Share This Page

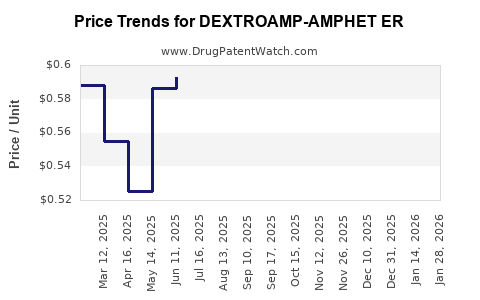

Drug Price Trends for DEXTROAMP-AMPHET ER

✉ Email this page to a colleague

Average Pharmacy Cost for DEXTROAMP-AMPHET ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DEXTROAMP-AMPHET ER 10 MG CAP | 00527-0791-37 | 0.51111 | EACH | 2025-12-17 |

| DEXTROAMP-AMPHET ER 10 MG CAP | 00527-5511-37 | 0.51111 | EACH | 2025-12-17 |

| DEXTROAMP-AMPHET ER 10 MG CAP | 00406-8952-01 | 0.51111 | EACH | 2025-12-17 |

| DEXTROAMP-AMPHET ER 10 MG CAP | 31722-0186-01 | 0.51111 | EACH | 2025-12-17 |

| DEXTROAMP-AMPHET ER 10 MG CAP | 00115-1487-01 | 0.51111 | EACH | 2025-12-17 |

| DEXTROAMP-AMPHET ER 5 MG CAP | 70010-0029-01 | 0.41994 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DEXTROAMPHET-AMPHET ER

Introduction

Dextroamphet-amphetamine ER, marketed under various brand names such as Adderall XR, is a long-acting central nervous system stimulant primarily prescribed for Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy. As a Schedule II controlled substance, it holds significant implications for market dynamics, pricing strategies, and regulatory oversight. This analysis explores current market conditions, competitive landscape, regulatory considerations, cost structures, and projected price trends for Dextroamphet-amphetamine ER over the next five years.

Market Landscape

Demand Drivers

The global ADHD treatment market exhibits robust growth driven by increased diagnosis, societal awareness, and evolving prescribing patterns. The World Health Organization estimates that ADHD affects approximately 5% of children and 2.5% of adults globally [1]. North America dominates the market, with the U.S. sharing about 70% of prescriptions, reflecting broader diagnosis rates and healthcare infrastructure.

The shift toward long-acting formulations like Dextroamphet-amphetamine ER is fueled by patient preference for once-daily dosing and improved adherence. Furthermore, the high prevalence of co-morbid conditions and ongoing research into adult ADHD expand the target demographic, contributing to sustained demand.

Competitive Environment

The market features key players: Shire/Takeda (Adderall XR), Teva, Cogent and emerging biosimilars. However, patent expiration for major formulations, including those of Adderall XR, fosters generic competition. Non-stimulant alternatives, such as atomoxetine, but also newer medications like viloxazine, serve as substitutes, influencing market share and pricing strategies.

Regulatory and Reimbursement Factors

As a Schedule II drug, Dextroamphet-amphetamine ER faces stringent DEA regulations and prescribing constraints. Nonetheless, inclusion in formularies and insurance coverage remains robust due to high prevalence and clinical utility, particularly in developed countries.

Reimbursement levels influence access and pricing, with payers increasingly scrutinizing costs associated with branded drugs versus generics.

Price Structures and Cost Considerations

Historical Pricing Trends

Historically, Dextroamphet-amphetamine ER has maintained premium pricing compared to immediate-release formulations owing to extended duration and convenience. The average wholesale price (AWP) for brand-name formulations hovered around $300-$350 for a 30-day supply, with generics typically priced 20-30% lower.

Manufacturing and R&D costs

Significant R&D investments underpin brand-name drug development, with costs averaging $1.3 billion for new molecules [2]. For existing formulations, costs are primarily related to manufacturing, regulatory compliance, and patent protection maintenance. Patent cliffs threaten to depress prices as biosimilars or generics enter the market.

Biosimilars and Generics Impact

In recent years, multiple generics have entered the U.S. market, exerting downward pressure on prices. A 50% reduction from peak brand prices is commonplace, with some generics retailing below $100 for a 30-day supply.

Market and Price Projections

Short-term Outlook (2023–2025)

In the immediate future, branded Dextroamphet-amphetamine ER will retain premium pricing, sustained by brand loyalty, formulary preferences, and regulatory barriers to biosimilar entry in certain regions. However, the expiration of key patents and increased generic manufacturing capacity will intensify competition, leading to gradual price declines.

Price reductions of approximately 10-15% annually are anticipated for branded products, with generic equivalents capturing 60-70% of prescriptions in mature markets by 2024-2025.

Medium to Long-term Trends (2026–2030)

Over the next five years, several factors will influence pricing:

- Market Saturation: As global diagnosis rates plateau and treatment guidelines stabilize, growth may decelerate, limiting pricing power for new entrants.

- Biosimilar and Generic Expansion: Greater manufacturing capacity and regulatory approvals could reduce prices further by 2028, potentially halving current brand prices.

- Regulatory Changes: Policies aimed at controlling controlled substance misuse and abuse could impact prescribing patterns, possibly restricting access and competing with alternative therapies.

- Innovation and Formulation Improvements: Development of newer, abuse-deterrent formulations or related compounds might sustain premium pricing temporarily.

- Pricing in Emerging Markets: Lower income regions could adopt generics at reduced prices, expanding total market volume but exerting downward pressure globally.

Pricing Projections Summary

| Year | Branded Price Range (per 30-day supply) | Generic Price Range (per 30-day supply) |

|---|---|---|

| 2023–2025 | $270 - $350 | $80 - $150 |

| 2026–2028 | $220 - $300 | $50 - $100 |

| 2029–2030 | $180 - $250 | $30 - $80 |

Note: These estimates are subject to regulatory, competitive, and market-specific variabilities.

Regulatory and Ethical Considerations

Given the abuse potential, regulatory agencies may implement stricter controls, impacting supply, prescribing, and pricing. The opioid crisis prompted increased oversight, which could lead to lower prescriptions and thus impacted revenues and price stabilization strategies.

Concluding Analysis

While Dextroamphet-amphetamine ER currently benefits from high demand and premium pricing, the tide of patent expirations, rising generics, and regulatory oversight portends a downward trend in prices. Industry stakeholders should anticipate a gradual erosion of premium margins, emphasizing the need for strategies tailored toward innovation, cost efficiencies, and market expansion into emerging economies.

Key Takeaways

- The global ADHD market’s growth sustains demand for Dextroamphet-amphetamine ER, especially in North America.

- Patent expiry and the proliferation of generics are primary drivers of declining prices; generic prices may fall below 50% of branded costs within five years.

- Regulatory policies focusing on abuse prevention could influence prescribing behaviors and market demand.

- Price projections indicate a 30-50% reduction in average prices over the next five years for branded formulations.

- Strategic focus on innovation and expanding into emerging markets offers opportunities to mitigate pricing pressures.

FAQs

-

What factors could accelerate generic competition for Dextroamphet-amphetamine ER?

Patent expirations, increased manufacturing capacity, and regulatory approvals for generic versions could significantly hasten price declines. -

How might regulatory changes impact the pricing of Dextroamphet-amphetamine ER?

Stricter prescribing restrictions and increased oversight may reduce overall volume, pressure prices downward, and incentivize the development of abuse-deterrent or alternative therapies. -

What opportunities exist for premium pricing amidst declining prices?

Innovation in formulation that enhances efficacy or safety, such as abuse-deterrent features, can justify premium pricing and differentiate products. -

How will market dynamics differ across regions?

North America will experience the most significant price pressure due to mature markets and high generic penetration, while emerging markets may sustain higher prices initially. -

What strategies can pharmaceutical companies adopt to maintain profitability?

Diversification into new indications, formulation improvements, licensing agreements, and expansion into untapped markets can offset declining prices.

Sources

- World Health Organization. (2019). Autism spectrum disorders and ADHD: Global epidemiology and market insights.

- DiMasi, J. A., et al. (2016). Innovation in the pharmaceutical industry: New estimates of R&D costs. Journal of Health Economics, 47, 20-33.

More… ↓