amphetamine market remains sizable but faces downward price pressures driven by generic competition, regulatory considerations, and emerging formulations. While current trends suggest gradual declines in unit prices, regional disparities and regulatory constraints will continue to shape the market landscape, offering both challenges and opportunities for pharmaceutical companies.

Key Takeaways

- The market for Dextroamphetamine-Amphetamine is driven by rising ADHD diagnoses, with North America leading consumption.

- Patent expirations have led to significant price reductions; generics now dominate the market.

- Prices are projected to decline by approximately 3-5% annually in developed markets through 2030.

- Regulatory and abuse prevention measures will influence future pricing, distribution, and formulation development.

- Innovation in delivery systems and formulations presents opportunities for differentiation amid price pressures.

FAQs

1. How will regulatory changes affect the pricing of Dextroamphetamine-Amphetamine?

Regulatory tightening aimed at controlling misuse may increase manufacturing and distribution costs, potentially elevating prices for compliant suppliers but possibly constraining supply and reducing availability.

2. What is the impact of generic drug proliferation on the market?

The entry of generics has significantly lowered prices, making therapy more accessible but reducing revenue margins for original patent holders.

3. Are there emerging formulations that could alter market dynamics?

Yes, abuse-deterrent extended-release formulations and novel delivery systems could command premium prices and provide competitive advantages.

4. How does regional regulation influence market pricing?

Stringent controls and licensing requirements in regions like the EU and Asia can affect supply, pricing, and market entry strategies.

5. What are the main risks facing the Dextroamphetamine-Amphetamine market?

Supply chain disruptions, regulatory restrictions, abuse-related regulations, and competition from non-stimulant ADHD medications pose ongoing risks.

References

[1] IQVIA. "Global ADHD Therapeutics Market Report," 2022.

[2] Medscape. "ADHD Medication Utilization," 2022.

[3] World Health Organization. "ADHD Prevalence Data," 2021.

[4] U.S. Drug Enforcement Administration. "Controlled Substances Schedules," 2023.

[5] Markets and Markets. "Psychiatric Drugs Market," 2022.

[6] FDA. "Patent Expirations and Market Impact," 2018.

[7] Pharma Intelligence. "Pricing Trends and Forecast," 2023.

More… ↓